eDreams ODIGEO [EDR.MC]

Playing a Different Game

“Most companies pursue scale efficiencies, but few share them. It’s the sharing that makes the model so powerful. But in the center of the model is a paradox: the company grows through giving more back.” -Nick Sleep, Nomad Investment Partnership, 2004 Annual Letter

Overview

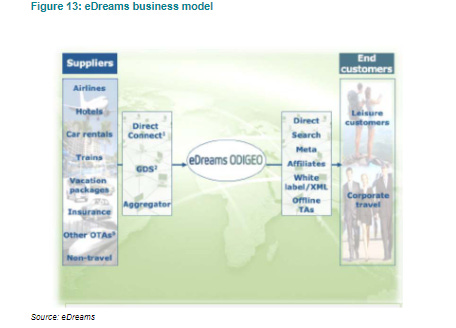

eDreams ODIGEO ($EDR.MC, “EDR”), based in Spain, is a leading Online Travel Agency (OTA) specializing in leisure travel in Europe, where it generates 80% of revenue and covers 80% of the total travel market. Through its five brands – eDreams, GO Voyages, Opodo, Travellink, and Liligo - eDreams offers flights, hotels, car rentals, travel packages, and ancillary services (seats, baggage, insurance, etc.). eDreams connects its 690 airline and 2.1 million hotel partners on one side to its 18 million customers annually on the other, generating revenue by matching consumers to their desired travel products (flights, hotels, rental cars etc).

For context, EDR is a €494M market cap company and €891M EV. Prior to the pandemic the company grew revenues (which were around €550M) in the low single digits per year with 20%+ EBITDA margins, €110-120M EBITDA in FY’19 and FY’20 (EDR’s fiscal ends in March). However, after their transformation to a subscription business they are set to grow top line mid teens with EBITDA margins returning to their pre-pandemic norms.

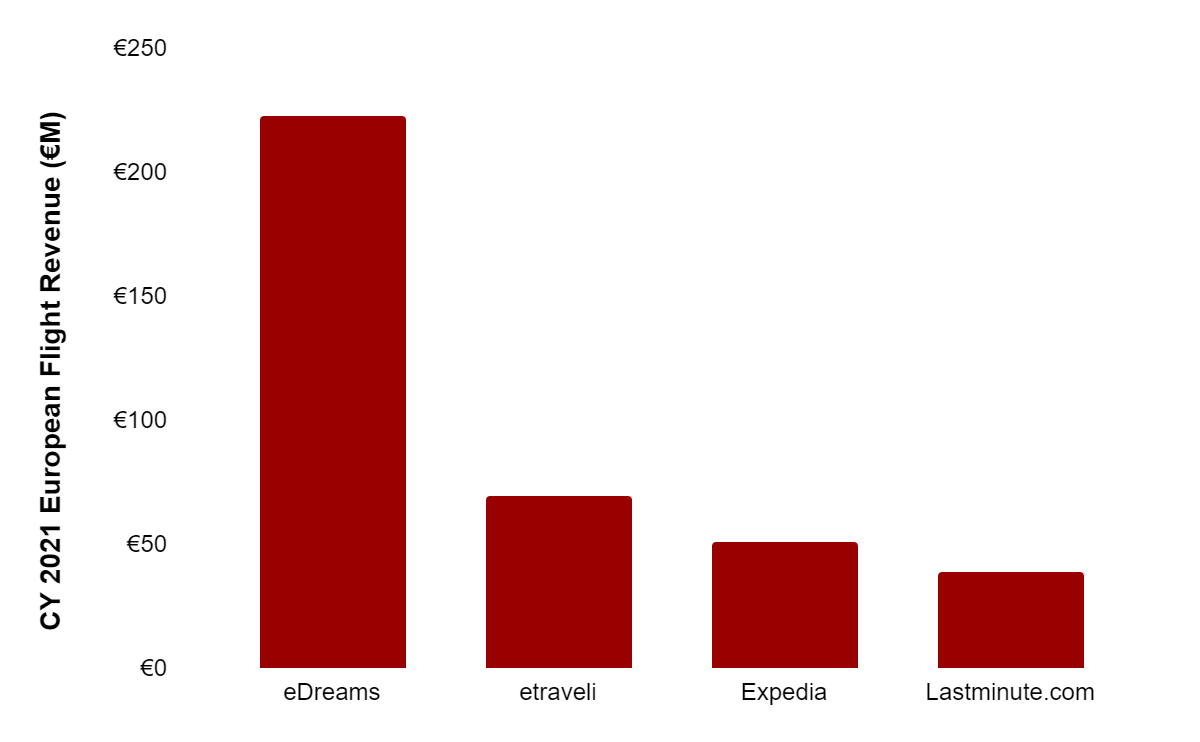

As with all two sided marketplaces, scale is a paramount. eDreams is the largest flight OTA in Europe (2x the size of the next-largest player) with 32% market share in flight bookings including the #1 spots in France, Italy, Germany, Spain and the UK and #2 in Norway and Switzerland.

For most of its history, eDreams operated using a transaction business model, getting paid for each booking a customer made. However, in 2017, eDreams unveiled their Prime subscription offering which differentiates their business model from OTA peers and has helped the company execute a fantastic turnaround.

The company was founded by Javier Pérez-Tenessa, James Hare and Mauricio Prieto in 1999, predominantly offering its services in the Spanish and Italian markets. The company was then bought out in 2006 by TA Associates for €153m and then again in 2010 by Permira PE (which still owns 25% of the company) for €350.

In 2011, Permira and AXA acquired Opodo (another European OTA) from Amadeus for €450M and subsequently merged it with Go Voyages which was then merged into eDreams to form eDreams ODIGEO, the business we see today. In April 2014, EDR IPO’d on the Madrid Stock Exchange for €10.25 per share (€1.5bn valuation).

After a tumultuous year in which Google changed their SEO algorithm toward keyword bidding which compressed company margins and bad press (including a lost lawsuit) after RyanAir complained that the company was misleading customers by offering the “guaranteed best prices on all flights,” and then adding a surcharge on top of that the stock ended 2014 at €1.68/share.

