Share Price: $20.20

2027 Price Target: $45 | 18% IRR

Introduction

Richardson Electronics is an engineered solution business focusing on power management, microwave tubes and digital displays. Started in 1947 by Arthur H. Richardson as an electronics overstock seller and distributor, the company moved into manufacturing through the 1981 purchase of National Electronics in La Fox, IL, still the headquarters today. The company went public 1983 and has been in the Richardson family for 76 years. Exhibit A shows revenues for since 2008.

The core function of the business today is to act as an outsourced R&D department for multinational companies working on niche, specialized components. Richardson’s global infrastructure, long history, focus on niche markets and sole supplier contracts help it operate in a sweet spot that protects them from competitors.

The business occupies a meaningful niche and distributes critical parts in larger systems (CT tubes, digital displays, wind turbines and electric locomotives). RELL is a “demondust” business: the components they manufacture and distribute are an essential part of a process or larger machine. RELL’s components are a small part of the cost structure of their end product but the big “thing” just won’t work right without it. This leads to high switching costs and pricing power. Once you’re “in” you tend to stay in due to inertia and maintaining the status quo. Companies will resist, as much as possible, delaying their multi million dollar projects for a small $10,000 part.

Customers tend to be sticky and offer repeat business for new products. Although in theory, a customer could approach a new engineered solutions company each time they need a unique component, there is a convenience or familiarity factor that deters switching. If Richardson has worked with a customer and done a brilliant job before there is little incentive to go off and find another company. Anecdotal evidence supports this as management has mentioned weekly calls with TMUS, NextEra and CAT and has mentioned that those customers are approaching them with more and more ideas for components on a monthly basis.

Richardson’s worldwide distribution and sole supplier status differentiate them from both small and large engineered solutions competitors. Huge businesses like NextEra Energy, Progress Rail (a subsidiary of Caterpillar) and T-Mobile have all come to RELL organically over the last 18 months which speaks to company reputation. RELL is small enough where a single engineered product can make a meaningful difference to their top line while large competitors aren’t interested in competing for the business as it wouldn’t move the needle in their business. RELL’s scale and global infrastructure differentiates them from smaller engineered solutions competitors. It allows for easier and quicker product distribution to customers with global operations and better margins through pricing discounts from suppliers. Large engineered solutions businesses can’t come down and compete with RELL either because the contracts are sole-source or RELL is in niche-enough markets that it would be immaterial to their competitor’s revenue. The $40mn cell tower business they launched this year wouldn't make a difference to Littlefuse, Fabrinet or Arrow Electronics.

RELL maintains over 100,000 part numbers in their product inventory database and they’ve estimated that more than 90% of orders received by 6:00 p.m. local time are shipped complete the same day for stock products. It is a huge advantage, especially in a niche market making specialized products, that RELL can be local with customers and in constant contact. (See Exhibit B). This promotes sticky relationships with better customer service. Smaller engineered solutions businesses don’t have the global presence to support and distribute to a CAT or TMUS.

RELL can make a product for the US operations of TMUS and can immediately leverage existing infrastructure to sell the product to its international arm which can make them the engineer of choice with the ability to ship to any location worldwide in 1-3 business days and transact in local currency. I think there is a viable argument to be made that RELL isn’t a simple distributor. They’ve done a terrific at demand creation, product introductions and ongoing global customer support.

Lastly, and it is tough to validate with data, but RELL’s long history (75 years in business) and the CEO’s willingness to fund almost any project with a “let’s see where it takes us” mentality makes them one of the first calls when a former customer needs a new component. In essence, RELL has a venture portfolio of products. They continuously launch one product after another hoping one is a grand slam. It seems they have hit a few in recent years.

The two biggest risks are that Richardson’s products, specifically ultracapacitors, flop and that the controlling shareholder misallocates capital. In either case, FCF would be ever-elusive. There is enough evidence that RELL has found a real niche in power management and should be able to drive sales by iterating on the product and finding new customers. I’m hesitant to give them the full seal of approval as there have been long standing issues with the healthcare business and this is worth monitoring closely. To own RELL is to make a product bet with lots of embedded options. In essence, there is a venture feel to a company like this. Those are notoriously hard and as a result I am demanding a higher margin of safety. Therefore, in my base case I give little weight to new products working and value RELL on what I see today.

As for governance, Chairman, CEO and President Ed Richardson holds the vast majority of voting power via possession of 98% of outstanding Class B common stock, giving him 63% of voting power and absolute control over the company. Mr. Richardson owns 2.1M Class B shares, which convert 1:1 to common shares but has 10x voting rights. The class B shares get 90% of the dividend of the common stock and over 60% of Mr. Richardson’s total compensation comes from cash salary. He does own 15% of the common shares, but I still remain skeptical of his alignment (and the rest of the board who collectively owns less than 4% of the company ex Mr Richardon!) with minority shareholders. Through listening to calls and interviews, I gather that this management team is passionate and committed to scaling the business and deeply cares about Richardson and its products. Ed’s family name is on the business and he has worked at RELL since 1961 and led the company since the mid 80s. The question is: do minority shareholders get a piece of the pie.

I think there are a few reasons why this opportunity exists and where the debate lies. The company’s operations, at first glance, are hard to classify leading to widespread investor misunderstanding and perception of the business still being levered to the semiconductor capex cycle. RELL is a small cap ($315m market cap) company that trades $4m of shares a day with one sell side analyst (Sidotti) covering the name. The company screens poorly with sales more or less flat over the last decade and cash flow negative over that span. Lastly, Healthcare has been a drag on earnings since it was internally started.

RELL’s operations appear to have reached an inflection point, where I anticipate sustainable revenue growth and profitability. The thesis is driven by the fast growing, higher margin GES segment. RELL is debt-free and ended Q2 '23 (the fiscal year ends in late May so FY 2023 covers the second half of calendar 2022 and most of the first half of calendar 2023) with $31 million of cash and investments on hand ($2.15 per share Common + Class B). My base case suggests that shares are worth $25 today driven by 11% revenue growth throughout my forecast period driving slightly higher than $3.00 per share in UFCF by FY27 and a $45 price target.

RELL’s much larger peers trade an average of 12 EV/NTM EBITDA while RELL, with the highest TTM revenue growth among them, trades at just 9x. I think the lackluster corporate governance, the long history of under-performance, and the belief that growth here is all driven by cyclical semiconductor capex spend leads to the mispricing. However, underlying secular trends, a reputable customer base, growing backlog and high incremental margins offer potential for a sustainable shift in earnings power that is not yet reflected in the price.

