Share Price: $15.84

2026 Price Target: $32.25 | 17% IRR

Overview

Verra Mobility ($VRRM) is the leading outsourced toll management and traffic enforcement company in the US. Verra Mobility is the result of American Traffic Solutions’ acquisitions of Highway Toll Administration Euro Parking Collection. In late 2018, Verra Mobility’s private equity owner, Platinum Equity, took part of the company public via a reverse IPO by selling a piece of its equity stake to the Gores Holdings II SPAC.

VRRM did roughly $550m in revenue in 2021 through three segments – Commercial (47% of revenues), Government Solutions (51% of revenues) and Parking Solutions (2% of revenues). VRRM is a $2.4B market cap, $3.6B enterprise value company.

VRRM is a capital-light business with ~5% of revenue used for capex with a quasi monopoly over their industries growing high single digits with 40% EBITDA margins with impressive returns on incremental invested capital. At first glance, VRRM’s business is somewhat related to the infrastructure and travel industries which has been associated with cyclicality and low margins. From first principles, VRRM removes the administrative and payment processing burden from its customers which enables strong unit economics.

The commercial services business serves rental car companies (“RACs”) like Hertz, Enterprise and Avis and fleet management companies (“FMCs”) such as Element by registering vehicles with local tolling agencies and billing customers when they run a toll or incur a traffic violation. The government solutions business works with government entities and schools to install, operate and maintain road safety cameras and deliver the software for these systems to properly run. They are the #1 provider of speed, red light and school bus stop arm cameras in the world. The parking solutions business is primarily SaaS as VRRM helps universities, airports and corporate campuses organize, bill and run their parking needs.

At the most simplistic level in the commercial business, VRRM drives its revenues by earning a spread based on road traffic volumes plus any widening of that spread driven by the growing delta between cashless/electronic toll rates and cash toll rates. Neither of these two variables requires VRRM to invest any more money to earn that incremental revenue – every dollar they earn from incremental traffic volumes or incremental expansion of that cash/cashless toll rate delta drops down at essentially a 100% contribution margin to VRRM.

Anytime the driver of the vehicle and the owner of the vehicle are not the same, you can think of VRRM stepping in to bridge the gap.

Thesis

A business growing high single digits with 40%+ incremental EBITDA margins and 30%+ ROTC should not trade for 11.5x EV/EBITDA. VRRM will generate $1.20 in FCF per share in 2022 and currently trades at a 7.5% FCF yield. While Verra Mobility the company performs, $VRRM the stock is floundering. I believe this is due to three reasons: Platinum Equity liquidating their large holding for noneconomic reasons (locking in gains to return cash to LPs) creating overhang, the market recently punishing all de-SPACs regardless of business quality and a delayed annual report as a result of an internal control problem which management has fixed.

I believe that VRRM will generate ~$1.2B in cumulative FCF over the next 5 years while maintaining 3.5x leverage. In my base case scenario, VRRM will generate $2.15 in FCF per share and trade at a 15x FCF multiple as the market comes to appreciate strong secular tailwinds in cash to cashless toll conversion, significant white space in the US and Europe for government solutions and high switching costs in all three of their segments. Doubling of FCF per share is driven by 9% topline growth, 30% incremental FCF margins and 5% of shares being purchased per year. This results in a $32.25 share price in 2026 ($18 PV per share discounted at 15%) or 17% IRR from today’s $15.84 stock price.

Commercial Services

The Commercial Services business offers several solutions including Toll and Violations Management and Title and Registration to rental car companies (“RACs””) including the Big 3 (Hertz, Enterprise and Avis) and other large fleet management companies (“FMCs”). The Toll Management business solves a huge headache for RACs and FMCs. Prior to VRRM, anytime a RAC car would pass through a toll for which they weren’t registered the RAC would have to track down which car ran what toll, who was driving it at that time and re-bill the driver. In the process, they were often issued tons of penalties in late fees from local tolling authorities combined with substantial administrative back up and headcount for a non revenue generating department. Commercial Services is a ~$340M revenue business with 60% segment margins with nearly 70% incremental margins