In 2015, management was shaken up, and then-COO Dana Dunne (previously CEO of AOL Europe, CCO of EasyJet and ex McKinsey) was appointed CEO. Dunne began by integrating the multiple backend platforms that made up the eDreams Group to create one unified platform in order to focus the company and begin to cultivate scale efficiencies. The new management team began diversifying its product base away from low margin, commoditized flights into ancillaries, hotels and rental cars. Furthermore, they began offering more transparent pricing to customers, and improving its tech lead vs. competitors with almost 90% of pre-covid operating cash-flow invested into technology. Lastly, and most importantly, the company sought to simplify the fragmented European travel market by introducing a subscription platform, Prime.

For €55-€70 a year customers save money on flights and lodging, creating repeat, more loyal customers. LTV for prime customers is 2.5x higher over 24 months and 4x higher over 36 months.

OTAs are already asset light businesses that require minimal capital to scale with a variable cost structure (~70% in EDR’s case), making them resilient in downturns. This is evidenced by nearly EBITDA breakeven and a growing Prime subscribers base each quarter during COVID. However, Prime adds yet another layer elevating EDR to an antifragile player in the European travel market.

Thesis

The opportunity to buy EDR at 8x next year’s EV/EBITDA, while OTA peers have historically been rewarded with double digit multiples, exists due to legacy issues. EDR is a broken IPO that skidded 90% in its first 8 months as a public company. In addition, the company trades on an off-the-beaten-path, small Madrid Stock exchange with a market cap below €1B which prevents larger funds from putting meaningful capital to work in the stock as they cannot enter and exit easily.

Private equity firms Permira (25.1% ownership) and Ardian (15.6% ownership) reduce liquidity as only 52% of shares outstanding are free float. Share volume liquidity in FY’22 was ~€1m per day.

Currently, EDR has limited analyst coverage with BNP Paribas Exane, Deutsche Bank and Barclays (who initiated coverage only in mid September) as the only reputable banks covering the name. However, management has done well to spread the word to the sell side, hosting a US two roadshows in the last year and attending multiple sell side conferences to convey the thesis.

This seems to be coming at an opportune time. Investors have been slow to recognize the value of eDreams’ Prime subscription. Trailing financials do not yet reveal the value of Prime subscribers entering the second and third year of their membership. This will change as large cohorts anniversary in the next twelve months.

EDR is an asset-light, resilient online-travel agency (OTA) rapidly growing its high-margin member subscription business while connecting the highly fragmented European airline travel industry.

eDreams is a leader in a massive, growing market whose economic characteristics lend itself to entrenched oligopolies. With its aligned management and differentiated subscription business model, EDR no longer has to compete with other OTAs on a perpetual customer acquisition (and re-acquisition) treadmill. Instead, Prime allows EDR to pass back transaction costs to customer, lowering costs and raising their value proposition creating a flywheel to scale.

As Prime continues to scale, customer lifetime value should expand significantly, which should have the effect of improving the entire margin profile of the business through greater scale efficiencies (negotiating power with suppliers) and lower CACs as the Prime subscriber base matures.

I believe it’s possible for management to reach EBITDA guidance of €180M by FY’25 ( ended March ‘25), against a market cap of around €500mm euros. At today’s prices I believe there is a substantial margin of safety in even pessimistic scenarios with multiple catalysts for value to be realized and EDR to re-rate in to peer multiples. In addition to EBITDA margin expansion from lower CAC as Prime members' anniversary, long time private equity owners Permira Advisers Ltd. (25.1% ownership) and Ardian (15.6% ownership) have been invested for a decade. At some point they need liquidity for their underlying investors. Either EDR will be recognized as a market leader and valued appropriately allowing legacy owners to exit or EDR is acquired by a larger player such as Expedia or Booking.com.

In the case of the former, if the stock rerates and trades into the double digits it could be a candidate for IBEX 35 inclusion, Spain’s leading index, which would increase liquidity and investor interest. Lastly, EDR sell side coverage has been lackluster. The lack of out year estimates (beyond 2025 which management has guided to) lead to significant time arbitrage opportunities for long term investors. With a business transforming such as EDR’s short sighted sell side estimates by analysts who have trained in transaction business such as traditional OTAs struggle to properly model unit economics of a subscription business.

One thing is certain, we believe: eDreams will remain the market leader in OTA Airline and continue to gain market-share given the change in industry dynamics. The company is on better footing than Pre-Covid due to a more profitable customer base allowing them to re-invest in the business to continue to gain market share.

OTAs have been rewarded double digit, 12x-18x, EBITDA multiples over the past decade. Assuming the low end of the multiples EDR could be a 12* €180M = €2,160M EV company by 2025. Management has stated their intention to de-lever to 1-2x net debt to EBITDA which means net debt would be ~€270M giving us a market cap of €1,890M on a flat share count EDR is a €14.77 stock in 2025 representing 264% upside or a 68% IRR to March 2025.

In short, you have a company that is trading below peers because of former managements’ mistakes, not receiving any credit for its new business model because it is in a hated industry, and whose ultimate profitability profile is not readily apparent in the current financials.

Understanding OTAs

Before jumping into the business it is important to frame eDreams in the overall travel landscape and explain its role in the ecosystem as over a third of travelers will buy their flight tickets from an OTA this year.

As an online travel agency (OTA), eDreams distributes travel products (flight tickets, rental cars, hotel rooms etc), and makes money by charging a commission on top. In the past, most money was made by commissions on flight tickets, and incentive fees paid by GDS providers (global distribution systems like Sabre Corp and Amadeus and airlines. Today, most money is made by commissions on ancillary products and services (seats, bags, and insurance).

OTAs have traditional deployed a mix of three different business models. In the merchant model (which makes up a majority of Expedia’s revenue, eDreams closest competitor and the second largest non-Chinese flight OTA behind EDR), OTAs purchase hotel rooms or other bookings in advance at a discount due to volume and resell those bookings over time at a higher price to the end consumer. In essence, they get paid for taking on the risk of unfulfilled bookings. In the agency model (which makes up most of Booking.com’s revenue), the OTA will facilitate a booking with a hotel, airline etc and receive a commission in exchange for selling the booking. Lastly, the advertising model is self explanatory. Select advertisers target OTA because of the demonstrated customer interest which allows for easy ad-targeting. This is mostly employed by metasearch players like Trivago and Kayak.

