Somnigroup [SGI]

Kingmaker to Grim Reaper

Thesis Summary

As Scuttleblurb wrote in the intro to his SHW analysis:

“In some industries you will find one player that uniquely and above all peers excels at something that is foundational to excess returns, whether that be customer service, cost discipline, scale economies or product innovation. At times, you may find yourself thinking “I get it, X is a much better company than Y. But Y trades at a 30% discount and if its turnaround initiatives pan out, then at X’s margins and multiple…” This rarely works. Disparities in returns on capital and valuation multiples between the best and the rest stubbornly endure, as often: 1/ the competitive advantages driving excess returns tie back to culture and culture is hard to change, and 2/ greatness begets greatness – the best companies attract the best talent and win the most customer trust, which feeds back into more of the same. There are exceptions of course, but as a rule of thumb and assuming a long enough time horizon, it makes sense to go with the company that clearly and consistently stands out from its peers on dimensions that matter in a particular industry, even if that means paying up.”

This means buying Somnigroup in the mattress industry.

Somnigroup is the industry’s leading mattress manufacturer and retailer with $7.6B in pro forma sales in 2024 (net of intercompany sales) and the result of the TPX/MFRM merger. Prior to the merger, TPX had become an increasingly dominant manufacturer in the category, consistently taking share from competitors since CEO Scott Thompson’s arrival in 2015. The merger combines them with the industry’s largest mattress retailer (MFRM has more than 2,200 stores) giving the vertically integrated SGI the ability to control their own destiny at an opportune time in the cycle.

Since 2022, the mattress industry has undergone a depression-like downturn creating a trough on trough set up that has multi-year legs as volumes return to their long-run trend. This downturn has led the Street to perceive SGI as a cyclical bet on housing when in reality it commands the control point within its industry giving us an attractive 3-5 year story and a trough valuation on trough earnings.

Somnigroup is the best managed and highest quality business in its industry trading for 15x normalized free cash flow to equity. We believe that Somni’s current valuation fails to reflect its earnings power in a normalized demand environment and an industry that has structurally improved over the last decade.

In particular, we believe the Street is not giving enough credence to (1) CEO Scott Thompson’s ability to execute (2) MFRM’s impact in meaningfully improving the business quality/distribution power and (3) the industry’s trough on trough conditions creating a multi year tailwind.

SGI is positioned to accelerate share gains due to 1) incremental share gains from taking over more slots at MFRM 2) the combined size of SGI will unlock scale economies in production and allow them to dominate industry advertising spend 3) their new access to customer data from Mattress Firm which will aid in product development (they have a best in industry R&D organization which allows them to stay on the leading edge of the industry)

