XPEL [XPEL]

Building an Ecosystem

Share Price: $59.75

2025 Price Target: $88.20 | 14% IRR

Thesis

Xpel is a high quality automotive paint protection film (“PPF”) business that is growing at 20%+ per year. The market fully recognizes this and the business trades at 20x next year's EBIT. Xpel is a high quality small cap with recurring demand, strong growth profile, high returns on capital, barriers to entry, and customer diversification.

Importantly, the growth story at Xpel is still in the early innings; less than 3% of cars in North America get paint protection film installed today, but adoption rates could reach 20%+ as consumer awareness continues to increase.

Xpel has an extremely high quality business with recurring revenues, no customer concentration, a dominant market position with a strong brand advantage, high barriers to entry through their PPF ecosystem, high customer switching costs, high returns on capital, and a very significant runway for future growth both domestically and abroad.

The trend and really it's been the trend for paint protection film for the last decade, has been toward more and more coverage over time. Years ago, small amounts of film just on the leading edge of the vehicle or a partial hood on a high end vehicle like Porsche made up the large majority of installs. Over the years, vehicle owners have moved toward full front or full vehicle coverage on over 80% of installs. As the popularity of PPF proliferates we will continue to see more vehicles opt for PPF and more PPF coverage per vehicle. Ryan Pape captured this succinctly in the recent earnings call.

“As you see, more mid-range vehicles that give any attachment in paint protection film when those are through the aftermarket, we've seen the coverage on those continue to grow. So it really is twofold, it's paint protection film content per vehicle and paint protection film attach rate, and both have had and continue to have positive trends and we're a beneficiary of that.”

Lastly, Xpel is run by a savvy and aligned management team, namely CEO Ryan Pape who is just 40 years old, that has plenty of opportunities for intelligent capital allocation. As XPEL signs more relationships with OEMs and penetrates more new car dealerships, its installed base of repeat customers grows.

Due to the fact that Xpel has been public for over decade, barely raises debt or equity and has been profitable for years, it lacks sell side coverage with only 3 analysts covering the name. We believe this is because banks use their research function as a way to gain clients on the capital markets side, leading to a systematic undercoverage of high quality small caps. Although a darling for microcap investors, the investing community at large is unaware of Xpel’s quality. We hope that the narrative of a recession affecting car sales and Xpel sequential growth slowing will hurt the stock in the short term as it did in May and June. I hold the view that autos will not be affected in this recession due to the all-time low dealer inventories and backlogged consumer demand for new cars.

Without FX headwinds in the quarter Xpel did ~$21M in annualized EBIT which translates to $84m annualized. At 21% tax rate is $66M in NOPAT. D&A is about the same as capex so that translates well into FCF. At 22x FCF, reasonable for a business of this quality growing FCF 25%+ annually and plenty of opportunities to put that capital to work, Xpel would be worth just north of $53 per share today and $82.50 by 2025.

Overview

Founded in 1997 and headquartered in San Antonio, XPEL has grown from a software company designing vehicle patterns used to produce cut-to-fit protective film to a leading provider of paint protection film for cars (~58% of sales in NA, remainder international) as well as a provider of complementary proprietary software.

In 2007, they began selling paint protection film (“PPF”) themselves. Their break-through innovation came in 2011 with the launch of the ULTIMATE line. ULTIMATE was the industry’s first PPF with self-healing properties that return to its original state after damage from surface scratches or rock chips. In 2019, the stock was listed on the Nasdaq after being TSX Venture listed for over a decade. Exhibit A shows Xpel revenues by segment.