However, eDreams has opted for a different approach. Not easily mimicked by competitors due to counter positioning, eDreams prime subscription offering creates a captive customer base which is extremely valuable in the CAC treadmill-filled OTA world. Travel is a low frequency vertical, which makes converting disloyal into loyal customers harder and raises eDreams value proposition that much more.

Today, there is no real Prime alternative out there; loyalty programs (which tend to be focused on one specific airline for heavy users; often business travel related) and TripAdvisor’s cashback program (Tripadvisor Plus members pay $99 per year, so they can book a hotel via the Tripadvisor website to get a cashback) are the closest comparisons.

Traditionally, marketplaces are fantastic businesses with network effects in which the economics lead to winner-take-most or at least entrenched oligopolies. OTAs provide value to suppliers by providing access to consumers, and to consumers by providing choice. However, U.S. based OTAs have been a lukewarm industry despite these dynamics. This is because the supply side, airlines, typically control most of the market.

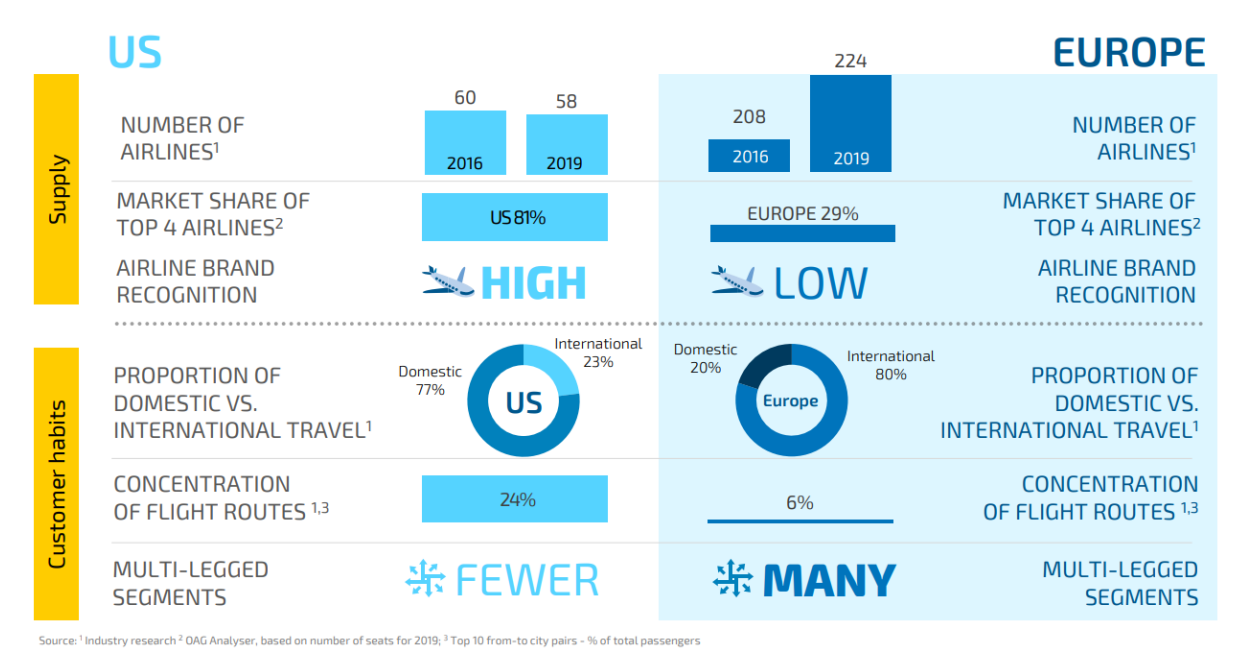

The U.S. has 58 airlines, with the top 4 (American, Delta, United and Southwest) commanding 81% market share with high brand recognition. Therefore, the U.S. airlines do not need to negotiate on price with OTAs and it is easier for end customers to book directly with them. This makes the value prop of U.S. OTA quite weak, as travelers can go directly to the airline to get the best prices/routes. However, competitive dynamics in Europe make it so that any given supplier doesn’t have too much market power.

As can be seen from the above infographic, Europe has a significantly larger number of airlines than the U.S., making any sort of oligopoly difficult to maintain. In Europe there are 224 airlines and the top 4 players have only 29% share which means the European consumer is more brand agnostic. The European flight market is also characterized by a greater number of multi-legged segments and lower concentration of flight routes. More connecting flights means travel is more confusing which means consumers rely on OTAs more often. On average EDR has 8 more flights per day and route than airlines offer on their websites directly. Given the differences between the markets, U.S. OTAs earn a 2-3% take rate on flights vs. ~9% for EDR.

This dynamic remains true on the non-flight side as well. The average major European country has ~20% hotel market share controlled by chains, whereas in the US, this number is over 40%.

Market Size and Secular Trends

EDR is the largest player in the flight market, triple the size of the second player eTraveli. Since 2020 EDR has almost doubled its European air travel market share, from 3% to 5.4% in FY’22 (March ‘22 end).

EDR operates in the €200Bn European travel market which is expected to grow 13% per year to 2024 to €291B. Pre COVID, from 2012-2019, the European domestic travel market, grew about 1.7% a year.

There are numerous trends pushing this growth which EDR should be the outsized benefactor of:

Europe air traffic passenger volume was back to >80% of 2019 levels by July 2022 with ticket price inflation supporting the value recovery so there is still plenty of demand to come back online. COVID was also characterized by shorter duration, closer trips which have lower basket size so as the basket normalizes and there are more long haul flights EDR should benefit from a step function change back.

EDR will continue to benefit from online channels continuing to take the share from offline. The online travel market has moved from below 47% of bookings to ~55% in 2021 as of March ‘21. Higher access to online tools and better mobile access will help the trend to continue.

Difficult to quantify, but given the change we have experienced in business meetings moving online, it is feasible that airlines will cancel routes which relied heavily on business travel. This leads to more indirect travel which means there is more need for an OTA.

eDreams’s focus on leisure travel, where customers are more cost sensitive, meaning that as cheap and simple direct flight routes are canceled, consumers will have to turn toward OTAs to help them sort out indirect flights. EDR becomes the logical choice as they offer the largest selection and combination through their 690 airline and 2.1 million hotel partners at the lowest prices.

It is also important to note that leisure travelers start with booking their flights first 70% of the time when planning their trips, so even though eDreams does fall behind the likes of Expedia and Bookings in hotel inventory, it does not play as large of a role in capturing the customer.