Brief History

For 30 years the company was a sleepy grower fighting secular changes in its core segment. At its peak in 2006, RELL was a $640 million revenue business with 1,000 employees and barely breaking even. In 2007, they sold their security systems business to Honeywell for $75M and in 2011, the over-levered, money losing company completed the sale of its core RFPD electronics distribution segment to Arrow Electronics ($ARW) for $210M (link) generating significant cash and rolling the company back to a $140M revenue business.

In the wake of the RFPD sale, the business owned two small divisions: The Electron Device Group (“EDG” now under “PMT”), a distributor of vacuum tubes (long thought to be a dying business) and capacitors. The second division, an integrated display business, Canvys, focused on the healthcare space. In 2014, three years after the sale of RFPD, the company rehired Greg Peloquin, the segment’s former leader who had been part of the sale, and put him back in charge of the PMT division. From there management committed to rebuilding their product offerings and importantly retained their global infrastructure vowing to leverage that fixed cost base.

In 2014, RELL funded Richardson Healthcare with an initial $35 million investment to provide manufacturing and maintenance for CT and MRI tubes. Healthcare has been slow to gain traction, with many potential customers tied up in maintenance contracts from the OEM. OEM’s are willing to match replacement prices in order to protect longer term, higher margin service revenues. This business is currently loss making, masking profitability.

It is clear that this business has been a drag on earnings. So much so that the incentive compensation for the Canvys and PMT business leaders acknowledges this by excluding performance at the Healthcare segment from their comp structures. The head of Canvys and PMT are compensated 50% based on segment results and 50% based on corporate operating income excluding Healthcare.

Healthcare at status quo would kill RELL. They either need to see success in pending product launches for Siemens machines or close the segment. Both would have a meaningful impact, boosting earnings by $0.25 a share immediately.

Over the pandemic, Richardson more or less stumbled into the ultracapacitor business when it was put in contact with NextEra Energy through one of its suppliers. In 2019, Tesla acquired Maxwell Technologies for its dry capacitor business and shut down the rest of its operations including its commercial industry segment. RELL had sourced UCs from Maxwell for the last 15 years and was forced to look elsewhere for supply. This led them to a division of LG in Korea called LS Materials.

At the same time, NextEra, the largest wind turbine operator in the United States, who had also been working with Maxwell to replace lead acid batteries, went to LS Materials to find a supplier and were referred to RELL. For the next two years RELL worked with NextEra, designing the ultracapacitor modules to replace lead acid batteries (LABs) in GE wind turbines. NextEra is the largest GE wind turbine operator with ~10,000-11,000 wind turbines. RELL has leveraged this business expanding to other owner operators and expanding into cell tower operators through T-Mobile and electric locomotives through Progress Rail (a division of Caterpillar). These products collectively make up the Green Energy Solutions (GES) segment.

Today, RELL has a global presence, with operations in North America, Asia/Pacific, Europe and Latin America and 450 employees. In 2022, 44% of sales were outside the U.S. and no customer accounted for more than 10%. Their small, but fast growing products include ultracapacitors to replace lead acid batteries in backup power systems (wind turbines, telecom base stations) and a permutation of UC, lithium phosphate batteries, to replace lead acid batteries in diesel engines; and magnetrons used to convert methane into diamonds. No doubt it takes effort and patience to get to know the company, but it has found a durable niche in the uninterruptible power supply ecosystem

Power and Microwave Technology

RELL’s largest segment by revenue is the Power and Microwave Technology segment (“PMT”). There are two distinct businesses here. The Power and Microwave Group (“PMG”) provides an assortment of electron tubes and RF, microwave and power components used in semiconductors. The second business is the Electron Device Group (“EDG”) which is the legacy tube business that has been RELL’s core segment since its founding 75+ years ago. Exhibit C lists a few of their specific products.

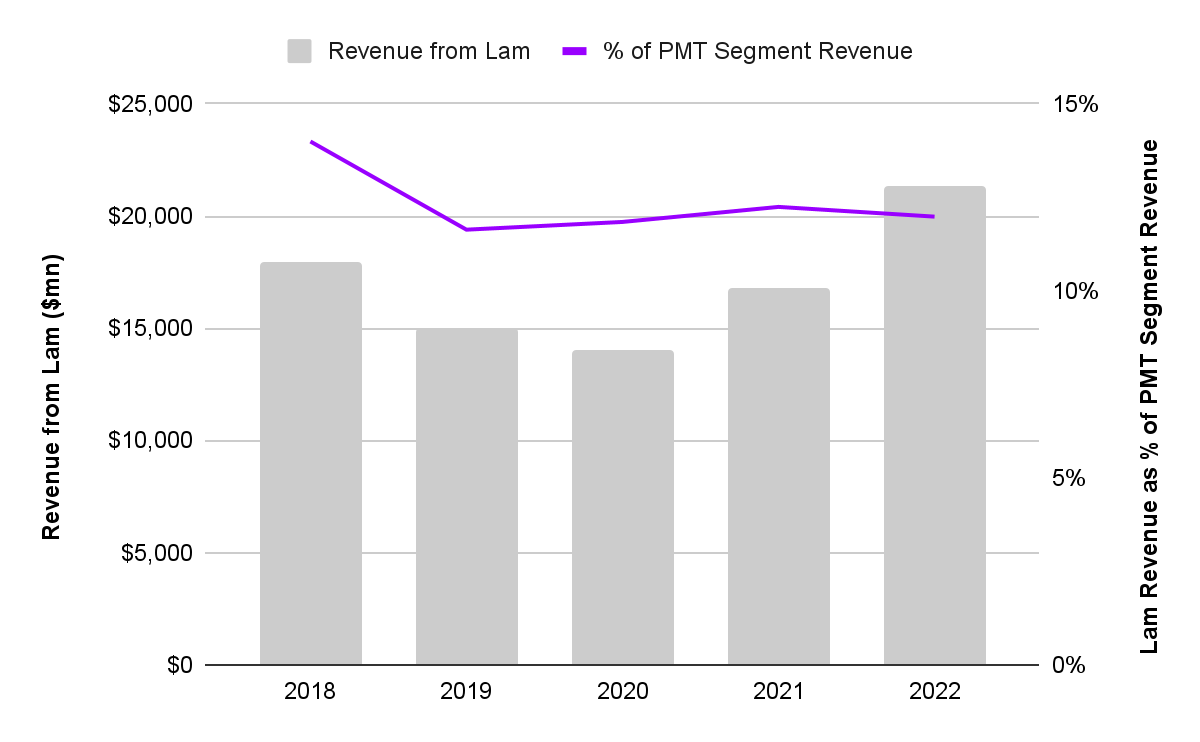

Semiconductor fabrication is highly cyclical and highly capital intensive, as a result capex spending will follow the cycle which leads PMG revenues to be quite lumpy. PMG’s largest customer is the $65 billion dollar semicap giant Lam Research.