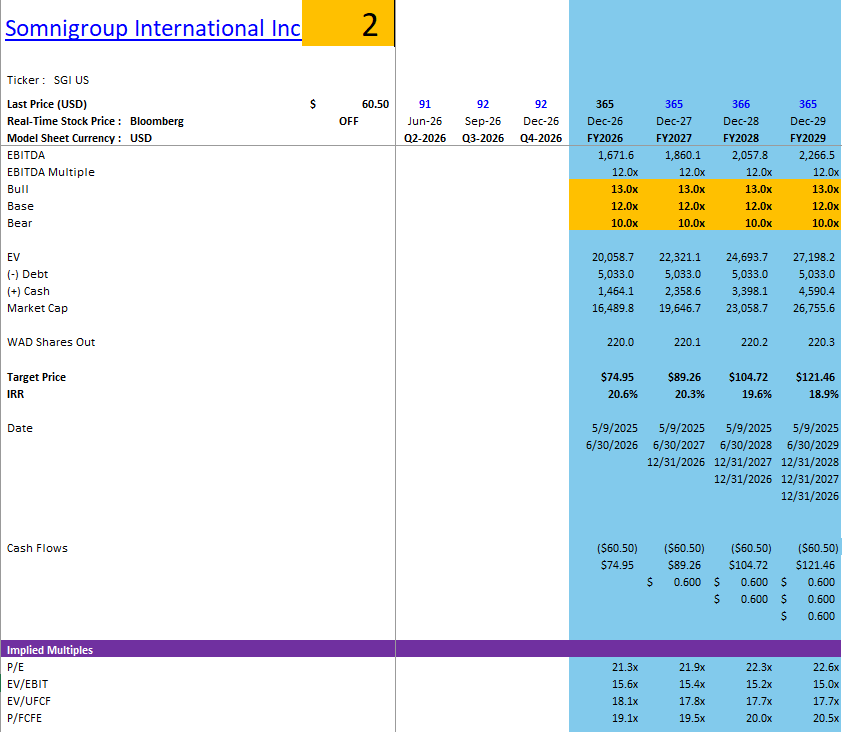

Trading at 15x levered FCF or 9.5x EBITDA on normalized estimates, SGI is a vertically integrated consumer business with a killer CEO at the helm and clear levers to grow EBITDA. We see a path to $121.00+ per share on our 2029 assumptions (June 2029), corresponding to a 19% IRR on a 3-5 year view as the business will do $5.39 in EPS and trade at a 20x+ EPS multiple in line with other dominant consumer businesses.

Brief Business Overview:

Somnigroup (SGI) is a vertically integrated designer, manufacturer, distributor and retailer of mattresses and other bedding products. The company's wholesale brands include Tempur-Pedic, Sealy, Stearns & Foster and retail brands such as Mattress Firm (~2,200 stores) in North America and Dreams in the UK (~200 stores). The company operates over 2,800 retail stores globally with 65% of their $7.6B in revenue “direct” to consumers and 35% wholesale through 3rd party retailers (previously 24% direct, 76% wholesale prior to the acquisition). The company generates ~85% of its revenue in North America and ~15% internationally. 56% of sales ($4.9B including intercompany sales) will come from legacy TPX with the remainder ($3.9B) from MFRM. There is approximately $890m in intercompany sales for net sales of $7.6B.

As a stand-alone TPX had historically taken share from competitors and grown topline faster than the industry average with a normalized growth algo of 4-6% comprised of 1% industry unit growth, 1-2% pricing and 2-3% share gains. Combined, Somni is well positioned to continue this same algo. Somni will have 45% gross margins and baseline EBITDA (pre-synergies) of $1.3B (17% EBITDA margin) and EBIT of $1B.

The company primarily caters to the mid to high end of the market with Sealy and Tempur being the dominant brands in the industry with #1 and #2 positions. Tempur-Pedic is proceed from $2,200-$9,998, Sealy $300-3,000 and Stearns & Foster $1,800-$6,450. Importantly, MFRM is the primary distribution channel for mattresses in this category as 30 of the 50 slots on an average Mattress Firm floor are priced at $1,500 or higher.

Thesis 1A: MFRM Deal is a Homerun

To quickly recap deal economics: MFRM was valued at $4.7b EV, or 11.5x TTM cyclically depressed EBITDA of $406m or 9.2x TTM EBITDA adjusted for run rate synergies estimate of $100m by year 4. We think normalized EBITDA is closer to ~$500m + $100m of synergies implies an attractive post - synergies normalized EBITDA deal multiple of 7.8x. SGI financed the deal with $1.3b of equity, equating to ~34.2m new shares at the latest share price (19% dilution). The rest was funded with $2.7b of debt and cash on hand bringing leverage to 3.5x. We believe this level is manageable and think the company can return to its 2-3x target within 2 years.

We believe the MFRM acquisition cements the case that SGI will accrue the outsized majority of the North America profit pool going forward. We believe the deal will enable SGI to earn $5.36 in EPS by 2029 and a similar amount in FCFE per share.

The bedding industry is unique in how fat the distribution margins are. In FY2024, TPX North America had 40.4% gross margins while MFRM earned 37.7% gross margins. On a $2,000 Tempurpedic bed, MFRM earned a gross profit of $800 while TPX earned a gross profit of just $400. Arguably it's much better to be the channel than the manufacturer in this industry (the retailer tends to earn higher ROICs). With the market only growing at ~GDP, the main opportunity for SGI to grow earnings is from taking market share. We expect that over time SGI will significantly increase its market share on the Mattress Firm showroom floor. Unlike most acquisitions, this represents real, tangible revenue synergy potential that is essentially fully in the company’s control.