VRRM’s toll management business provides fully outsourced toll management solutions for RAC and FMC customers. VRRM provides coverage for more than 95% of all toll roads in the United States, and processed more than 224 million toll transactions and 1.4 million traffic violations in 2021. VRRM is integrated with more than 50 individual tolling authorities throughout the United States which affords RAC/FMC drivers the convenience of using cashless and all-electronic tolls. VRRM enrolls the license plates of customers’ vehicles and installs the transponders, registering them with tolling authority accounts, pays tolls and violations on the customers’ behalf and, matches the toll or violation to the driver and then bills the driver (or the RAC/FMC). They do everything for the RACs/FMCs including payment processing allowing the RACs to focus on their core business: renting cars. This creates a symbiotic relationship which allows VRRM customers to focus their efforts on attracting renters which funnels customers directly to VRRM. By freeing up the fleet companies to focus on their business’s health, VRRM benefits as more customers are pumped into their program. Toll management solutions accounted for ~40% VRRM total revenue in 2021.

VRRM has a convincing value proposition: a customer with a 2,300 fleet size in a toll heavy area that runs 134,000 tolls annually saw their toll management costs reduced by 21% from $443,000 per year to $349,000 after implementing VRRM’s program. In addition to reducing personnel toll costs by 85%, VRRM enabled admin time and dollars to be re-focused elsewhere.

VRRM makes a spread per toll by paying the local tolling authority at the discounted electronic rate and charging the car rental company at the 10-15% higher cash toll rate, who can then turn around and immediately re-bill that fee to the appropriate car renter. They also charge ~$5.95 for a customer to opt into their program. VRRM is the only national provider of its Toll Management service in the US and one of the major growth opportunities for this business over the next 3-5+ years is replicating the success in the US in the EU.

The commercial segment basically get paid a fairly consistent $ rate based on the underlying number of cars rented through their partners. The P&L formula is basically: (total number of cars rented in the US on a partner's fleet) x (% probability of the renter using PlatePass or running a toll during their trip).

They also offer other ancillary services that make up a much smaller portion of revenue. The violations management business (including parking, speed, red light etc) is a natural extension of the toll business and accounted for ~5% of 2021 revenue. VRRM processes violations incurred by the drivers of RAC and FMC vehicles by working with more than 8,000 domestic violation-issuing authorities (more than 400 of which they are directly integrated with). The Title and registration business (“T&R”) is self explanatory as VRRM works with the local DMV in 20 states to ensure all RAC and FMC cars are registered and up to date.