Semicap companies supply machines and tools that quite literally make sand think. As you can imagine, these are complex processes executed by highly complex machines. Therefore, components that aid in deposition and etching of semiconductors are rarely turned over because of their high switching costs and once in a system they are seldom tinkered with or ripped and replaced which leads to pricing power over time on new units. This leads to long relationships with customers and consistent replacement demand. I think it is evident that RELL has been a consistent and competent partner for Lam. The relationship still being intact after 7 years of operation and the absolute growth in revenue since 2018 (when we first get data on the Lam relationship) speak to this. (Exhibit D)

Management has talked about the semiconductor cycle running for 12-18 months and then slowing for 9-12 months. We are currently facing one of those downturns. As a generalist, the semiconductor space is one I tend to step around as I have read (and seen!) many generalists get their faces ripped off in the industry. This is the segment that investors are overly hung up on and one of the main sources of my variant view. I believe that investors are falling victim to representativeness bias by labeling all of RELL as a semicap company (and therefore exposed to the industry’s stomach-churning ebbs and flows) despite the segment making up less than 20% of company wide sales. Most investors believe whatever is happening at the company today is mostly tied to the semi CAPEX cycle and missing the new, independent product launches.

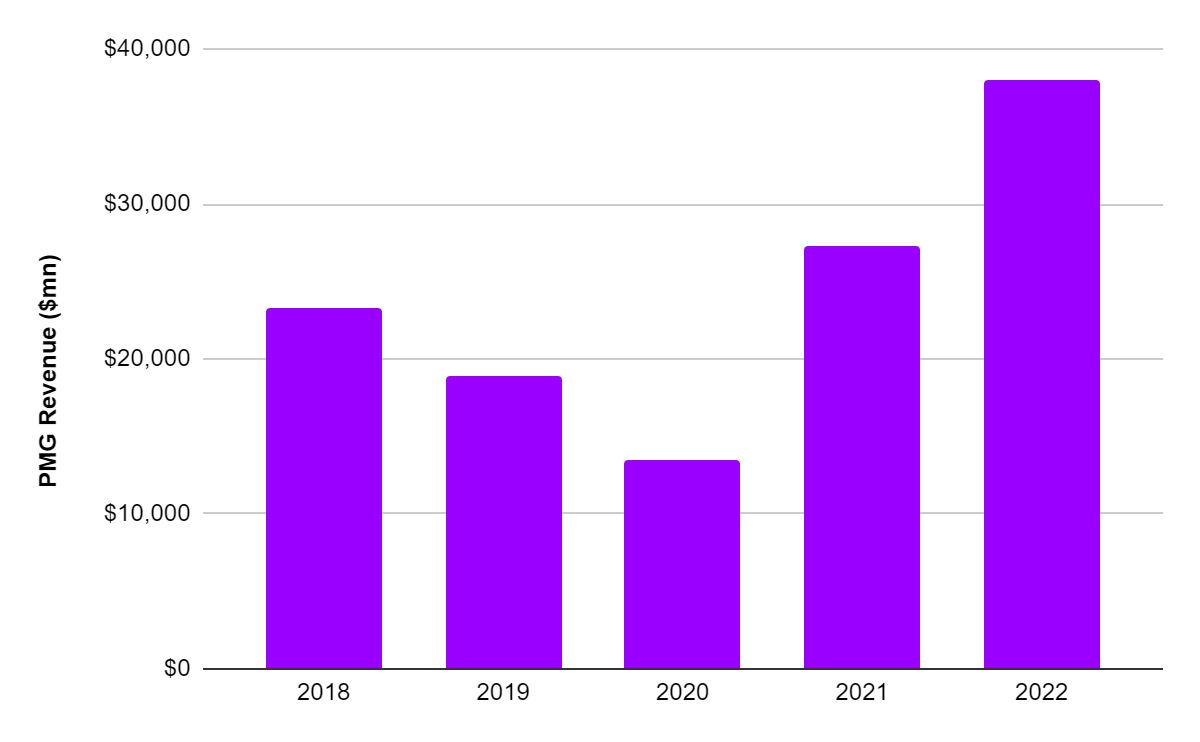

Calling these cycles is undoubtedly out of my circle of competence so I am falling back on stress test math here for the segment. Reality is that RELL's earnings were dominated by Lam only a few years ago. Going forward that reality seems to be shifting. Nevertheless, management has stated that they have visibility to the end of the fiscal year (late May), but can’t see out further than that. Shooting from the hip I estimate that the business did ~$27m of sales in FY21 and ~$40M in FY 22 as you can see in Exhibit E. I have tried to back into the split between PMG and EDG revenues in the segment and PMG’s revenue concentration with Lam.

I’ll touch on it more in the valuation section, but even if this segment gets cut in half in 2024 and reverts back to $20m in sales the green energy solutions business has enough firepower to be able to make up for the drag. Penciling the unit economics through, a $20m loss in sales at 33% gross margin and SG&A at 25% of sales is ~$1.5-1.6m hit to the bottom line.

Electron Device Group

The second business is the legacy Electron Device Group (“EDG”) which distributes tubes for a wide range of uses in industrials and communications businesses. This was long thought to be a dying business but has remained resilient throughout RELL’s history and has helped them fund launches into new engineered solutions.

At its core the EDG is better described as a power management business as many of their products like electron tubes and microwave generators are used to control, switch or amplify electrical power signals. This expertise, which they have developed over 75+ years, has allowed them to parlay into new categories in ultracapacitors in the green energy solutions business.

The segment’s resiliency was highlighted during the depths of the pandemic when sales fell only 5% against 2019 comps and is demonstrated year in and year out by the consistent low 30% gross margins in the segment through the semicap cycle which highlights a strong, non-cyclical base and low competition (Exhibit F). Backing into EDG specific revenue I estimate that the business did $110m in revenue in 2021 and $130m in revenue in 2022.

All in all, the engineered solutions aspect of this business puts a cap on how fast and large this business can grow. The tube market is only ~$400m today and my estimates imply RELL already has 25% of the market, anything more than low single digit growth in this segment would surprise me. In my eyes, the people that still demand microwave tubes really need microwave tubes or they would have moved on to a better product already. This means that there are no real new entrants because the market is so small and stagnant. This leads to lower competition (which is backed by consistent margins) and a steady cash producing business to fund new products with. However, this also infers that gaining new market share will be hard to come by because customers and suppliers are already really entrenched. RELL is good at picking their spots and playing in markets or products they know they can dominate, but it means they will suffer when the semi cycle turns down because investors will paint the entire segment as highly cyclical. Looking out five years, I project revenue from this segment to remain flat from here to 2027 as I believe FY’22 was a near term semi induced top.