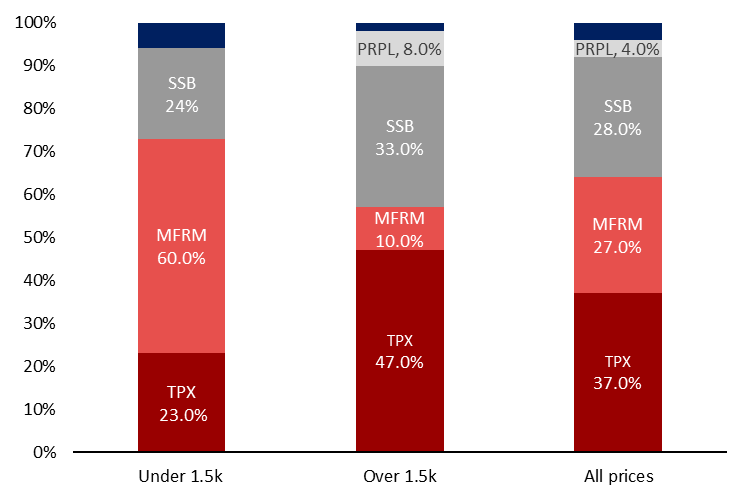

SGI currently under-indexes at Mattress Firm compared to SGI’s overall market share (42-44% of Mattress Firm vs. a typical third-party mattress retailer 50-60% range) while its largest competitor Serta-Simmons over-indexes at Mattress Firm with 28% share vs industry share of 16% (see below). We expect the balance of share within its stores to match the market more closely over time.

Primarily this will come at the lower end of the price point by virtue of FTC slot commitments and as this is where TPX is the most underindexed.

The overall floor space available for mattresses at each brick-and-mortar retailer is limited. Mattresses occupy a significant amount of retail floor space because of their size. Each retail store typically has a fixed number of “slots” available for mattresses, which are places on the floor where a mattress can be displayed and tested. Some retail stores may have five or fewer slots available, while the largest retail stores may have several dozen slots. Mattress suppliers often compete for slots by offering retailers various financial incentives.

In a regular Mattress Firm store there are about 50 horizontal slots for beds to be placed. Around 30 of the 50 (60%) are dedicated to what was most in focus during the trial, beds priced at $1,500 or above. Of these 30, SGI is committed to give 12 other third-party brands (24% of total store slots). Everything else on the floor (the 20 slots under 1.5k) would not be subject to any of these commitments. So, there is opportunity for SGI to gain an unfettered share on ~40% of the floor. In an extreme case/over the very long term this could mean legacy TPX can take share of MFRM slots from 42% to 76%. Importantly, SGI has one of its biggest product launches scheduled for midway through '25. The new Sealy PosturePedic line will include four new mattresses, which span price points from $799 to $2,399. Three of the four models could potentially fall into the below $1,500 slots.

We have a high confidence interval in this incremental share gain. Retail sales associates figure prominently in the sale of premium mattresses at brick-and-mortar stores. Because customers purchase mattresses infrequently and the mattress itself may be hard to distinguish from the outside, retail sales associates play a critical role in explaining the features and qualities of premium mattresses and in helping customers decide which mattress to purchase. As one Tempur board member stated, “bedding is sold not bought,” and the salesperson is, “more important than anything else.” The industry participants we talked to corroborated this view saying that “slots don't matter, sales people drive what direction the customers go.” Therefore some of the people we spoke to at the Las Vegas Market exhibition speculated that, Scott is likely is paying extra commissions to Mattress Firm salespeople if they sell Tempur-Sealy products.

In working out the size of these revenue synergies (which aren’t included in the $100m of synergies plaid out in the investor deck) FTC docs (page 64) gives some helpful context:

“a December 2014 analysis in connection with Project Gray (a prior consideration by Tempur Sealy of acquiring Mattress Firm) indicated realization of $120 million in revenue “synergies” from moving to one hundred percent balance of share. The Project Gray analysis was emailed to a Tempur Sealy finance executive in September 2021 when analysis turned to the current proposed acquisition of Mattress Firm. That executive then circulated a Project Lima Accretion Model to executives including the CEO, showing that a balance-of-share increase of just five percent at Mattress Firm would generate an additional $57 million in EBITDA and $42 million in net income. In June 2023, after a call by the Tempur Sealy CEO with a top investor, the investor inquired about the profitability of increasing the Tempur Sealy balance of share at Mattress Firm by ten percent. Written follow-up stated that a hypothetical increase in TSI “balance of share by 10% [at Mattress Firm] would generate $420M incremental retail sales.”