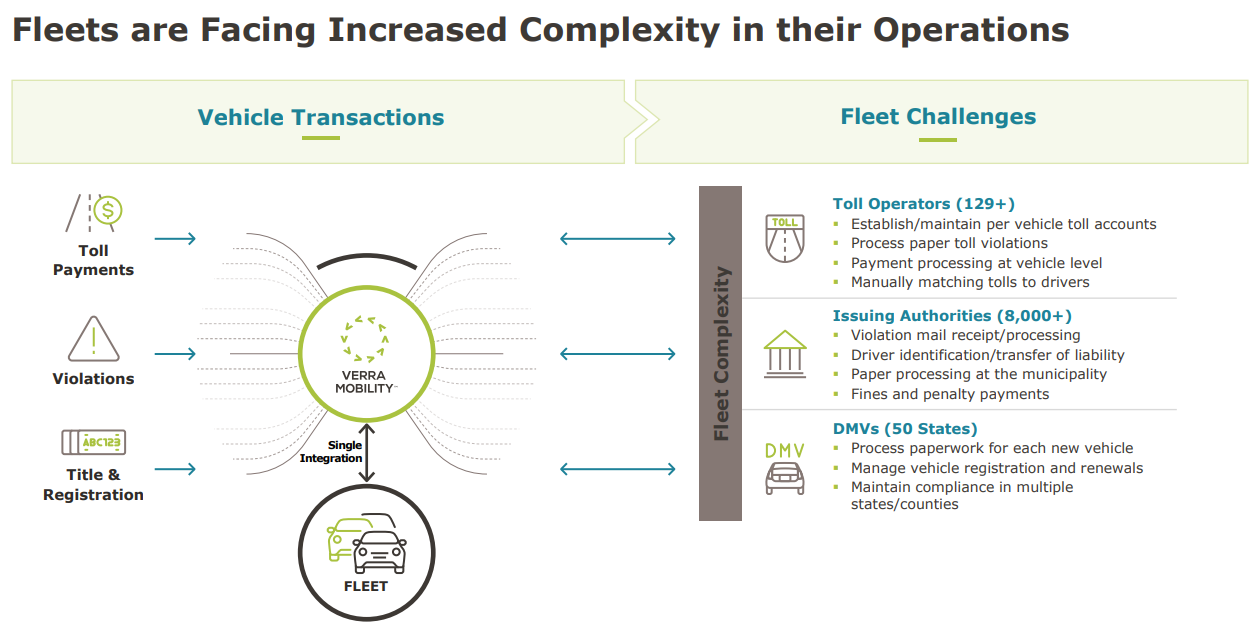

The tolling industry is highly fragmented and complex as it is comprised of 50+ tolling authorities, each operating as independent organizations with specific coverage regions and disparate technology platforms. VRRM handles all the administration, all the rules and regulations, all the changes in toll operators, communication with the 129+ toll operators, issuing authorities (8,000+) and DMVs (50). They plug into the middle of the relationship with the RACs/FMCs and every organization they have to deal with to make their business run smoothly.

VRRM has long relationships with Avis Budget Group (until 2024), Enterprise and Hertz (just signed a 5 year contract in 2021) as well as the six largest FMCs in the US: Element, ARI, Enterprise Fleet Management, Wheels, LeasePlan and Donlen. The rental car industry is highly concentrated in the US with Enterprise, Hertz and Avis/Budget having 94% market share. To these nationwide players, scale and breadth of offering is essential. The RACs need a single toll management company that can serve their entire fleet with relationships across the country with DMVs and tolling authorities. This leads to a natural monopoly with significant barriers to scale.

The European market is even more complex than the US. Toll authorities are very country specific just because you are integrated with the toll authority in France does not mean you are integrated with a toll authority in Spain or Portugal which increases integration complexity. VRRM supports 20+ languages, 10+ currencies. Furthermore, the rental car companies operate with a franchise-like model in Europe vs a central model in the US. The complexity and cost savings is what drives their switching cost advantage. The opportunity cost of paying VRRM or hiring an entire new back office department is an easy choice for the RACs/FMCs.

VRRM’s business is reliant on the health of the rental car companies (Avis, Hertz, Enterprise) and is therefore correlated to airline travel which can be tracked through passenger air miles or TSA throughput which introduces some cyclicality to the business. As travel slows down, the demand for rental cars follows suit which limits the amount of customers funnel toward VRRM.

The commercial services business is benefiting from a number of tailwinds including 1) the conversion from cash to cashless tolls and the increasing spread between the payment methods 2) increasing cost to maintain highways and implementation of dynamic pricing at tolls 3) people renting for longer.

Cash to cashless conversion. Once a renter has a car, they have a choice: they can choose to not drive on a toll road, they can choose to pay cash, however most people choose to adopt the program. The transition to cashless tolls has been a strong tailwind for VRRM. Naturally, when the option to pay cash is taken away that increases their adoption. Management has stated that they are in the 8th inning of the cashless tailwind as 64% of U.S. tolling is down cashless now, up from 50% in 2019.

EZ Pass accounts have 5x’d since 2005 and transactions have grown 3.5% per year from 2 billion to 3.6 billion in 2021.

Increasing cost of maintenance leads to an increase in the number of toll roads. US tolling collected over $20 billion in toll revenues in 2020 to fund infrastructure construction and maintenance. As the costs of maintaining highways continues to increase (1 lane mile of road costs ~$6,800/year to maintain) and revenue from fuel tax continues to decline, tolling has emerged as an alternative source for funding operational and maintenance needs of highways. Toll operators control ~6,000 miles of roadways and generate $3 million average revenue per mile compared to $159,091 generated by traditional means such as fuel tax. In addition, with the introduction of electric vehicles and the continued improved fuel efficiency of motor vehicles, fuel tax revenues will continue a downward trend forcing governments to lean more toward tolling to supplement. As shown below, revenue for the US tolling industry has increased at an 23% CAGR from $9 billion in 2010 to $17 billion in 2018.

Toll roads are monitored 24/7 and are generally safer than non-tolled roads due to better maintenance. Additionally, toll operators have a financial incentive to keep roads running safely and smoothly. Electronic tolls also allow local and state governments to implement dynamic pricing, which allows toll rates to fluctuate based on traffic trends and real-time congestion, and increase the number of express and high occupancy lanes.