Green Energy Solutions

Before Green Energy Solutions (“GES”) was separated out for the first time in FY23, investors attributed the entirety of PMT’s revenue growth to growth in the semicap business. After all, this was a fair assumption: the tube business has long been thought to be dying or best case scenario stagnant and there were limited disclosures around the burgeoning GES business. So, the logical conclusion was that Richardson was getting meaningful uplift from the semi cycle. As a result, would-be investors are concerned whether the recent revenue and FCF growth (Exhibit G) is a permanent inflection or a temporary boon that's strictly a function of the cyclicality of the semi cap equipment market.

There are four products fueling GES’s 200%+ y/y growth. Ultracapacitors used in wind turbines that replaced lead acid batteries, ultracapacitors used in cell tower base stations to replace lead acid batteries in generators, lithium-iron-phosphate batteries used in electric locomotives and microwave tubes used to make synthetic diamonds.

Ultracapacitors in Wind Turbines

RELL developed the ULTRA3000 to replace the lead acid batteries (LABs) that power the pitch control in wind turbines. The pitch is the part of a wind turbine that adjusts the angle of the blades based on wind direction in order to control the rotor speed. Turbine operators are interested in getting pitch right as it is estimated that nearly 20%-25% of all downtime in wind turbines is due to pitch system failures which handicaps the wind turbines’ efficiency and reliability. (link). As a result, these ultracapacitors are a small percentage of the overall cost of the turbine, but play a critical role in its success giving RELL both pricing power and switching costs. It is early days in the segment so this is hard to quantify, but judging by the two decades that LABs were used in wind turbines despite being frustratingly inadequate any improvement device seems to have good prospects for sticking around.

The two options for changing pitch of a blade are to do it hydraulically or electrically. Hydraulics (used in Vestas turbine) is less precise and more prone to error and therefore requires higher maintenance costs. The electric option (used in GE turbines) has long been fulfilled by (“LABs”).

The LABs have their drawbacks as well. They require replacement every 3-5 years and therefore have high service costs that come alongside them. Many installers see them as a razor-razor blade model with a low cost for the battery itself but higher margin service revenue once in place.

Wind turbine operators, such as NextEra Energy, are electing to swap out LABs for ultracapacitors because they last longer (10 years) which saves on product and service costs for the turbine operator and operate consistently in wider temperature bands (-40 to +65 degree celsius) which makes the turbine more reliable year round and opens up the potential addressable geographies for wind turbines. The obvious benefits to operators are proven out by the strong demand RELL has seen for the product already. RELL has been able to ramp this product from conception to more than $10M in shipments and backorders in less than 14 months. Of the 35,000 GE turbines in the U.S. today, NextEra operates 11,000 and has a program to add 1,000 wind turbines a year. RELL is currently the sole source supplier of ultracapacitors to NEE and received an order for replacements in 1,000 turbines last year, ~$10m in revenue, and has stated NEE plans to replace 1,400 turbines in FY 2023. This implies 40% revenue growth from NEE alone. It’s difficult to quantify, but I think there is a slight ESG factor at the margin here. We have replaced lead in paint and gasoline and my gut tells me it's time to do that in batteries.

As mentioned in Brief History, the opportunity to sell ultracapacitors to the wind turbine operators fell into RELL’s lap when Tesla acquired Maxwell. During the acquisition, Tesla shut down all non dry capacitor activities at Maxwell. RELL, who formerly sourced its ultracapacitors from Maxwell, was forced to go looking for a new supplier. In the process they found LS Materials, who then referred NextEra to RELL to produce an engineered solution based on LS Materials’ ultracapacitor.

The competitive advantage here is two fold. First, RELL has two 2 patents on the Ultra3000, one of which is a design identical in form to the lead acid battery system used in GE wind turbines which makes it an easy rip and replace for operators. A big reason why they are the sole source supplier of ultracapacitors to NextEra and were able to ramp so fast. There is also counter positioning against the lead acid battery suppliers. In all, the ULTRA3000 costs about $10,000 per turbine (0.33% of the total cost of the average $3m turbine) compared to $700 for LABs.

While this seems high at first blush, there is reasonable evidence to suggest that wind turbine operators actually save money over the lifetime of the device when factoring in the service and replacement costs of LABs. Annual maintenance costs on a wind turbine range from 1.5%-3% of installation costs or about $45,000 annually (link). Exhibit H shows the different components that make up operation and maintenance costs in wind turbines. 50% goes to service/parts and, I’m shooting from the hip, if 10% of that goes to servicing the lead acid battery annually then that is a cost $2,250 alone each year. This battery needs to be replaced every 3-5 years and accounting for other implicit costs such as down time this adds up to well over $20,000 in costs per LAB over the Ultra3000’s ten year lifetime. In comparison to the $10,000 per turbine for the Ultra3000.

The lead acid batteries would have to cannibalize their product revenues and abandon their high margin service revenue in order to compete against RELL. It is also worth mentioning, here, RELL’s process power. They have been in the power management business for 75+ years and ramped this product from conception to more than $10M in shipments and backorders in less than 14 months. At the margin, I think their global distribution and, for lack of a better term “know-how” gives them an advantage to serve these geographically dispersed turbine operators and ramp so fast.

The Ultra3000 solely replaces LABs in GE turbines. According to the U.S. Wind Turbine Database there are roughly 72,500 wind turbines in the U.S. (link). GE controls nearly half the market with 35,000 turbines making this a $350m revenue market at the $10,000/turbine price tag management has disclosed. While I am sure that RELL won’t be in every GE turbine I think two things are evident. One, the market is RELL’s for the taking and as a result of patents and sole source agreements despite inevitable volume discounts the unit economics at maturity won’t look much different than today.

Exhibit I shows the growth in wind turbines each year since 2000 and GE’s share of the U.S. market. In addition, RELL is expanding their reach to establish partnerships with other large operators of GE wind turbines in North America. On the Q3 '22 earnings call, management noted increased bookings with Enel, Inver Energy, RWE and other owner-operators of GE wind turbines.

With the current ULTRA3000 unit economics (see Exhibit J), this $350m+ TAM in U.S GE aftermarket wind turbines and 8% operating margins (which should expand as they benefit from scale economies) is more than enough to drive the RELL thesis and sustained revenue growth for years ahead. As an aside, RELL is in talks with Siemens and Vestas, the leader in hydraulic pitch turbines, to retrofit the modules to work with their turbines, which could significantly expand its market. This product could come to market faster than thought (using the Ultra3000 as a base rate), but is just a call option at this point and does not contribute to the thesis.

My last note on initiatives or call options is that RELL has said they are in discussions with some major manufacturers of wind turbines to make their module an OEM sale as opposed to replacing the lead acid batteries that are in the field. If this were to occur and their demon dust product is placed in the OEM design, there exists a status quo or inertia for the product that drives mass adoption and predictable, recurring revenue. Moving from the aftermarket to OEM would unlock a whole new market for them in addition to the $350M GE aftermarket TAM today.