Today Tempur-Sealy brands are in the low to mid 40 percent of MFRM sales which is still below the TPX peak share before pulling from MFRM in 2017 (51%). On the Q1’25 earnings call Thompson remarked that, “Tempur Sealy manufactured products represented mid-forty percent of Mattress Firm's total sales in 2024, and we expect to be in the high 40 percentages of Mattress Firm's floor and sales by the end of 2025. This improvement is driven in part by the expanded private label partnership between Tempur Sealy and Mattress Firm.” And later in the call he mentioned that, “in mattress specialty compan[ies] that we usually have a six handle” on balance of share. Getting back to this high watermark of 51% would represent $210m in incremental wholesale sales and at 35% incremental margins is is ~$72m in EBITDA or 50-65c of EPS. If they reach 60% balance of share this would be $136 of incremental EBITDA.

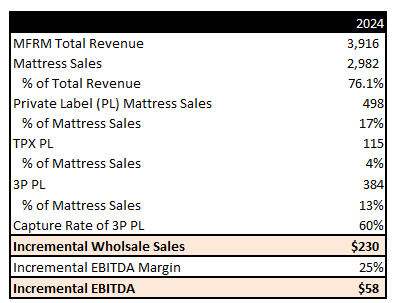

On the private label side, TPX does only 4% of MFRM PL revenue despite PL being 17% of MFRM revenue. If they can take their share of private label in line with their share of branded products this could be an incremental $230m of revenue or $58m of EBITDA.

We also believe SGI now has more ecosystem control and can use this power to extract better economics from third party channel partners. Its now sizeable retail channel and the fact that its Tempur-Pedic products (the best known brand with the most advertising behind it) are critical to driving traffic for most retailers to strong-arm non-MFRM retailers to take higher allocations of TPX products (namely Sealy and Stearns & Foster). Tempur is 50% of the profit in the industry while being 7-8% of the units. Therefore, the Tempur-Pedic brand is too powerful for most retailers to outright abandon it without putting their businesses in jeopardy. A key company initiative in recent years has been to “kill grandpa,” (i.e., eliminate grandfathered supply agreements existing prior to its 2013 acquisition of Sealy that allow the retailers not to be restricted on what other non-TPX brands at premium price points they can slot.) Some of the private mattress retailers and manufacturers we spoke to at the UBS conference were spooked about SGI forcing them to hold onto more Sealy/Stearns in their stores in order to maintain their relationship with SGI as now SGI can credibly threaten to remove all slots if they don't comply. We believe this initiative will accelerate in the coming years to drive a 1.5% gain in wholesale market share or $152m in revenue at 30% incremental margins or ~$45m of EBITDA synergies from higher sell-in to third-party retailers.

In sum we believe total synergies on the deal could be $335m on a $1.3B EBITDA base.

On the margin:

Advertising/marketing and product innovation will all get better which can drive further revenue. Prior to the combination, TPX wielded 25% of all industry advertising spend. Now their marketing budget will be 2x the next largest player. MFRM’s historical marketing focused on the store (which people are indifferent to) versus underlying brands and a lot of TPX’s success and share gains have been from marketing. TPX’s old head of marketing is now in control of the combined SGI budget to drive more refined/targeted marketing (and push TPX brands). TPX spent $470.9m on advertising last year (9.5% of sales) and will spend $720m this year when adding MFRM’s budget (assuming 6.5% of sales).

SGI’s product innovation engine will be sped up: SGI gained access to Mattress Firm’s valuable POS data which can help them better understand customer behavior and other supplier’s pricing/products. SGI will then be able to take more risks with its product innovation, and speed up its go-to-market capabilities. Management had called out that as a standalone entity, anytime it makes a new product, it doesn't automatically mean retailers will take the product. So, this has limited the risk and complexity of innovation that made economic sense in the past. But now that SGI will have some level of commitment from Mattress Firm, it can afford to take greater risks and drive truly innovative features.