Cars being rented for longer (increasing billable days) and higher toll fees paired with more programs opt in. Post COVID, vehicles are being rented for a day longer on average compared to 2019. This means that drivers are running more tolls and having more violations. This is despite rental car volumes remaining below pre-pandemic levels. VRRM has also called out that people are renting in areas that are more heavily tolled, toll rates are increasing and higher utilization rate of their program

The commercial services business has a large market to grab and can continue to grow revenues in the HSD digit range for the foreseeable future. Outside of the RACs where they already have significant market share, there is a 12M vehicle opportunity split evenly between small fleet, commercial, government and OTR trucking. The company announced an expansion of its toll and violation management solutions in Europe with three new contract wins including Hertz in Spain.

The IBTTA estimates US tolling revenue will reach $65-70Bn by 2030 which suggests an 11% CAGR from today, driven by the growing amount of road-miles covered by tolls, increases in toll rates, and vehicle-miles-driven generally increasing over time. This, combined with gradual toll revenue mix shift from cash to cashless tolling and an increasing delta between cash and cashless toll rates could add another 1-2% to revenue growth for VRRM’s Commercial business, which brings total revenue growth for this business to roughly 12-13% over the next decade. VRRM estimates commercial services has a $7B TAM today in North America, Europe, and Australia, which is expected to grow to $27 billion by 2030.

Government Solutions

The Government Solutions business contracts with cities (NYC, Chicago, Dallas, Seattle, Baltimore for example), 300+ school districts and other government entities to install, operate and maintain over 10,000 cameras and provide software to operate a traffic safety and violations program. These programs are namely red-light, speed, school bus stop arm and city bus lane cameras. VRRM’s platform is customized to the rules and regulations of each client and its system captures and flags any violations to the appropriate enforcement agency. VRRM makes money in this business by contracting on a fixed fee per camera basis and earning a share of the violations revenue. After their recent acquisition of, Redflex, this business is the leader in the US with roughly 70% share of the US photo enforcement market (the other notable player is Conduent with ~20% share).

Government Solution is around a ~$400M revenue business, 80% of which comes through sticky services revenue, with 40% segment operating margins growing mid to high single digits per year. This business has a higher fixed revenue base than the commercial business and contracts are typically 3-5 years in length, but vary in the terms of their fixed/variable mix. Revenue is driven by the number of systems installed and the monthly revenue per system.

The company aims to be the only one-stop shop for violations services with a 98% contract renewal rate. Two of the biggest competitive advantages are legislative barriers to entry and the high switching costs. Getting cameras approved for installation is a hassle. For example, since 2010, there have been over 1,500 pieces of legislation introduced nationwide related to the photo enforcement industry. Photo enforcement programs are also regulated at the state and local level, as opposed to federal. This means a new entity would have to adapt to each district-level quirk to recreate the VRRM network of relationships and coverage.

This business also has high switching costs. Having the technology – the actual camera itself– is table stakes. VRRM cameras have a 98% up time, look at ~11B vehicles a year and issue ~14M violations. With violations being sparse it is necessary to have an exceedingly high camera up time.

Around the cameras VRRM has entrenched themselves by providing a suite of services. They do everything from installing the camera, to maintenance, to making sure it is issuing violations, they review and send violations to local police. Police will check and verify the violation and give VRRM the go-ahead to print, mail and bill the violation. VRRM cameras save law enforcement time and help them focus on serious crimes by automating minor infractions such as speeding acting as a police force multiplier. In one week, 40 FL counties spent an average 95,263 police hours on school zone speed enforcement. Those hours saved could be huge.

The government segment is propelled by higher recognition and adoption of photo enforcement as a tool to change driver behavior and increase safety in communities. As the number of vehicle miles traveled continues to increase and cities and municipalities wrestle with the evolving challenges of managing traffic congestion and road safety, automated enforcement solutions are increasingly adopted.

There is a level of “ESG” support that is fueling investment in the space, driving growth. According to USDOT, almost 95% of people who die using U.S. transportation networks are killed on streets, roads and highways, resulting in more than 350,000 deaths between 2011 and 2020.Recently, the American Association of State Highway and Transportation Officials encouraged states to support greater use of automated speed enforcement. New York City’s Automated Speed Enforcement Program 2014-2020 Report, noted a 72% average reduction in dangerous speeding at its fixed camera locations. Additionally, programs like Vision Zero, the goal to eliminate all traffic fatalities and severe injuries, across most major U.S. cities and around the world, are driving capital investment to make meaningful strides in traffic safety.