Today there are three main competitors LICAP and UCAP (which split out of Maxwell) and Skeleton in Europe, but RELL has sole source contracts with the top 4 owner operators in the U.S. Even if the products are homogeneous among the large players, I believe that RELL can differentiate themselves through their scale and distribution to support international players.

The ULTRA3000 is a plug-and-play module that replaces hazardous lead-acid batteries within the wind turbine generators’ pitch system. The ULTRA3000 has shown a longer operating lifetime, lower maintenance requirements and better cold-weather performance than LABs. RELL is the sole source to the top players in a large and growing market with secular tailwinds and a global geographic distribution network. Their current contracts alone, just in the NEE aftermarket is a $110m opportunity that is growing $10m a year. This doesn’t account for other GE aftermarket operators, the chance to go upstream to the OEM or expand into the European manufacturers.

Ultracapacitors in Cell Towers

The general benefits of the ULTRA3000 (the longer life, lower maintenance and ESG friendliness) make the ultracapacitor a logical product to find other niches. RELL adapted the product to replace LABs in generators and is currently beta-testing their UltaGen3000. While nascent, RELL’s global infrastructure, manufacturing and S&M team lowers the barriers to scale for the business and their reputation with the turbine operators will give them (even if it is marginal) credit in new markets.

While simply a call option today the new product has a large potential market and sole source nature. The UltaGen3000 replaces LABs in cell tower base stations. Today there are nearly 400,000 cell sites and ~60,000 (15%) of them have existing generators. Exhibit K shows a similar trend to the wind turbine market as the installed base of cell towers is growing as AT&T, Verizon and TMUS expects to add 15k base stations between now and 2025.

RELL values the market at $250 million (including some ancillary verticals like hospitals) and anticipates more meaningful bookings in the second half of FY’23. Of that $250 million estimate, only about $65 million is serviceable ($42million in wireless base stations and $23 million in critical facilities) today. Judging by recent addition trends and commentary from the big three cell tower operators (AMT, CCI and SBAC) I think the number of cell towers in the US will stay more or less flat from here and therefore RELL can only capture aftermarket sales.

More than anything this highlights management’s desire to experiment and take shots on goal. Maybe the UltaGen3000 will never be a material bottom line contributor, but in the worst case scenario, they gave it a try on a small $1 million initial investment. Even if it is a mediocre success it can help them leverage their fixed cost base. Judging by the way management has spoken about new product launches in the past I get the feeling they view these similar to venture bets. They will continually test, experiment, and launch new products. Oftentimes, they’ll hit a foul ball or a single, but occasionally they’ll catch a fat pitch and send it deep. With each swing they give themselves another chance to hit a home run. This product in particular is not material to the thesis, but the idea behind the product (to innovate on the products that are working and move into adjacent markets) is significant.

Lithium Iron-Phosphate Batteries in Electric Locomotives

The GES segment also has a supply distribution agreement to provide lithium iron phosphate batteries to Progress Rail, a division of Caterpillar, for integrating into rail cars. In effect, they are replacing the diesel engine in locomotives and driving the conversion to electric. Progress Rail approached RELL to see if they could replace the lead acid batteries in electric locomotives by building the entire battery compartment ($1-$3m per train). I believe there are three reasons why Progress Rail approached RELL for this product. RELL is one of a few U.S. manufacturers with the technical capacity to build these cells thanks to their long history, they have prior knowledge in power management and their ability to service such a large organization with their distribution infrastructure already in place.

The Progress Rail batteries have much the same value proposition as the ultracapacitors. It has a wider charge and discharge temperature range, longer lifespan than current batteries and is considered more green. RELL is developing four prototypes for Progress Rail and management has talked about converting $50m in locomotives over the next 3-5 years and then launching in full after that.

This will be a $5-8m business in FY’23 that contributes a de minimis portion of revenue, but Progress Rail is one of two leaders in the locomotive market alongside Wabtec (who bought GE Transportation in 2019). According to the Bureau of Transportation Statistics (link) and Statista (link) there were ~23,500 Class I railroad locomotives in North America in 2020. This seems to foot with management estimates of 25,000 Class I locomotives. Exhibit L shows the total number of locomotives in North America since 2000 and rail freight carloads. Judging by industry reports, Progress Rail (Caterpillar) and Wabtec filings, and management commentary there seems to be a 40-60 split in market share between the two locomotive manufacturers. Implying ~9,400 locomotives for RELL to convert at Progress Rail. The industry's goal to convert the vast majority of locomotives to electric by 2030 means that Progress Rail Class I locomotives are a $1 billion+ market alone over the next decade. RELL, as the sole supplier today, is in pole position to capture a meaningful portion of that market.

The decline in locomotives starting in 2016 was spurred on by PSR (which led to longer trains and less locomotives) and slowing/declining volume growth at the rails at large. In my view, most of the low hanging fruit from PSR has been plucked since it took over the industry 7 years ago (as we can see in a leveling out of operating ratios in the last 5 years) and the overall number of locomotives should level out from here as the Class I railroads struggle to find more efficiency.

I still have some serious questions around how successful RELL will be at fending off competition in the space. Historically, they have been a supplier to more niche markets (the tube industry is only $400m in total) and there is a real possibility (call it 50%-60%) that they are in over their skis and will face tough competition. I’ll touch on it more in the valuation section, but this seems like an embedded option more so than anything to build a thesis around. RELL has never historically played in manufacturing/distributing standard products, but have more so focused niche products that are unique to the customer to help them win market share. Working on CAT forklifts rather than locomotives would be more characteristic for them. There are just too many outstanding questions around competition swooping up the market, the market shifting to hydrogen over electric and even if the industry moves electric the partnership still has to be successful and RELL’s module has to work. As a result, I am only giving them minor credit over the next 5 years for this project.

Developing the relationship with CAT is important for new ideas/product generation, however. CAT is obviously a massive company with a plethora of engineered solution opportunities which means if the partnership is successful then CAT will continue to bring more and more projects to RELL giving them more swings at the ball. See the electric forklift idea. (This VC thing isn’t so hard!)

Synthetic Diamonds

Lastly, RELL manufactures magnetrons that are used to create synthetic diamonds from methane. The magnetron allows diamonds to be made more environmentally friendly, less expensive and equally clear. This is another growth avenue as synthetic diamond manufacturers continue to experience high demand for sustainable and humanely sourced diamonds, specifically in Asia. According to Ed Richardson, RELL built approximately 800 magnetrons in prior years, but demand jumped to over 5,000 in FY22. RELL sells magnetrons for just under $3,000 a unit and the tubes only last about 2 years, providing RELL with a recurring revenue base for these products. There is little data around the market to help quantify the opportunity/durability of demand, but I think it is fair to say that was a historic peak and we may not see revenues like that again in the business.