Increased reaction speed: because SGI now controls its own distribution it can instantly reprice its products to combat any inflationary pressure and protect its margins whereas in the past there would have been a lag as they had to go through re-negotiations

On the cost side a combined entity would have even greater control over the mattress supply chain, and we would expect to see significant supply chain related savings. We believe that SGI’s guidance of $100mm of synergies to be realized over four years post deal is a low ball. Of the $100m in guided synergies, 45% is from “better product lifecycle management” (e.g., larger owned store base for wholesale distribution and clearance), 35% from improved logistics (e.g., eliminating duplicate distribution points), and 20% from more efficient sourcing (e.g., scale benefits on larger raw material purchases given higher distribution certainty). In our base case, we believe they can save $20m-$60m in advertising and $20m by removing duplicate corporate overhead and back office costs.

Lastly we believe there are less quantifiable outcomes due to industry reverberations. We believe PRPL and SSB are deeply disadvantaged (we believe the recently announced PRPL warrant deal is an admission of this). Recent conversations with other MFRM suppliers reveal their skepticism that SGI will not de -prioritize their products. Considering that Mattress Firm is the largest customer for both companies (12 -15% of sales for PRPL and going to be 27%+ after new deal), this could put both companies (that are currently running cash flow break -even ) back into more precarious financial positions unless they gain more distribution elsewhere.

SSB is in a weakened position and SGI is free to execute a termination-for-convenience provision with SSB. Financially, SSB does not have much room for error given its precarious financial position (still highly leverage and FCF negative) and would need to quickly replace the volume through other retailers or risk going Chapter 11 again. That provides MFRM with strong negotiating power to extract concessions in terms of price, number of slots, and advertising commitments. In short we believe SGI could bankrupt SSB again.

Thesis 1B: Scott Thompson is the Right Person to Execute on the Deal

We believe Scott is a relentless competitor and killer CEO and as he pointed out himself he is, “doing this transaction to make money,” with the reason to buy Mattress Firm being to “create shareholder value.” Our conversations with industry players indicate that Scott Thompson is the perfect person to execute on SGI’s runway with one going so far as to say, “Scott is a menace he doesn't care about anything but winning.”. Scott is motivated to build a legendary track record and genuinely enjoys running a public company. He has demonstrated time and again that he is willing to do things that are uncomfortable in the short for long term results. 1) He walked away from Mattress Firm in 2017/18, 2) executed beautifully on the DTC opportunity and 3) simplified the Tempur-Pedic product line to allow them to focus. He has also proven to be an adept capital allocator buying back stock significantly below intrinsic value.

As TPS points out, even going back to his days as CEO of Dollar Thrifty, the company went from the verge of bankruptcy to selling for $87/share and took the company from negative EBITDA to >$300M in 4 years. Jana Partners spoke extremely highly of Scott’s track record at Dollar Thrifty and can be found here.

SGI also has a track record of emerging from these downturns stronger. Scott and team have been willing to lean into marketing and advertising to support the channel and build goodwill with retailers even as other competitors have pulled back. When competitors pulled back on marketing by 25%, SGI came out publicly with TPX saying that they did not/would not pull back even when they can't make deliveries. This long run thinking is important because it helps support wholesale partners. Scott realizes SGI’s importance to the ecosystem wherein if he was going to burn his partners by not being able to make deliveries, he wanted to at least support them by driving some traffic that they can steer elsewhere and make them remember how much traffic his brand brings to them so they didn't lose slots.

Scott’s track record in managing omnichannel growth is particularly instructive and gives us incremental confidence in his ability to fully realize SGI’s potential. In August 2021 SGI purchased the leading UK omnichannel mattress retailer for $476.7mn or 6.3x 2020 EBITDA which was ~200 brick and mortar stores as well as manufacturing and distribution capabilities. From a standing start, prior to the Dreams acquisitions, SGI was building an excellent DTC business that was compounding >30% and outpacing all peers and in 2024, SGI had ~$1.2B DTC business direct sales vs ~$600mn before the Dreams acquisition (the largest of any mattress manufacturer other than Sleep Number). DTC went from 5% ($150m) of sales in 2016 when they first began to report it to 25% in 2024 ($1.2B). Since 2017, the DTC has grown at a 27% CAGR, outperforming all competitors that we have data for (and we can guess for Casper too!).

This is important because DTC gross margins in North America are in the 60-75% range (depending on the channel), whereas Wholesale margins are ~40-45%. This means that for every 1% mix shift in favor of DTC the North American business was experiencing a 0.25% gross margin lift.