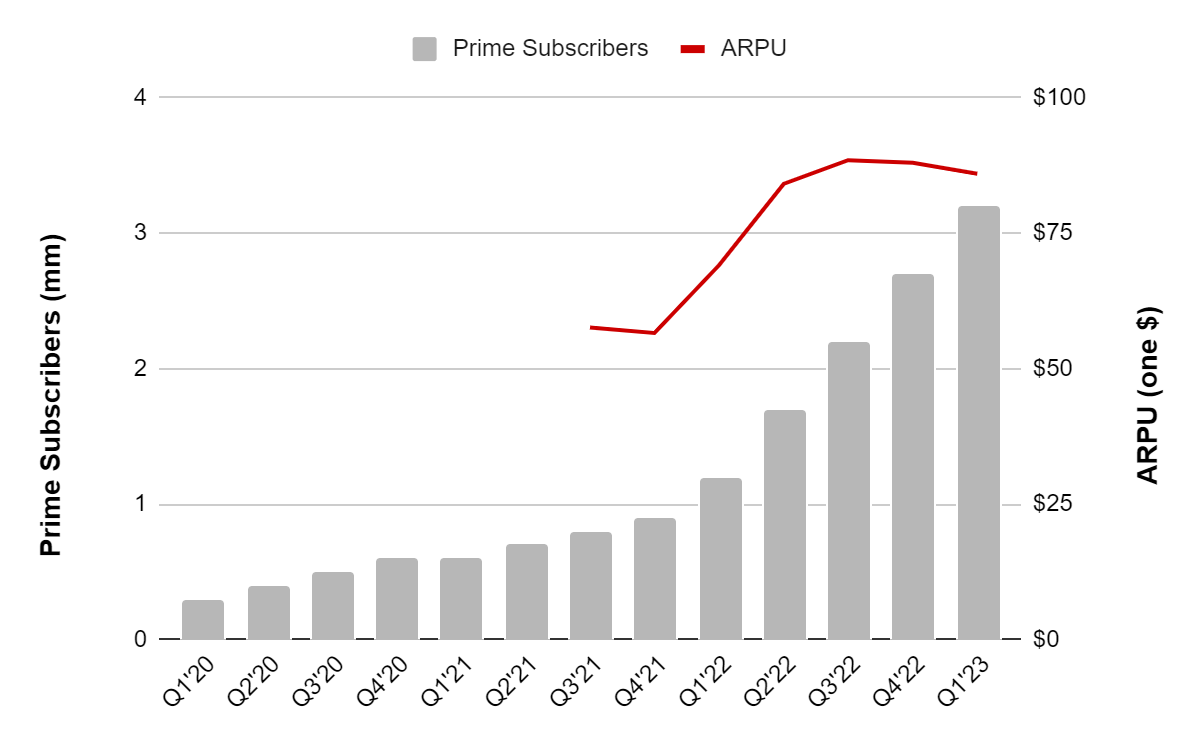

At the end of FY’22 prime had only 1% TAM penetration with 2.7 million subscribers in the 225mn European households. By 2025 they are targeting 3% penetration, or 7.25mn subscribers. This is not overly optimistic as in France, the market with the longest operating history, they are already at 3% penetration and EDR is, according to management, “ still today achieving all-time growth rates, so we are in fact accelerating versus the early years as opposed to plateauing.” This implies a 30%+ subscriber CAGR as new subscribers are converted from their existing 18mn customer base prime roll out in new and existing markets.

In short, the thesis is that eDreams will remain the market leader in OTA Airline and continue to gain market-share given the change in industry dynamics. The company will be on better footing than pre-covid due to a more profitable customer base allowing them to re-invest in the business to continue to gain market share.

Business Overview

EDR Pre-Prime: Customer revenues (70% of revenues in FY2013). Suppliers would sell products for their base fares to eDreams on top of which eDreams would add a commission, either as a transparent service charge, or hidden as a mark-up included in the ticket price. For Example, eDreams would source a €100 flight ticket from British Airways, and sell it to the customer for €110, making €10 of revenue margin in the transaction. This service fee is the classic way OTAs make money. Supplier revenues (30% of revenues in FY2013), such as incentive fees paid by standard airlines, GDS providers and hotels. GDSs, for example, would pay €2 of incentive fees per booking, representing €2 of revenue margin.

Post Prime: Diversification Revenue (73% of revenue margin, €281M in revenue last year ) Earned through vacation products (including car rentals, hotels and Dynamic Packages), flight ancillaries (including reserved seats, additional check-in luggage, and additional service options), travel insurance, as well as commissions, over commissions and incentives directly received from airlines.

Flight aggregation is an industry characterized by low order frequency, low customer retention and relatively low fees from suppliers given tight margins, making economics difficult in the traditional transactional business model. Monetization on the marketplace is thus reliant on the consumer side of the network – in this casemark ups on tickets and ancillaries (cross sell, mark-up on flight-related items, e.g.reserving seats). Meta search engines, such as Skyscanner, have made the industry more transparent, limiting the mark-up opportunity on tickets. Monetization from ancillaries is therefore fundamental to how eDreams makes money.

While the image below is dated it helps illustrate the push to diversification revenue and level of ancillary sales.

Classic customer (10% of revenue margin, €37.8M): This segment represents customer revenue other than Diversification Revenues earned through flight service fees, cancellation and modification fees, tax refunds and mobile application revenue.

Classic Supplier (15% of revenue margin, €55.8M): Represents supplier revenue earned through GDS (global distribution system) incentives for bookings mediated by eDreams through GDSs and incentives received from payment service providers.

Advertising and Metasearch (2% of revenue margin, €8M): Represents revenue from other ancillary sources, such as advertising on Edreams websites and revenue from metasearch activities

Prime’s Moat

Prime is eDreams’ subscription offering. It serves two main purposes: to save customers money on repeat bookings, and significantly reduce eDreams’ CAC through funneling customers to direct booking channels which lowers their dependence on Google and metasearch platforms. If Prime is successful it will have the effect of improving overall company margins.