Canvys

Canvys provides customized display monitors and touch screens primarily to medical OEMs. To make it tangible, Canvys sells the monitor that displays the image of your baby during an ultrasound. RELL will partner with both private label manufacturing companies and branded hardware vendors on specialized products. With over 2,000 customers including Honeywell, Stryker, and Medtronic, Canvys offers steady, low variability cash flows for management to reinvest into the other parts of the business.

Blue-chip medical and industrial systems are propelling demand for Canvys displays. The unit generated $35m in sales in FY22 with 32% gross margins. This is generally an overlooked portion of the business with a sporadic topline (See Exhibit M). The gross margin stability in Exhibit L also leads me to believe that RELL has found a niche with low competition they are comfortable operating in.

The business should continue to grow mid to high single digits going forward with flat gross margins in the low 30% range. Because they are willing to white label and fully customize their products to each individual customer, Canvys has differentiated themselves from larger players who would find the market or job too small for their mass distribution businesses or refuse to white label. In my opinion, the quality of service and willingness to work with customers sets RELL apart from the big players. When competing against companies of the same or smaller size Canvys has the edge in operational excellence that smaller competitors can’t mimic as they are ISO certified with global offices. Quick delivery, transacting in local currency and scale help them dramatically in a relatively homogenous offering.

In summary, the segment is a consistent source of cash that has a durable niche provided by their scale of distribution, breadth of offering and depth of service. The scale and quality offering differentiates them from smaller providers but that benefit erodes quickly and RELL then relies on their service and ability to customize.

Healthcare

Richardson Healthcare offers replacement options for CT tubes that help to lower the cost of healthcare delivery by repairing, refurbishing and distributing high-value parts and equipment for hospitals and medical centers. RELL works with Canon (Toshiba), Siemens, GE Healthcare and Philips Healthcare.

The healthcare business was added in 2014 when RELL hired most of the team from Philips, after Philips closed its CT tube-manufacturing facility in Aurora, IL. RELL injected $35m to start the segment. This was originally touted as their growth ticket, but has since been a thorn in management’s side. The fact that this growth has failed to materialize brings into question management's credibility with new product launches and is the main reason I am discounting them in base case.

The business is only 6% of revenues (Exhibit N) and has been operating at a loss since its start. 95% of this revenue is product oriented with only a meager 5% dedicated to servicing their installed base. Management has not stated the margin difference between the service and product businesses and has not indicated an interest in building out their service offering. I would guess this is because services are outside management's circle of competence as they have focused resolutely on manufacturing and distribution. There is also stiff competition for the higher margin service revenues. The incomplete offering probably plays a role in their inability to win market share here.

Normal gross margins in this business are mid twenties which is lower than the corporate average. The success of this business depends on RELL launching new tubes to expand its portfolio of replacement parts it can offer to customers. This will increase utilization and help them expand over their fixed cost base which could, if everything goes to plan, help the business reach break even by management's deadline of Q4’2024 (May 2024). RELL produces about 300 tubes a year but has the capacity for 1,000. Ed has said the segment will break even at around 500 tubes a year.

The segment is currently limping to profitability which could provide a massive tailwind to earnings power if they ever figure it out. Healthcare lost $6mn last year, if they get to break even in ‘24 then that is a ~$0.30 gain in EPS from just eliminating the earnings drag. The company values the aftermarket diagnostic imaging parts and service market opportunity at $10 billion. Management has made clear that it will never be more than a niche player in the market catering to the businesses they know they can excel in/can differentiate themselves.

They are also releasing their ALTA 750G to expand the product portfolio and make it more attractive for potential customers to switch to a third-party vendor. With the benefit of hindsight, getting customers to switch from the status quo of the vendor that installed the tube proved more difficulty than they thought. The business has high switching costs but with the ALTA750G, the second tube the company releases that works as a replacement for Toshiba/Canon, management hopes to overcome this.

Richardson is also working on a series of replacement tubes for Siemens, which has a much larger installed base than Canon and lacks third-party replacement options. This is a field with low competition and high barriers to entry due to capital needs and expertise requirements. RELL expects a revenue contribution from the Siemens program to start building in this fiscal year. This reminds me a bit of Heico’s offering in aftermarket aerospace. If RELL can come in and steal even a portion of the market at lower prices, the incumbent player’s hands are tied in game theory. Lower prices to get the measly few percentage points back but hurt the rest of the revenue you retained or let RELL be and sacrifice the small portion of the market.

AGB has a great primer on Heico and this quote reminded me a bit of RELL,

“With a successful PMA, HEICO can then leverage its scale and distribution capabilities to sell the part to its customers. HEICO is careful to keep market shares near 30% for certain parts to not upset the OEMs and still satisfy the end customers. With its distribution and repair centers, HEICO can determine which parts (mainly HEICO PMAs) will be pushed to service maintenance and repairs.

We also have to remember that the demand for many of these aftermarket parts are not discretionary. Due to strict repair and maintenance regulations, parts need to be repaired or replaced after a certain number of flights and miles flown. So as long as planes continue to fly …HEICO should see continued steady demand for its products.”

Management has been guiding for 3 years now that Healthcare will break even by Q4’24 (May 2024) and the business is on pace for that. However, there has been issue after issue with the business over the years (delays, trouble getting customers to switch etc) so I would be hesitant at best to say that healthcare is a lock for success.

Risks

Beyond the bear arguments that we covered earlier I think there are a few important risks that deserve acknowledgement here. The first is management. Avi at Long Cast Advisors captured this well in his piece (link), “It’s understandable for a company in the distribution space to use its working capital to fund growth by reinvesting profits into inventory and receivables - that’s what distributors do – but RELL’s FCF conversion is lumpier than larger, well known and arguably better managed distributors.” Given the corporate governance structure, Ed Richardson would need to find internal motivation to change. In the meantime, he’s buying as much inventory as he can, eating up FCF through growing inventory. A large portion of the inventory growth relates to components needed to fulfill orders on hand for the ULTRA3000 and other long lead time parts for both the manufacturing and GES businesses. So the question then becomes, what do normalized NWC numbers look like?

I also have some questions around the operational ability of management as well. RELL used to be a dominant supplier of medical magnetrons to an oligopoly of medical device players. Ultimately, lack of quality and innovation forced customers to in-house this. This and the failure of Richardson Healthcare so far raises some questions about management's operations ability and therefore the chance of success for the new product launches in GES.