They have also proven to be able to integrate a business acquired out of bankruptcy before. SGI acquired Sleep Outfitters in April 2019 for $24mn out of bankruptcy, with integration completed in Q2 2019. This 100 units retailer carried the full range of brands: Tempur-pedic, Sealy, Stearns & Foster and this business has likely returned 5x+ of their purchase price in FCF.

Lastly, Scott and team have been quick to react to competitive threats. When the BIAB competitors originally mounted their assault, SGI deployed two products across its Sealy and Tempur Pedic brands. Cocoon by Sealy (Launched in 2016; ~$800 - 1,000 ASP) and TEMPUR-Cloud (Entry-level Tempur-Pedic mattress launched in 2019; $1,300 – 2,000 ASP)

Thesis 2: Trough on Trough Conditions

We are currently in the worst drawdown the industry has ever seen and a 3 year pull back following post-Covid demand strength, exceeding the -19% cumulative unit decline from 2007-2009. 2024 unit sales came in 23% below 2019 levels and a new 20 year low for US mattress units produced. Regardless of the way you slice the data the mattress industry as a whole has more than given back the excess growth it saw during 2020-2021 period, creating upside potential from pent-up demand once sales inflect. We believe the bedding industry has ample runway in the event of a recovery and benefits from a long term tailwind once the inflection does occur. U.S. mattress units grew at a ~1% CAGR from 2005 to 2019 while 2020-2021 industry units grew at a 4% CAGR. The result was the industry “over-earned” by ~4.3m units than if these periods would have performed in line with the pre-pandemic CAGR.

However, since then, substantial unit declines from 2022-2024 have caused the industry to “under-earn” by a cumulative 13 million units. In other words, unit levels in 2024 are now 8.4m units below what would have been expected had the historical growth rates persisted over the last four years and no boom bust cycle had occurred, suggesting a large amount of pent-up mattress demand that can drive industry growth over the medium term.

Raymond James also has another useful framing that TPS pointed out which uses the 2000-2019 industry demand CAGR of ~1.0% to calculate whether demand is running “above trend” or “below trend.” This analysis is applied to the total US market (inclusive of imports) and shows 2024 to be running ~8mm units below what historical trend would suggest.

The mattress industry has historically grown at 1-3% since 2000 without extreme peaks and troughs. Long run unit growth has been in line with population growth (0.75%-1.0%) with the remainder driven by ASP increases from premiumization as consumers place more importance on sleep quality. We believe the demand pull-forward from COVID has fully unwound already (see below). A theoretical return to “normalized” volumes of ~31.8 million units would represent a 35% increase over 2024 figures.

On a shorter term outlook, one of the vertically integrated D2C mattress companies we spoke to said that based on the math they were running internally they were expecting demand to normalize in Q2 or Q3 of 2024. He then said the most people are expecting the recovery and second half of 2025 because tariffs and election kicked the can down the road. For 2025, we forecast ~0-2% U.S. mattress industry unit sales growth. Our full year estimate compares with the latest International Sleep Products Association (ISPA) industry forecast calling for a 1.5% industry unit volume growth in 2025. Based on our conversations with industry players, our forecast is back-half weighted, with demand down slightly in 1Q followed by a modest recovery throughout the rest of the year. Combined with our forecast for ~1.0% average unit price growth, this equates to 2.0% industry sales growth in 2025, at the midpoint. This compares to ISPA’s +3.0% y/y industry sales forecast and Mattress Firm’s (MFRM) forecast for flattish retail industry over CY25 (ending September 2025) with early signs of recovery in the 2H (CY2Q and CY3Q). Illustratively, in the event of a prolonged recovery where the tailwind is evenly distributed each yar we believe the industry could grow units at 2% from now until 2032 adding another 1% to SGI’s growth rate., If the recovery is steeper than that it could add 2-3%+ to SGI rev growth each year over the next 3-5 years in a bull case.