Customer benefits: For €55-€70 annually Prime subscribers, and their booking group, receive discounts on 100% of flight bookings and 50% of lodgings, gain access to an exclusive 24/7 customer service hotline, and can take advantage of special deals and promotions (Prime Day sales). These discounts are made possible because Prime bookings incur a lower customer acquisition cost, these savings are then used to lower prices as EDR passes back the would-be acquisition cost to the subscriber. Instead of paying Google, they take that money and lower the customer’s price. This has the effect that 90% of the time Prime ticket prices are cheaper than any other offer in the market.

Company benefits: EDR benefits as Prime customers are more engaged with a higher return rate (1.4x non-Prime), book more frequently (Prime customer have 2.7x more repeat bookings and book 2x as many trips), have 50% lower customer acquisition costs as measured by cost per booking, present an easier cross-sell opportunity for accommodations (luggage, assigned seating, insurance etc) which have a higher take rate than flights. EDR aggregates demand while also receiving a stickier, recurring revenue stream with a negative cash conversion cycle transforming a transaction based business enlisted by competitors to a higher quality subscription business.

In sum, this translates to Prime customers having a much higher LTV than that of a non-Prime customer. On a 12-mth horizon Prime members are 2.3x more profitable, 3.6x on a 24-month basis, and 4.4x on a 36-month basis. The benefits of Prime will likely scale up as the subscriber base grows and inflects.

The value prop for customers is huge as the payback period for the subscription program is reflected in continued cost savings on trips, while value accrues to eDreams in the form of reduced customer acquisition cost, decreased churn and a large LTV uplift on a per customer basis. Prime has grown from an idea in 2017 to over 3.5 million members to date, and even grew 55% YoY during the pandemic. Currently, Prime members account for north of 40% of all bookings. Prime has essentially lowers the customer acquisition cost for customers, makes customer relationships sticky, and creates a moat around their business.

The competitive moat enabled by prime is simple and obvious. EDR uses prime fees to supplement transaction revenues which they pass back to customers allowing them to offer the highest discounts in the market. This allows them to be the low cost provider in the market which attracts customers. Airlines then offer EDR discounts to access their now aggregated and captive demand which means EDR has the greatest selection of available flights which attracts more subscribers. This powerful flywheel is thrusted into motion by economies of scale shared.

EDR uses the subscription fees to lower the cost of flights, making it more attractive for people to join, thus increasing subscribers and further lowering the cost of flights. EDR has an opportunity to create one of the most powerful business model, what Nick Sleep refers to as scale efficiencies shared. The more subscribers they have, the cheaper they can price flights, which will draw in more subscribers. I have resisted it up to this point, but the model is akin to Costco’s where margin is not made on individual transactions, but on the membership fee.

Although the barriers to entry are relatively low within the industry, OTAs that have reached scale can be very hard to compete against given their brands, supplier relationships, customer bases and in the case of eDreams, technology. In eDreams’ case they have some of the strongest brands in travel in many of Europe’s largest markets including GO Voyages, Opodo, Travellink and Liligo, dominating air travel in Europe with over 18 million customers.

As an OTA scales and is able to offer better pricing, selection and service, more customers book travel through them, leading to more suppliers offering inventory, leading to increased selection and more favorable pricing, leading to more customers, and so on. With these profits EDR can also further invest in their product and technology offering which creates a better user experience attracting more customers and driving further scale.

This is the very definition of a flywheel. As a result of this dynamic, leading OTA’s typically sport EBITDA margins in the 20-30% range and have historically been assigned double digit EBITDA multiples.

It is easy to understand how powerful this flywheel can be once it has begun to spin. The real question is, can competitors set it up themselves? Behind Prime there is a major investment in time and IT resources by eDreams. Moving from a transaction based model, the way most of OTAs function, to a client-oriented platform is a daring move that requires cannibalizing existing revenue streams. Other OTAs have trouble copying EDR due to their counter positioning. Furthermore, before launching Prime, eDreams had set up more than 2000 tests and 50k client interviews.

EDR’s tech advantage over their competitors is also significant. In eDreams’ mobile app, you are able to track your flight, check your bag or get your boarding pass without the need to go through the airline webpage.

This customer centricity aids the user experience and translates to much higher repeat usage in the eDream app, which cuts out Google and lowers CAC. In 2015, 70% of eDreams’ business was from indirect channels, with Google representing 40% of bookings and other metasearch engines providing 20%. Since the shift to focus on direct channels, indirect represented 40%, with direct contribution 60%.

53% of total flight bookings are now made on their app (19% better than the industry average), up from 10% in 2015, which has reduced CAC by 37% over the period. This is hugely valuable as mobile users don’t benchmark prices - meaning EDR truly owns the customer relationship if they choose to use the app on an ongoing basis - which in turn translates to higher margins given low/zero CAC. The dollars not spent on reacquiring the customer (along with the Prime membership fee itself) can then be reinvested back into marketing to grow the membership base and lower flight costs for current members. This helps keep the flywheel spinning.

Prime and mobile app usage helps Edreams collect more data on the customers which they can either share with partners (hotel or airline) or use to encourage more bookings. Data collected from flight bookings gives the company an edge vs. hotel-based OTAs (more personal info required to book a flight vs. a hotel) and allows the company to better cross-sell other products/services.

EDR also has a slight network effect akin to Costco’s. I’ll leave it to Nick Sleep to explain the Costco side of the analogy: “In the case of Costco scale efficiency gains are passed back to the consumer in order to drive further revenue growth. That way customers at one of the first Costco stores (outside Seattle) benefit from the firm’s expansion (into say Ohio) as they also gain from the decline in supplier prices. This keeps the old stores growing too. The point is that having shared the cost savings, the customer reciprocates.” Existing Prime members benefit with each additional Prime member as the value of the captive customer base rises giving EDR better bargaining position with hotels and airlines to win customers more deals who reciprocate by booking more often.

Like most two sided marketplaces this is a winner take most industry, however Prime evokes a lollapalooza by also directly hurting competitors. Imagine a pool of 100 potential travelers. Historically this pool would remain at constant size as after each trip the OTA would have to reacquire the same customer time and time again.

However, Prime, by not having to collect transaction fees (eDreams gives these back to customers through discounts) they can bid aggressively on metasearch sites to acquire new customers. If eDreams wins the bid, they have a good chance to gain a new Prime customer, therefore removing them from the pool altogether. If they lose the bid to the competition, the competition is likely overpaying and taking business at little to no margin. Not to mention, the remaining clients that non-subscription business will have to compete over will be less profitable as the cost of acquisition will be higher (EDR attracts the most frequent travelers).