This leads me into the second risk: inventory obsolescence. As a distributor it's important to have a reliable source of supply for customers, that is literally their moat as a business, so I understand why management has to put up the cash; but in the meantime they are running the risk of that inventory going obsolete. Who knows how fast those end markets change due to new technologies, evolving industry standards, frequent new product introductions and changing end-user demand. Without many long-term supply contracts with customers, I have some pause. In my mind they are constantly on a treadmill of launching new product after new product and hoping one pays off (this is akin to a venture capital model, take as many shots on goal and see what sticks).

If they fail to anticipate the changing needs of customers, miss a turn, or inaccurately forecast demand, customers may not place orders with RELL. Investors could wake up one day and realize that each of the new products in GES failed to culminate and all that pre changes in working capital “cash flow” was eaten up paying for inventory that is essentially worthless now.

Also, what if the ultracapacitors don’t work or the manufacturing is poor? Maybe turbines are the test bed and they end up flopping in cell towers? RELL is sole sourcing from a South Korean manufacturer that is new to the market and therefore reliant on a single supplier for a large market. One of their suppliers represented 11% of total cost of sales in fiscal 2022, 15% in fiscal 2021 and 16% in fiscal 2020.There is a really deep reliance here that we have to discount.

Management

If I haven’t made it abundantly clear, I have mixed feelings on RELL’s management and governance. First, the positives.

Ed has plenty of experience in the power management and tube business. It’s been all he’s ever worked in for the last 60 years! He was with the business from its time as a startup to over $600m in revenue and comes across as knowledgeable, passionate and smart in interviews and calls. You can tell he knows the business through and through and is intimately familiar with each product. He is open and honest with shareholders as you can see on the calls talking freely about guidance and where he thinks the business will be in a few years time and the challenges to get there.

He is clear about the markets he is willing and not willing to play in, where he thinks the competition is too tough and the niches he thinks they can dominate. This is a management team that knows their circle of competence. The team around him is strong as well. Greg Peloquin and Wendy Diddell are solid operators who have been key players in large companies before. Greg at Arrow and Wendy, who has been with Richardson for 20 years, during RELL’s peak. Each of the segment operators’ compensation is 50% cash salary and 50% performance based. Greg’s performance comp is tied 75% to operating income at PMT and 25% “Operating Income excluding Healthcare” while Wendy’s is ⅓ to each of Revenues, overall Operating Income, and Cash & Investment Activities.

Ed owns 63% of the voting power in the company and has emotional alignment with shareholders because his family’s reputation is at risk. He will refuse to let this flounder. Ed has done a good job tying compensation to business unit performance for each segment manager and the 40% of his personal compensation is driven by revenue, operating income and cash & investment activity. 61% of his total $1.37 million compensation comes from salary. I’m not super stoked about more than half of his compensation coming from just showing up and the governance structure ensures that minority shareholders can’t change that. There is also a funky car lease payment that each NEO gets of $12,000 which turns me off. I would love for compensation to be tied more toward ROIC and operating margins, but there is no shot this changes.

Valuation and Scenarios

PMT

The driver of the PMT segment is the semiconductor cycle. The EDG side of the business should exhibit stable margins and grow alongside inflation due to the limited competition and stagnant market growth. On top of this $130m base sits the more volatile PMG business. My forecast between 2023 and 2027 shows revenue dropping 3% in ‘23, 5% in ‘24 and growing 5% thereafter as the semiconductor exposed business starts to recover through the end of the forecast period. Despite the drop in revenue I expect gross margins to remain flat through the forecast period in line with history.

I don’t expect industry-wide tube sales to change meaningfully over the next decade, so most of that recovery comes from pricing in EDG and recovery in PMG

GES

GES is the thesis here and the primary driver of topline revenue. Management has guided this segment to be between $40 and $50 million this year. Throughout the forecast period I have revenues growing 45% annually from $45m in ‘23 to nearly $175m in 2027. This is driven by greater penetration in NextEra turbines. I have turbines converted per year ramping from 1,400 in ‘23 to 5,000 in 2027. In all this implies RELL converts 90%+ of NEE’s 15,000 turbines by 2027 including new turbines built. This projection also relies on RELL penetrating other GE turbine operators.

As GES scales I expect margins to expand by 0.5% per year due to the segment’s 37% incremental margins. High demand and engineered/specific design for the product have historically led to pricing power for other RELL businesses is supporting evidence for this thesis. I also believe RELL will benefit from economies of scale as they move more volume simply due to new products over their fixed cost structure. Exhibit P shows my GES estimates in the base case which drives a RELL wide 10% revenue CAGR on its own.

Canvys

Canvys contributions are primarily a function of volume growth based on its steady track record. The business grew 9.4% from 2017 to 2022 (albeit in a lumpy fashion) and I project only a 4% CAGR throughout the forecast period. I suspect that sales took a large jump last year as customers over ordered due to supply chain constraints in order to ensure product which results in a hangover in the business for the next few years. Margins are remarkably consistent in this segment because of low competition and limited market growth. In truth, this segment is more or less inconsequential in the long term to the thesis.

Healthcare

Healthcare’s primary driver is the launch of their new Siemens product. I forecast 5% revenue growth in this segment over the forecast period and hold margins at 25%. If I am wrong to the upside here, it is because of this forecast. RELL could sell or shut down the business today and immediately get a $5.5m tailwind to the bottom line. If they reach limited success and get to break even through selling more tubes and filling their excess capacity this would drive gross margins significantly higher (I estimate into the low 30% as seen in the first half of ‘23). This would have the same result as the $5.5m tailwind to earnings in the event of a sale. I am skeptical to underwrite a scenario like that based on a spotty track record in healthcare and management’s stubbornness to see this through. I think they may be suffering from some sunk cost fallacy here.

I think this segment’s loss in ‘23 will be $3 million to $3.5 million. This $2 million improvement to the bottom line is a 15 cent tailwind to earnings. Success in healthcare would be getting the business to $14.5m in sales and breaking even.

Margins

Gross margin will grind higher as the higher margin GES segment contributes more to mix. SG&A is the second largest expense in the business after COGS and is made up of compensation and benefits, rent and occupancy and travel. As RELL sells more units of existing products and launches new products in secularly growing industries I expect that compensation and occupancy expenses will proportionally fall. At the same time, I think a proportional increase in selling and travel expenses will offset some of this leverage as they try to win new customers. Combined, I expect the proportional decline in these expenses to offset any new selling initiatives. As a result I expect SG&A expense to rise by ~$5 per year through the forecast period but fall as a percentage of revenue from 25% in FY22 to 20% in FY27 (Exhibit Q)

Sources and Uses of Cash

As I have already highlighted, RELL's legacy businesses will continue to generate cash. I don’t see this management team raising any debt (if they didn't do it in 2021 they may never!). In my base case I don’t assume any share repurchases as Ed has shown in the past that he needs to be shoved toward them and a continuance of the current dividend with the remainder of cash either building up on the balance sheet or being used to fund growth through working capital.