Thesis 3: Rationalized Industry Structure

We believe the formation of Somnigroup has materially changed the barriers to scale for the industry. Mattress Firm has 2x as many store fronts as the next largest mattress retailer. Building a network of retail stores is both capital intensive and time consuming (PRPL has only 61 stores after 5 years and Tempur themselves was only able to go from ~20 stores in 2017 to 88 in 2021) so owning the platform that can effectively choose which brands scale is incredibly powerful. Sleep Number, the mattress supplier with the greatest number of its own brick-and-mortar stores, took decades to reach its current size and has added fewer than 200 stores in the past 15 years—less than 10% of the footprint of Mattress Firm. They also announced in a press release on 11/7/23 that they planned to permanently close 40-50 of their ~670 stores. In our view, as a result of Tempur now controlling the largest distribution footprint in the industry it can effectively control which competitor it blesses to scale which significantly lowers potential competitive threats. In other words because Mattress Firm’s competitive significance is so great, owning it gives Tempur Sealy extraordinary sway over the fate of its rivals. As the FTC laid out:

On 5/7/25 we saw the first of this power of PRPL announced increased MFRM distribution. Mattress Firm will expand its showcasing of Purple products across its national store network from approximately 5,000 Purple mattress slots to a minimum of 12,000 Purple mattress slots and in exchange Purple will grant Somnigroup a combined 8 million equity warrants at a strike price of $1.50. (This is reminiscent of the deals that PEP, KDP and TAP can extract from scaling CPG brands such as FEVR and CELH). This gives us incremental confidence in SGI terminal value.

Between 2007-2017, Mattress Firm increased store count by over 8x through a roll up of 25 brands (Sleep Train in 2014 and Sleepy’s (1000 stores) in 2016) and increased its store base to ~3,500 stores at peak (~2,000 of which were acquired). As practically everyone is aware, the industry was oversaturated (it became a common trope on social media to assume these were money laundering schemes), with Mattress Firm locations cannibalizing each other's volumes driving down ASPs for wholesalers including Tempur. MFRM then used Ch. 11 to exit ~1,100 retail stores in order to drive an uplift in sales and profitability of the remaining store base between 2017 and today.

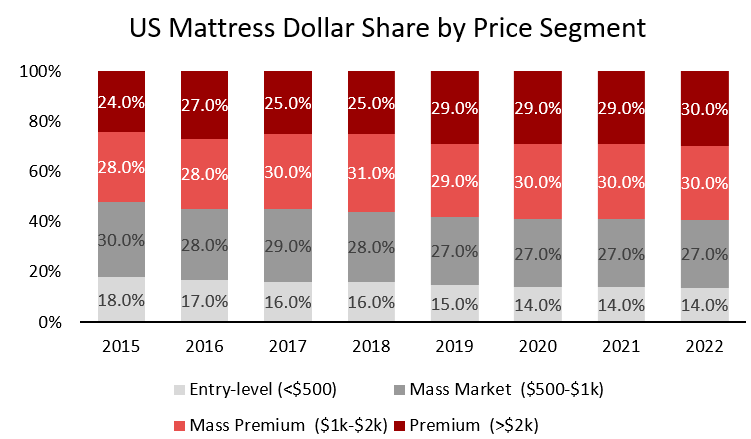

In the meantime, the industry has premiumized as entry level ($500) and mass market ($500-$1k) has bled unit and dollar share to mass premium ($1k-$2k) and premium (>$2k). In February of 2019, China had ~90% of the mattress import market in the US (in units) and ~25% of total unit share through dumping efforts, however today that has shrunk to less than 1%.

Today, according to ISPA industry data, mattresses priced at $2,000 and above make up around 10% of total US industry unit volume and 30% of industry sales.

From a brand perspective, Tempur has taken market share primarily from Serta Simmons (see below) which has been in and out of bankruptcy/restructuring and now has over 40% market share. During this industry downturn Tempur has begun to feed on BIAB competitors PRPL and CSPR who are in various states of financial disarray. All in all, we are confident in SGI continuing to take share even as SSB emerges from bankruptcy.

As a simple back of the envelope check for market share since the pandemic we can divide legacy TPX’s US wholesale revenue (ignoring its Direct business) by ISPA projected US wholesale revenue. This demonstrates that legacy TPX has steadily increased its share through the post pandemic turbulence. Recent competitive wins at Sam’s Club and the incremental floor share opportunity at MFRM outlined above are just two examples of the opportunity in front of SGI. We model ~100bps of market share gain each of the next two years, but view that assumption to be quite conservative.