In a way this is like TransDigm. As Rob Small pointed out on 50x with Will Thorndike,

“The big thing that it made me realize at that point was not only how great of executors they [The TransDigm management team] were and how much better it was, but it made me realize that they could always win an auction. They could, with confidence, wring more value out of an asset than anyone else in the industry, which means they could pay the highest price, which means they should be able to buy anything unless another bidder made a mistake, frankly, because no one else executes like they do… it makes them the logical bidder and the logical winner in all of these.”

Unit Economics

Prime’s value proposition is not lost on the consumer. First rolled out in 2017 with ~3,000 subscribers, Prime now has north of 3.5mn members. eDreams has learned from Amazon that the 30-day trial + auto-renewal + yearly subscription template works. The company added 200k subscribers from April through December 2020 (+71% and +55% y/y in 2Q’21 and 3Q’21) in the midst of the pandemic and minimal travel highlighting the inherent value proposition and antifragility .

COVID marked the biggest challenge to ever face the travel industry. eDreams’ fiscal 2021 (ending March 31) saw bookings fall 70%, to 3.2mm vs.10.8mm in fiscal 2020. Revenue fell 79%, to 111mm euro, and adjusted EBITDA swung into negative territory, with a 38mm euro loss vs. 115mm profit in fiscal 2020. Nonetheless, eDreams fared significantly better than its peers. The declines in airline bookings it experienced were less severe than the industry overall, resulting in 6 percentage points of market share gains. Mobile penetration improved substantially, and Prime memberships nearly doubled from 556,000 members at the end of fiscal 2020 to 1,009,000 at the end of May 2021. eDreams was the only publicly-traded OTA to not issue any stock or debt during the crisis.

Let’s walk through a Prime member's first flight transaction. eDreams receives a booking fee and the first-year Prime Fee. CAC to Google or metasearch provider is paid for via the revenue received from the GDS (global distribution system) or the commission from the Airline/Hotel. That leaves the prime fee. eDreams then gives a portion back to the customer in the form of a Prime discount. So a transaction works something like this:

As a reminder, EDR can then earn revenue on high margin ancillaries. Furthermore, Prime customers need to be acquired for the first booking, but subsequent bookings are done in "cheap" channels, i.e. where eDreams does not incur a customer acquisition cost. This means that the Prime model is significantly more profitable after year 1

The contribution margin on booking one is 8% for new Prime users – the CAC is meaningful and there is a discount on the flight. However, if the customer is reacquired via cheap channels, this goes up to 50-55% on future bookings. Therefore, most money is made on repeat bookings when the cheaper CAC more than offsets the discount on offer for these orders.

According to the company, over time, a Prime subscriber is more valuable than a transactional customer. Although the first booking for a Prime customer may have a slightly higher variable cost vs. a non-Prime customer, they are more profitable in the longer term because a Prime customer books 2.7x more than a non-Prime customer in the first year and the variable cost per booking is 30% lower (due to the lack of incremental customer acquisition costs). This helps offset the discount that a Prime customer typically gets.In the second year, a Prime customer typically books 2.9x more than a non-Prime customer. eDreams also gets the subscription fee for the second year again at a lower variable cost because of the lower CAC. Eventually, the company estimates that a Prime customer's lifetime value over 24 months is 2.5x greater than a non-Prime customer. The company has also stated that prime LTV to CAC is 2x-3x.

As one of the experts Farrer Wealth spoke to “the way the product works is that a Prime subscriber is either earning you the same/higher margin as a non-prime or if it is earning you a lower-margin than it is earned back in a far lower customer acquisition cost.”

We assume annual churn of 30-40% as travel is a low frequency vertical. Barclays wrote in their EDR initiation report “Primed for Change” that “25-30pts of churn are involuntary (e.g. credit card expiring), and 10pts are voluntary (i.e. the customer actively cancels Prime).”

So, what does the average Prime subscriber look like? According to the company, based on data from December 2020 to October 2021, they mostly have an income of €60k per year or less (~73% of subscribers) and are mostly in the younger age bracket (~43% of subscribers within the 18-35 years age bracket). In terms of bookings, the Prime subscriber typically travels alone, is evenly split between regular carriers and low cost airlines, and tends to travel locally (intercontinental travel only 23% of the bookings).

To make prime worthwhile as a customer you need to do somewhere between 1 and 2 trips a year. They have a dynamic pricing set by their AI depending on the LTV of that customer. EDR’s algorithms (another example of their tech advantage) will determine the discount to the customer based on how many additional products that they think the subscriber might purchase. This allows them to offset the discount with the margin achieved from ancillary product sales.

Bear Case

CAC treadmill. The biggest problem for an OTA is disloyal customers as they need to be re-acquired for every single transaction via expensive channels (i.e. Google or meta search). In essence, these businesses are on a perpetual CAC treadmill that they have to pay Google to run. Gaining share requires continual spend on paid search and performance marketing. This put up more to get more system has held ROICs stagnant and reduced operating leverage. EXPE earnings, for example, show direct marketing expense increases closely track increases in bookings growth.

Therefore, OTAs are beholden to Google’s search algorithm or their anti-competitive practices (i.e., launching their own meta search product).

The mitigant here is two fold. Direct customer traffic is the holy grail of the OTA industry. Every OTA is trying to minimize their dependence as website/mobile or organic search traffic (not paid) is the primary way to drive margin expansion given the largely variable cost model. EDR EBITDA margins have expanded from 17% in FY’15 to 21% in FY’20 (March ’20, which was partially Covid impacted). This tracks well with what Dana Dunne said on the FY’20 earnings call, “We are the flight OTA with the highest branded average monthly queries on Google in all European countries, which allows for a very effective capture of customers end demand and resiliency. And our scale advantages make us both a better partner and less reliant long-term on the metasearch versus competitors.”

eDreams’ has solved the direct traffic problem through Prime which has helped to create a captive audience that helps to circumvent the Google problem which has also helped EDR build a brand. We have covered that Prime customers book 2-3x more than non-Primes, and each of the subsequent purchases can be done without paying marketing cost to metas/search engines, as it’s a captive audience of subscribers. This allows EDR to hop off the treadmill (scalar quantity: speed and no direction) and begin running forward (vector quantity: speed and direction).