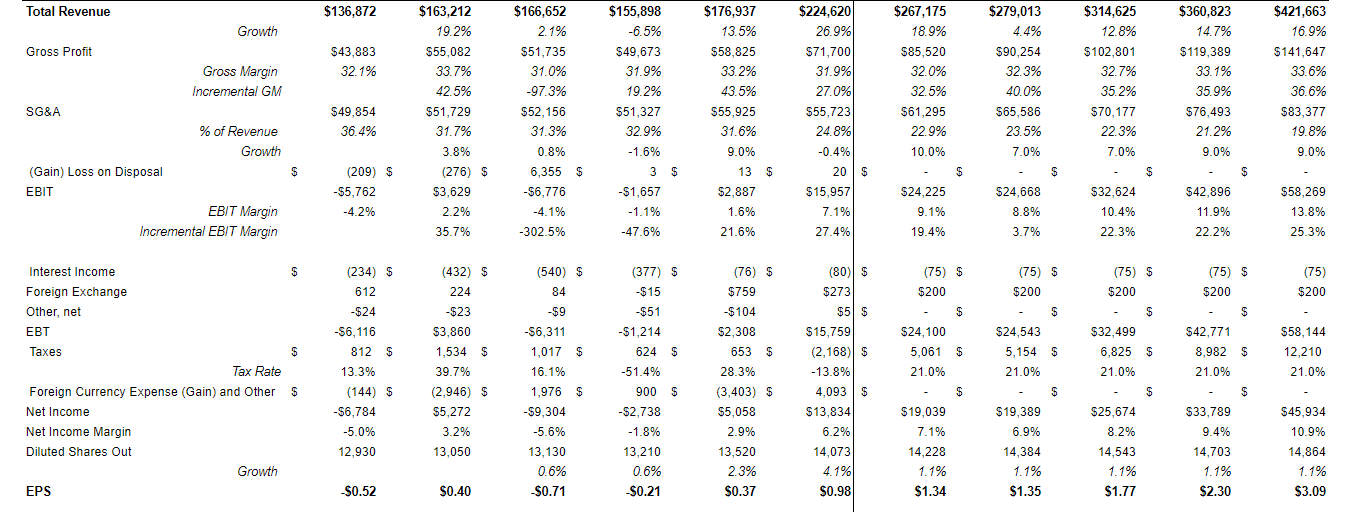

Tying it all Together

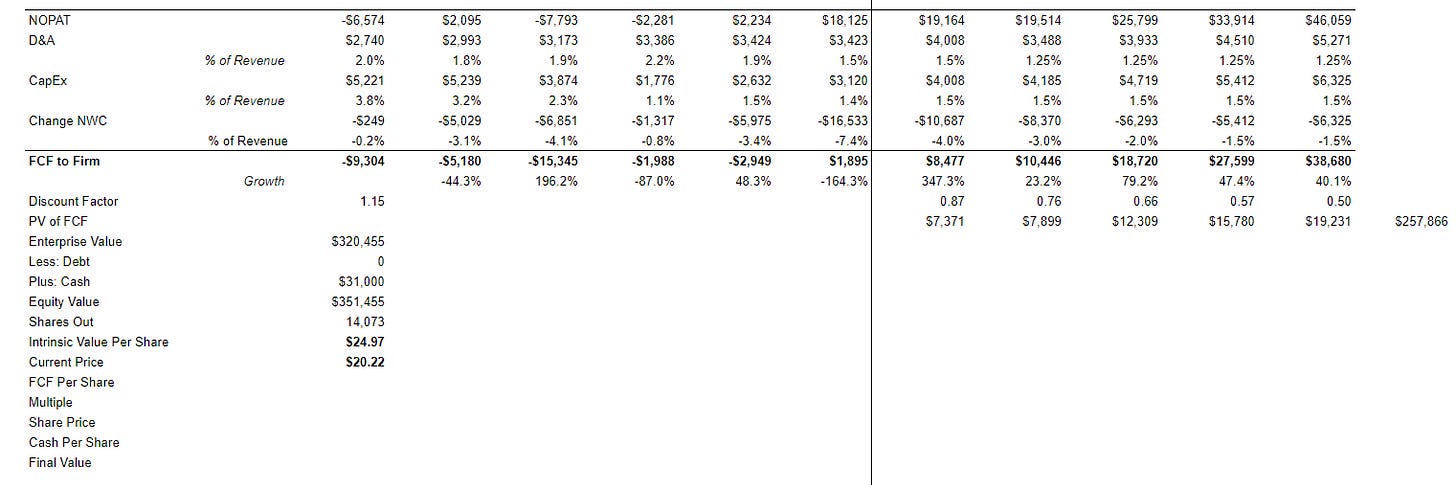

Exhibit S shows that my base case drives annual top-line growth through the forecast period of decade of 11%, absolute net income growth of 22%, and EPS growth slightly higher than 21% as a result of dilution from SBC. RELL has $31m of cash and investments on hand or about $2.15 per share. RELL’s current $284m market cap means that current EV is $253m. RELL is therefore trading at 10x NOPAT which I am projecting to grow 16% per year over the next 5 years.

My base case suggests that fair value is $25/share, which is ~25% higher than the current price of $20.20/share. In other words, I expect that an investor today could earn a 17% annual return over the next five years in my base case. Exhibit T shows a screenshot of my DCF output.

In a bull case where the company executes on each of their new projects I project they reach $500m in revenue by FY27 and 13% net income margins. This supports a $28 share price today. My bear case has sales growing to $380m, but only 100bps of net income expansion throughout the forecast period due to continual struggle in the healthcare business. This supports a $15 share price today.

Conclusion

RELL is perceived as a temporarily inflecting cyclical business levered toward semiconductor capex with governance red flags. Underneath the hood, a burgeoning and secularly growing green energy business with sole source contracts, numerous patents and world class distribution network allows RELL to place a critical role in niche power management. This locks customers in with high switching costs (who is jeopardizing their multi million dollar wind turbine for one tiny $10,000 part?) and begets stable margins and pricing power. The balance is strong with no debt and $31m in cash. I think shareholders can compounded in the mid to high teens over the next 3-5 years buying shares today at $20.20.

Sources

Longcast Advisors RELL Blog Post

Richardson Electronics Investor Visit and Tour October 11th 2022

November 2022 Ideas Conference

RELL CEO on PlanetMicroCap Podcast

Richardson Electronics Investor Visit and Tour October 11th 2022

Hey Ben, love the brilliant analysis. I'm curious about where you got the data for Exhibit H, J, and K?