The government business provides sticky long-term relationships that generate recurring revenues, and continuous growth from existing customer base as local governments typically start on a small scale and add more once they are convinced of results. Management projects the business to grow +MSD through 2026 driven by growing the core through capturing new cities in Florida, California and Connecticut and expanding into bus lane and workzone market opportunities. They serve a ~$11B TAM split between speed safety, rel-light safety, school bus stop-arm safety and transit bus lane enforcement markets growing mid to high single digits on average.

Parking Solutions

VRRM acquired T2 systems last year, a parking business started in 1994 providing university focused parking solutions. It has gradually expanded to 400 universities, 600 municipalities, and over 1,000 adjacent segments like airports, health care facilities, and corporate campuses. T2 Systems has been in business for more than 27 years and started as a company focused on permit and parking management solutions for the university market segment. The customer base is highly fragmented and includes large universities such as Arizona State University and Texas A&M University, as well as major municipalities and commercial parking operators, such as City of Houston, EasyPark Vancouver, MD Anderson Cancer Center, Reef Technologies, SP+ and Diamond Parking.

They have 44% market share in Tier 1 large university (15,000+ student) market and are expanding to the mid (7,500 student) market. They also have customer relationships with more than 21% of higher education institutions in its target tiers, and about 5% of municipal customers. The university market and municipal market represent a $2.3B market.

Thanks to the acquisition activity over the last three to five-years, T2 has expanded their portfolio to include multi-space station meters. Critical factors for the T2 business are renewal rates in the university of segment portfolio and new logo acquisition in the municipal market segment space.

The parking solutions segment will be little less than 10% of sales ($~60M) growing high single digits in the $4B North American market. The segment makes money in three ways: 56% of T2 revenue are from SaaS, 23% from services, and 21% in one-time hardware sales. In 2021, they processed over 115,000 transactions. Each need requires technology solutions for parking access and revenue control, single- and multi-space pay stations, integrated physical and mobile payments, back-office parking rate management, permit issuance and management, online citation payment, event parking, occupancy, and back-office management of violations, amongst other requirements

Future core growth of the parking segment targets universities that have >7.5k students and municipalities with 500k residents or below. Parking solutions processes $2.5B in parking payments per year across 2,000 customers with a 98% renewal rate. The parking segment has a bit lower margins than the rest of the business but should exit the year with 20% margins.

Moat

Verra Mobility benefits from switching costs. In all three businesses, they have 95%+ renewal rates providing mission critical solutions to customers. In essence, their business is taking on complicated administrative work and making it more efficient for their customers thereby reducing costs and allowing their customers to focus on the main business.

In the commercial services business they have made tolling a revenue source for RACs and FMCs and taken out reducing personnel costs by 85%. By removing the tasks of integrating with tolls and tracking and billing customers who run through tolls through outsourcing to VRRM, the RACs and FMCs can focus on renting more cars. No RAC is giving up a revenue generator to replace them with an administrative cost burden.

In the government business, VRRM again is an obvious opportunity-cost saver. Speed, red-light and other traffic violations can be automated through outsourcing to VRRM. Here again, they cover all the administrative work which allows police force hours to be focused on more serious crimes.

The parking segment has incredibly high, 98%, renewal rates with universities and other customers again highlighting customer lock in. The largest customer exposure by revenue is universities which struggle to run the complex systems of parking passes, curbside parking meters and other solutions they need. Integrating into this universe provides incredible inertia.

By taking out administrative burden, VRRM is the opportunity cost of time company allowing their customers to focus on what they do best.

Risks

Customer concentration and counterparty risk. The initial comment from every bear is the customer concentration and counterparty risk with the RACs in the commercial division and NYC DOT in the government business. The three largest RACs make up 11% of revenue each on average, 33.1% in total. This has fallen from 15.5% each in 2019. These companies went through significant financial distress during the pandemic and provide serious counterparty risk for VRRM. As far as the relationship goes, VRRM is a strong spot, they have Avis and Hertz signed through 2024 and 2027 respectively and are integrated in the RAC ecosystem.