Meta search. Meta search engines like Google Flight or Kayak aggregate results across many OTAs and directly from the airlines. Subsequently, customers are directed to the OTA or airline to complete the booking, and the meta search engine receives marketing and referral fees. This effectively commoditizes OTAs, forcing them to compete strictly on price. Google’s metasearch can bypass OTAs entirely, allowing consumers to book directly with the airline or hotel.

Metasearch engines depend on OTAs for content and income as OTAs have a presence across the whole travel value chain, while metas are only present in the decision to book a trip, the search for it and the process of comparison and selection. OTAs handle the rest of the process: booking, pre-travel requirements (visas, baggage, etc.), the travel itself (seat booking, car hiring, etc.) and post travel. Therefore because OTAs are one of the main income contributors for top meta platforms it makes more sense for metas to have partnerships with OTAs than with airlines themselves.

While the metsearch competitive dynamics are worth studying, it is important to note that Prime allows EDR to be the low cost provider so competing on price actually helps them.

Copy Cats. The obvious next bear case is that if a subscription offering is so beneficial, why wouldn't everyone just copy it? TripAdvisor announced a subscription service for hotel bookings called TripAdvisor Plus, but eventually transitioned it to a rebate program.

Booking has a loyalty program called “Genius,” which starts after a consumer makes two bookings with them (10% discount), and increases as you make more bookings (i.e., after five bookings, you get between 15-20%). This is more a loyalty program than a subscription program because BKNG would have to go out and reacquire the customer that makes 1 or 2 bookings because they aren't automatically reacquired via a subscription (sunk cost mentality).

Expedia has a loyalty program where members save ~$50 on average per booking. With eDreams’ subscription you get the discount right away, which taps into instant gratification to reward the consumer. Because of the sunk costs, instant gratification and reduced CAC I think the subscription model is stronger than the loyalty program.

I think there are a few reasons another player is yet to launch a successful copycat. As Dunne has stated in the past, ““Making the change from transaction to subscription-centric business requires a holistic company transformation and is difficult to achieve. While others may -- can offer a subscription. It is not simply sufficient to offer something. To do well, it requires a fundamental company-wide transformation as well as clear insights, years of learnings in product development and superior execution.”

Their counter positioning forces other players to cannibalize their current revenue stream to build up the subscription business which is both risky and time consuming. Furthermore, competitors would have to change their company culture from one focused on transactions to one focused on LTV.

There were thousands of hours of interviews and customer surveys that went into developing Prime so there’s a slight technical barrier to entry. EDR is also the first mover so they acquired the lowest hanging fruit.

Airline relationships and DTC Disintermediation. eDreams uses multiple methods to book a flight on behalf of its customers- this includes securing the ticket via a GDS (Global Distribution System) such as Sabre or Amadeus, or by directly connecting to an airline. If airlines become more protective of the access they provide OTAs to encourage customers to book directly on their platform, this could pose a challenge for growth. However, airlines would want to secure the sale of their seats as early as possible and giving others access to their inventory is an important way of ensuring this.

Airlines are taking a greater market share in the online travel market than the OTAs overall. However, bigger OTAs are winning market share vs small ones. OTAs benefit from complexity and lower route concentration: single and standardized routes make it easier for the customer to go directly to the airline to book their ticket which hurts OTAs.

Low cost carriers don’t use GDS providers for distribution, and hence no incentive fee is paid. Cognizant of the success of low cost carriers, standard airlines like Lufthansa started to copy their low-cost rivals. They, too, tried to disintermediate GDSs and OTAs by going directly to consumers, increasing the pressure on eDreams’ supplier revenue stream.

Attachment rates of ancillaries and pricing. eDreams is reliant on ancillary sales to make unit economics attractive. As eDreams moves away from classic customer revenue (i.e. a service fee on top of the ticket price), the company depends more on additional products that a customer attaches to the booking (such as hotels, seats, baggage, insurance etc.). If these attachment rates decline even though bookings increase, we can see revenue growth failing to pick up and margins suffering as a result. Additionally, will customers always be willing to pay a £16 mark-up on a bag vs buying directly from the airline? If not, the value-add of Prime could fall.

European Recession. I’d be remiss if I didn't mention the slowdown in the macro environment and its effects on leisure travel. I’m not a macro guy, but I know that COVID-19 was arguably the worst business environment EDR will ever see. Yet during that time, the company expanded its market share by 600bps and grew its Prime Membership 55% YoY to hit 1M members, all without taking a single euro of outside funding. Prime has helped make this business antifragile, gaining market share while others suffered.

European consumers have ample savings - €907B of pandemic-related savings, and want to travel. In ordinary times, Europeans save around 12% of their income. But as families stayed at home and furlough schemes supported income during the pandemic, this savings rate increased sharply to almost 19% in 2020 and 2021.

I think there are some factors that could offset the inflation/recession. Target CEO Brian Cornell explained on the company’s Q2 conference call that luggage was their fastest growing product category this year. Airlines and hotels also speak about the recovering demand picture. Airline capacity increases will likely absorb some of the increase in fuel prices

On the FY ‘22 earnings calls management stated, “With inflation increasing, we also showed data., which looked at the data of the last 50 years in terms of number of passengers, there's only being three occasions in which the number of passengers decreased and the year that decreased the most, it was 2.6%.” So even despite tough environments the travel category is resilient. Lastly, eDreams’ Prime program saves customers money which means they could gai market share as consumers become more cost conscious.

Balance Sheet. EDR’s balance sheet was a concern in the past as it ran extremely levered (over 6x net debt/EBITDA) at one point. But, eDreams recently issued equity, raising €75m (7% of share capital) in January 2022 at €8.50 per share. Up to €50m of net proceeds were intended to pay down debt, with the remainder being reinvested into business. eDreams has also refinanced its debt with a new senior unsecured bond (Jan 2022) with a coupon of 5.5% - favorable in hindsight given how tight credit markets are right now.

I think this Tweet captured the bears’ views well. “Prime fees are not 100% margin. I’m not even sure they are positive margins. After a member books 2-3 flights (and members can book discount flights for travel partners, and most leisure travel is at least 2 people) the membership fee is offset by the discounts provided. Then EDR is relying on ancillary sales to make customer relationships profitable. I suspect that prime is actually low margin revenue at best and EDR is trying to make it up with volume. Also when EDR talks about market share they are talking about flights. Flights are low margin, highly competitive, commodity products. Most OTAs are actively trying to diversify away from flights.”