In short, on a go forward basis we believe the industry is structured to be much more resilient to low end competition. With the top 3 brands now controlling more than 60% of the market which should allow Tempur to mitigate inflation much better than in the past through supply chain consolidation and better pricing discipline. As Scott Thompson remarked at the Piper Sandler conference, “The thing that really jumps out at me is the strong players got a hell of a lot stronger during that 3-year period. And the other thing that really jumps out at me is that companies that had the ability to be flexible and identify and change and rapidly change with the winners. And the ones that weren't took a step backwards.” With SSB still highly levered and FCF negative according to debt docs they are hamstrung and cannot invest in R&D or S&M. This leaves SGI well positioned to continue taking market share.

Risks

Recovery takes longer than we anticipate and we bounce along the bottom for a while

Industry recovery has been continually delayed with the most recent delay due tariffs. There always seems to be something and whats next “weak consumer” or “recession fears”?

From 2007 to 2015 the industry ran below trend and it took 4 years to bottom before beginning a gradual recovery and didn’t get back to trend for a decade

The “mattress fleet” is relatively young compared to history

The Trailing 7 year mattresses consumed in the US as a % of the US population is still near all time highs

We are wrong in our belief that MFRM makes this a more durable business

Leverage is now higher and FCF conversion will be lower as SGI does MFRM store refresh

TPX converted GP to EBIT at a much higher % than MFRM. The flexibility in the cost base provides significant downside protection during market downturns vs. high overhead costs of running stores where the operating leverage is working against you

Tempur has commanded more and more ecosystem gravity over the last decade to the point where they could dictate terms to MFRM. Maybe if they didn’t do this deal they could have negotiated a better split of the unit gross profit dollars which would obviously come with high incremental margins.

In a way, the risk can be framed as: Is the counterfactual where the deal got blocked actually more attractive?

The retail business has much higher fixed costs than the manufacturer due to store overhead/opex so earnings could be more volatile in the event of a downturn

Execution risk

Retail stores are really complex, much more labor intensive biz and the PRPL CEO has said numerous times that the hardest part of the business is running the physical stores themselves. This is a bet on Scott and his team to execute in retail at the same level they have in manufacturing.

Mitigant: Scott has been running about 200 North American retail stores with many company branded stores open for some time that have been very successful. It also purchased the UK-based Dreams retailer in 2021.

Other industry players get their act together

SGI could give up some share gains to Serta if they ever get their act together. SSB has been a long term share donor (from 40% of market down to less than 20%) *how much more share can they really bleed*

mitigant: maybe SGI just forces them in to BK again due to new found distribution power/control

Maybe trough industry values, but not trough for them because they are in a different segment of the market (i.e. premium volumes yet to bottom)

Tariff risk

SGI is well insulated from tariff risk in our view as the company doesn't import much at all from China. In terms of other foreign sourcing, it imports some adjustable bases from countries like Mexico and Vietnam, but overall this sourcing exposure is low. This compares favorably to some other players in the home furnishings industry which still import a substantial portion of product from foreign suppliers. Historically, the company has been able to pass along any price increases associated with tariffs or other trade policies to retail prices.

Management noted that SGI’s exposure is modest, and manageable, as most beds are produced in the country they are purchased in. On the Tempur Sealy standalone business, some sell side estimates have them pegged at roughly 10-20% of COGS are imports

Valuation

Management has guided to $7.3-$7.5B in revenue in 2025, 44% gross margins and $1.2-1.3B in adj. EBITDA. Over the medium term they guided to MSD sales growth and $4.85 in EPS in 2028. In our base case we believe SGI can grow EPS ~18%/year to $5.06 by 2029 and FCFE by over 20% per year. We are ahead of the street on both EPS and EBITDA due to our synergy estimate and conviction around legacy Tempur gaining share of the MFRM floor in both private label and branded.

Catalyst

Raising synergy estimates above $100m as advertising and revenue synergies come into view

Mattress market posting its first year of growth in 4 years in 2025 and becomes mid term tailwind/accelerating top line

Relaunching Sealy Posturepedic product line in 1H 2025 leads to re-accel

Sealy sales in sell side mattress retailer surveys have been running -DD% for all of 2024 given the current line on sales floors is somewhat stale. With the broad product line refresh in 2025, this could mark a 10%-15% improvement in Sealy sales growth y/y in 2025.

Incremental market share gains from taking over slots on MFRM floor and having the largest advertising budget in the industry

SSB goes back into BK