The way I get comfortable with this is that the commercial segment is nearly 1:1 correlated with volumes at AVIS and HTZ. These businesses, in turn, are also highly correlated with airlines. So it is important to follow both the airline numbers at a distance and the rental car guidance more closely. The underlying demand for travel, which drives rental cars, is still there and global air passenger traffic remains strong. Even if a rental car company goes under, I'd imagine the there is enough incentive to eventually push new entrants into the space or shift the market share to those companies that manage to stay solvent.

With such a heavy tilt toward the rental car ecosystem, anything impacting that industry will flow through to VRRM as well. An increase in WFH and the adoption of video conferencing could hurt rental car demand as it would result in less business travel which lowers the chance that a rental car runs a toll or has a traffic violation.

VRRM has been incredibly resilient despite headwinds that rental cars faced. The commercial business has grown 12% to 18% despite rental car volumes remaining relatively flat. I think some of these other trends such as the higher toll rates, the longer rental agreements could offset some declines.

By my math, VRRM generated ~$146.5M in revenue in 2021, or 26% of total revenue. NYC also accounts for 25% of accounts receivable. Despite this revenue and credit risk concentration, VRRM is comfortable as NYC wouldn't abandon the program they helped create. They currently have 2,000+ cameras running on VRRM software and administration.

Rental Car Insourcing Risk. I think I’ve talked at length about this, but VRRM has allowed tolls to be a source of revenue generation for RACs as was previously not the case.

Single toll authority integrates. The value of VRRM is that they are the integration layer for the RACs and FMCs on one side to the fragmented tolling authorities on the other. If a single toll authority provided coverage to the entire U.S. this could pose a threat to VRRM value. However, there is still value there for an organization to consolidate all toll spending and develop products and integration that link the rental customer information to the actual toll or violation. Each rental car company would have to build that capacity which is not easy.

They don't control pricing. VRRM does not control the $5.95 daily fee they charge to use their tolling service. The pricing that goes through to the end renter is completely 100% set by the rental car agencies. As management has stated, “We don't provide any influence on that whatsoever. So, if they believe that, that is a better -- if the value proposition and sort of match to the cost and everything else, I think they would make those types of decisions.” RACs have made increases in the past, but VRRM is not the one to drive those decisions.

VRRM also has no control over the customer relationship. Therefore, consumers’ view of VRRM and their willingness to try their program is impacted by their experience with tolling services delivered by the RAC.

Over the past few years, bills have been introduced in multiple states to limit whether and how much RACs can charge their customers for the use of a toll transponder, limit the administrative penalties and fees that can be assessed for processing tolls, and/or impose increased disclosure requirements on RACs with respect to tolling or violation processing fees. In addition, there has been an increase in interest and greater focus on RAC tolling programs from state Attorneys General related to tolling issues from a consumer protection perspective. Of course, any legislation could handcuff the industry.

Prohibiting Speed and Red Light cameras. In the same vein as the last section, legislation prohibiting speed and red light cameras hurt VRRM. In June 2019, Texas passed a law prohibiting red-light photo enforcement programs across the state, with certain carve-outs for some existing programs. This law resulted in lost revenue and the impairment of cameras assets in 2019 to the tune of $5.9M.

Terminal value risk with autonomous vehicles. This risk may be way down the road, but it’s worth thinking about. Have you ever driven by a Waymo? Autonomous vehicles follow the rules of the road to a T. The speed limit is 35, guess what? Waymo is going 34. No red light running or missing a sign which would obviously impair violations revenue. I think this is way off, but worth thinking about.

De-SPAC, Platinum Equity exit and Late Annual Report. I also think there are few issues weighing on the stock now causing overhang. The company is a de-SPAC. Although it happened in 2018, this could be a reason VRRM has lagged the market and been thrown out with the rest of the de-SPAC universe. Platinum equity has been selling off their interest reducing ownership from 40% to ~3.9% today which has caused some overhang on the stock.

Lastly, VRRM delayed filing its 2021 Annual Report due to an acquisition related accounting issue with Redflex, the Europe and Australia relight and speed camera company, and their private placement warrants in relation to the SPAC. They have fixed these issues which related to revenue reporting for Redflex. The error with the warrants resulted in the misstatement of private placement warrant liability, change in fair value of private placement warrant liability, additional paid-in capital and accumulated deficit which they are in the process of fixing now.

Management and Capital Allocation

VRRM’s CEO, David Roberts, has been a board member since October 2018. Prior to Verra Mobility, from April 2012 to August 2014, David was CEO of BillingTree, an electronic payment platform company. From August 2008 to March 2012, David was an MD at BAML, leading the Equity Plan Services business. BBA from Baylor and an MBA from Chicago with concentrations in Finance and Strategy.