The idea that “Prime is low margin and making up for it on volume” is the point of the model. That’s the moat. And the fact that flights are low margin, highly competitive, commodity products that most OTAs are actively trying to diversify away from ignores their strategic position. Leisure travelers start with booking their flights first 70% of the time when planning their trips, therefore if EDR is recognized as “the flight OTA” they have share of mind that allows them to easily cross sell into higher margin hotels and other categories.

Side note: why are hotels higher margin? This is in part because hotels have a higher take rate vs. flights and also because the sales incur no additional acquisition cost given it’s a pure upsell following a flight purchase.

And yes, Prime is not 100% margin but it is gross margin accretive. They make more margin post year 1 when they don’t have to spend to acquire the user again once they are “locked-in.” If they stopped reinvesting and acquiring new customers EDR could get to BKNG like EBITDA margins.

Management and Capital Allocation

Dana Dunne joined as the COO of EDR in 2012, and became CEO at the end of 2015. Dana is former McKinsey, was the CCO of easyJet (oversaw 50 million customers per year for the 4th largest airline in Europe) and previously CEO of AOL Europe.

The new management team focused on using its leadership in flights to diversify (flight revenue only 30% of total revenue vs 52% five years ago) into higher margin categories, offering more transparent pricing to customers, improving tech lead vs. competitors and simplifying the complex European travel market by introducing Prime. They’ve done everything they said they would do. For example, management made a bold claim of hitting two million Prime subscribers by the end of 2023, and they accomplished it more than a year in advance.

Management ownership percentage is mid single digits. Dana has about 3% of the company but on a personal wealth standpoint it is the vast majority of Dana’s net worth as he owns €18.5MM worth of stock (2.3 MM shares) as of March 2022.

The current LTIP dates from 2019. This plan is divided into four periods, ending in Dec 2022, Dec 2023, Dec 2024 and Dec 2025. 50% is linked to growth in EBITDA-Capex and Revenue margin targets and the other 50% is dependent on being employed at EDR.

Management has invested significant amounts with almost 90% of pre-covid operating cash-flow invested into their technology and algorithms to bolster their tech advantage. eDreams also stood out among OTAs during the pandemic as they didn’t issue debt or equity.

Valuation

At current prices, you don’t have to get very granular with EDR’s valuation. In March 2020, eDreams stock bottomed at less than 3.5x 2019 EBITDA. The outlook for an OTA couldn't be much worse than that and since then the business has improved markedly with prime growing 6x. eDreams is currently trading at 8x my estimated FY23 EBITDA (€850M EV and €105M EBITDA). Booking is trading 11x, a historically low multiple. Given eDreams’ stickier revenue base with its Prime program and its rapid revenue growth, it should trade at least in line.

OTAs have historically traded at 12-18x normalized EBITDA and past transactions have occurred at 13-15x EBITDA. A 7x multiple on next year’s EBITDA (€105m) would mean a €3.10 share price or 25% downside from today’s €4.05 price. Using the low end of the historical multiples on next year’s EBITDA, EDR is worth €7.23 a share or a 40% IRR.

Turning to my model and assumptions. I modeled average basket size returning to pre-COVID €450 per basket by 2025 as long haul trips and trip complexity returns, bookings growing 2% per year and a 7.5% take rate per transaction. As far as Prime goes I modeled management achieving their 2025 guidance of 7mn prime subscribers. In all this results in €838mn in revenue at 21.5% EBITDA margins I get €180M in 2025 EBITDA (again in line with management guide).

With capex of €50m I get €130M in “FCF” in 2025. If you think a business growing top line mid teens per year with 20%+ EBITDA margins is at least worth a double digit free cash flow margin EDR is easily €10+ stock in 2 years or a 40% IRR.

Management has stated they are going to keep EBITDA margins at that 20-23% range but reinvest the extra profitability to drive more growth. A lot of that margin expansion will be hidden from the market and passed back to customers.

They’ve also been very clear about where this margin expansion is coming from, “As guided, previously, the strong growth in first-year Prime members puts a drag on the growth in profitability. This jumps in the second year. As Prime matures, we expect improvements in profitability as the proportion of Prime members beyond their second year increases. The more the Prime member base matures, the higher margins are going to become.” Also, the greater the percentage of Prime Members, the less money EDR needs to spend to generate those revenues. In turn, EDR should experience massive operating leverage as the company lowers CAC across a more significant portion of its customer base.

I also found this comment from Dunne helpful when thinking about how growth affects subscription businesses which really brings to life what Tren Griffin has illustrated on his blog 25iq.

“We talked at the Investor Day of a sensitivity applied to fiscal '25 in which we said that if during fiscal '25, we had a stable number of Prime members during the year instead of continuing to grow during the year in Prime members, that the cash EBITDA margin would increase by 8 percentage points, which talks about the level of investment that there is in the P&L in terms of future growth. We can do a relatively similar exercise for fiscal '22. In fiscal '22, we have grown from 800,000 members to 2.7 million members. We have grown to just double going from 800,000 members to 1.6 million members. Our margins would have also increased by 8 points. We had a Cash EBITDA margin 10.4%. When you divide that EUR44 million of cash EBITDA by the EUR424 million of Cash Revenue Margin that 10% would have been 18%, if we had only quote-unquote double the number of Prime members to 1.6 million instead of reaching 2.7 million, but I think that answers the question”

Sources

Barclays Initiation Report: Primed for Change

Deutsche Bank: Prime Ready to Fly; Upgrade to Buy

BNP Paribas Exane: I have an (e)Dream

Disclaimer

I am not a financial advisor. These articles are for educational purposes only. Investing of any kind involves risk. Your investments are solely your responsibility and we do not provide personalized investment advice. It is crucial that you conduct your own research. I am merely sharing my opinion with no guarantee of gains or losses on investments. Please consult your financial or tax professional prior to making an investment.

Great writeup - just a small thing but worth nothing - 53% of bookings are on mobile, not necessarily the app (ie could be from mobile browser) - Dana doesnt want to break it out. That said Prime day showed significant growth in app bookings, so the number of bookings on app are increasing - we just dont know the number.

Great list of sources covering the stock. Curious if you have an updated list? Thanks!