Management has done well reinvesting earnings at 25% on tangible capital in 2021 and is on pace to do the same again in 2022. In their long term guidance, management has laid out a path to generating $1.2B in FCF between now and 2026 and holding leverage at 3.5x net debt to EBITDA which should yield another $500M in cash. In all, this means management will be responsible for redeploying $1.7B in cash over the next 5 years, 70% of today’s market cap.

The company has laid out their M&A priorities stating that they will focus more on pursuing companies in similar markets to strengthen core market position while keeping an eye on adjacent markets for acquisition. Two recent acquisitions, Redflex and T2 systems, highlight this point. The Redflex acquisition solidified VRRM as the leader in traffic cameras in the U.S. increasing market share from 50% to 70% while also allowing VRRM to expand into Europe and Australia. The T2 Systems acquisition opened up an entirely new vertical for VRRM in the parking solutions segment. These acquisitions provide strong growth potential in industries with high entry barriers and durable, recurring revenues. Management has stated they are ROIC focused and deploy capital with a margin of safety in mind as cost synergies define the upper bound they will pay for an acquisition. Seeing this sort of language in a de-SPAC investor deck is refreshing, they speak the value investing language.

With this $1.7 billion in deployable capital capacity over the next five years, VRRM has provided a range of capital allocation scenarios focused on stock repurchases and M&A. The central message of the Investor Day was that organic free cash flow their strongest value creation lever. Coupling this with capital allocation priorities, the company has multiple paths to double free cash flow per share by 2026.

Valuation

To walk through the back of the envelope math on the base case. With the commercial business growing topline at 11%, 7% growth in government solutions and 8% growth in parking solutions I get to ~9% organic revenue growth through 2026 or just over $1B in revenue. Management has been historically conservative in guidance and laid out a long term framework to 8% organic revenue growth through 2026. 40% incremental EBITDA margins drive 11% growth. By 2026 that is ~$440M in EBITDA. Commercial services competitor Cubic was taken private by Veritas and Elliot at 14x EBITDA, let’s hair cut and apply 13x or ~$5.72B EV. At the guided 3.5x net debt/EBITDA VRRM would have a ~$4.18B market cap in 2026. Meanwhile, they’ve generated $1.2B in FCF and maintained leverage which has given them ~$500M more to deploy, or 70% of today’s market cap. If half of that cash is used toward share buybacks they can gobble up 5% of shares out per year to get to~129M at the end 2026. This gives us $32.25 per share or, a 17% IRR.

In my bull case scenario I increase revenue CAGR to 10%, EBITDA margins grow to 42.5% with FCF margins pushing 28.5%, share buybacks are held the same which leads to $2.45 in FCF per share. At 15x FCF the bull case scenario gets us $36.78.

The bear case scenario leaves organic revenue growth at 5.7%, EBIT margins are held flat at 20.5%, which contracts FCF margin by 500bps from 2021 to 24%, shares out are only decreased by 4% per annum leading to $1.66 in FCF per share which at our 15x FCF multiple is a $25 stock or a 12% IRR from today.

Applying equal weight to each scenario our expected value is ~$31 per share for VRRM in 2026 or a 16% IRR. I want to note that I have modeled out the organic growth approach. Management has also laid out an alternate, M&A focused, scenario in which the math works out to about the same outcome in FCF per share (more FCF on more shares) although there is greater execution and integration risk in the scenario.

As always I have attached my full model here.

Sources

Disclaimer

I own $VRRM shares. I am not a financial advisor. These articles are for educational purposes only. Investing of any kind involves risk. Your investments are solely your responsibility and we do not provide personalized investment advice. It is crucial that you conduct your own research. I am merely sharing my opinion with no guarantee of gains or losses on investments. Please consult your financial or tax professional prior to making an investment.

did you take into account the 20m warrants outstanding that will be exercised by Nov 2023 (they're at $11.50 so not as dilutive as penny warrants but it does impact shares o/s even in net settled)? And what about the 5m additional earnout shares to be paid to Platinum if the stock hits $18 and $20.50?

Seems like it's fairly valued then. $31 price target discounted back at 15% gets you to ~$17. So 5% above current. Good business, but px already reflects it based on your projections