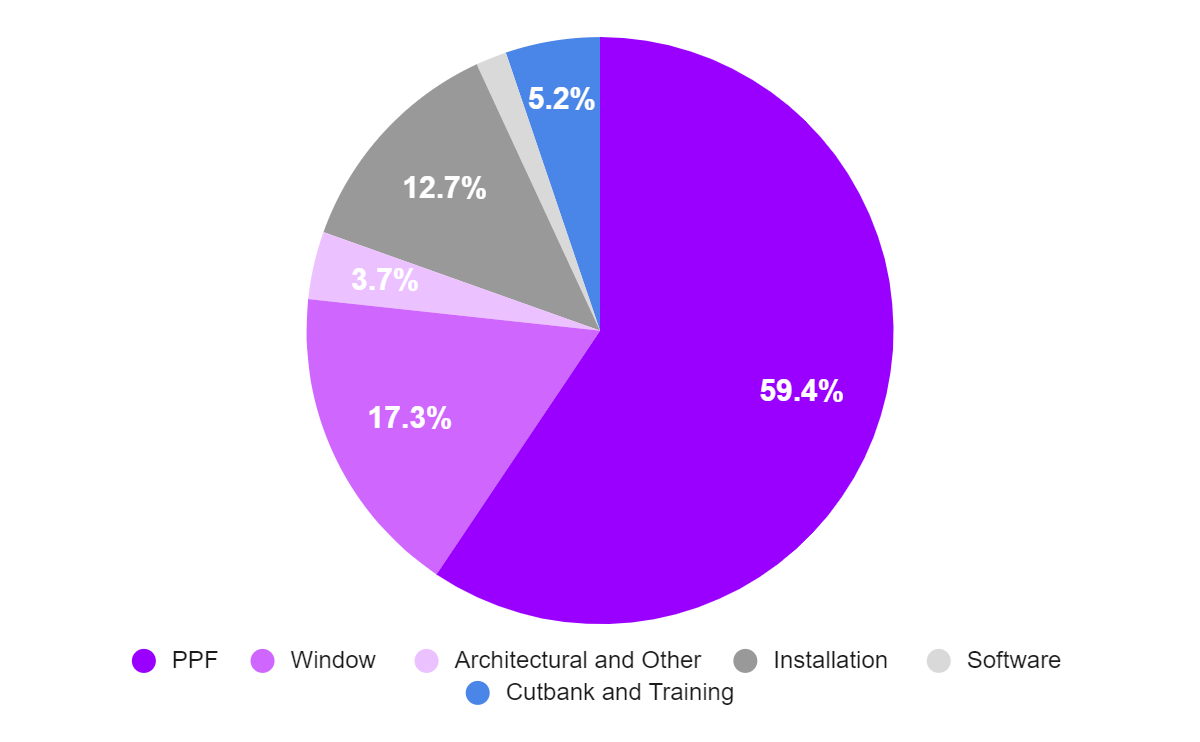

Xpel reports revenue in two segments: product and service. Total revenue has grown from ~$6M in 2011 to over $259M in 2021 (40% CAGR). Product revenue makes up over 80% of revenue as of Q3’22. There are three sub segments here, PPF (78% of product revenues), window film (17.5% of revenue) and other which includes architectural films (4.5% of revenues).

PPF is Xpel primary product, most of the products sold are destined for application to cars to protect painted surfaces from rock chips, damage from bug acids and other road debris. PPF is applied to the high-impact areas of the vehicle including the hood, front fenders, front bumper, headlights, fog lights, side view mirrors, rocker panels and lower doors. This segment is growing in the range of 15-25% per year. 65% of PPF is sold directly to installers or dealerships while the remaining 35% is sold through international distributors mainly into China.

Window film, sold under the brand name Xpel Prime, is the classic window tint business that protects passengers from UV rays and helps control the temperature in the car. This segment is in a more mature market but is rapidly taking share from conglomerate competitors by growing 40%+ per year. This is an easy cross sell both from and to the PPF segment.

Window film is much more heavily tilted toward the used car market than PPF. With paint protection film, there is the declining use if you don't apply it while the vehicle is new, because it's had the chance while you are driving to get chips/dents which PPF would lock in. Window films unlocks a whole new segment of cars that PPF was not targeted toward and creates the opportunity to cross sell and access that market.

Other films contains the architectural window film segment which doubled in 2021 and is growing 30% YoY. This product, sold into residential homes and commercial offices, can add tint and provide UV protection, which can lower a cooling bill by reducing the incoming sunlight rays. ~20% of its customer set overlaps with the architectural market market. Though its too early to tell if XPEL will be successful in this market, it is a large, established addressable market which has the potential to diversify XPEL away from automotive cyclicality. Exhibit shows how the product mix has changed over time each products revenue contribution.

Service revenues (19.5% of total ) are higher margin services that benefit from Xpel’s installed base and complete the valuable ecosystem they are building around PPF. Software makes up 8% of segment revenues. This was the original Xpel business before they began selling their own branded PPF. The Design Access Program (“DAP”) is a key component of their product offering. DAP is a proprietary software and database consisting of over 80,000 vehicle applications used by installers to cut automotive protection film into vehicle panel shapes for both paint protection film and window film products.

DAP gives Xpel the lead brand in the category. If an installer uses your software (which they have to as it has the most makes and models) they naturally gravitate toward your product. This software greatly enhances installation efficiency and reduces film waste – a valuable feature to their customers, as their highest cost tends to be labor. Xpel also provide marketing and lead generation to customers by featuring them in their dealer locator on the Xpel website.

Installation Labor makes up 65.5% of the segment. Xpel offers their products directly to retail and wholesale customers through their 11 company-owned installation centers: seven in the United States, three in Canada and one in the United Kingdom. These installation facilities in their respective markets and through on-site services to automobile dealerships. Installation labor is growing quickly year over year as Xpel continues to roll up installers at 4-6x EV/EBITDA. This is their primary lever in capital allocation. I think of this segment much like a parent company retaining a few company owned stores to run test products and keep a finger on the pulse of what their customers are seeing.

Cutbank credits make up the vast majority of the remaining 26.5% of service revenues. Cutbank is a per-cut fee for pattern access to XPEL’s database. After an installation shop purchases rolls of the film, the rolls are loaded into a cutbank and later drawn on when the installer is ready to place it on a vehicle. XPEL offers a discounted fee to customers who buy XPEL’s film. This, along with access to its DAP software, act as a loyalty incentive for recurring usage. Installers in the U.S. are not required to buy XPEL’s film if they use DAP software, but they are incentivized to do so. There is also a negligible ‘training’ revenue item where Xpel will host training sessions for installers to learn how to apply PPF.

The Economics of PPF

PPF is sold to local installers/car detailers, in turn these installers sell the film and install it on cars for end consumers. Installers generally charge around $1,800-$2,500 for full front coverage (as seen in Exhibit E), although prices can vary greatly due to the extent of coverage the consumer desires. The film is applied to act as an invisible shield for a vehicle's painted surfaces to protect the paint from rock chips, road debris, gravel, small scratches, bug acid, bird droppings, acid rain, tree sap, scuffs, tire rubber chunks, chemical stains and UV damage.

I’ve found that owners of SUVs and pickup trucks select the front coverage wrap on 80% of occasions and the entire car coverage only 15% of occasions. Owners of sport sedans select front coverage wrap on 40% of the occasions and the entire car coverage on 55% of the occasions. We believe that only 5% of customers select a minimal partial hood coverage.

This business is slightly seasonal. Although new car sales have relatively muted seasonality, Xpel’s business of selling rolls of PPF has a significantly more pronounced lift in the summer quarters (Q2/Q3). This is because their customer, essentially a mom-and-pop installer that is relatively capital constrained, tends to make more of its film roll purchases in the summer months when its business is more active and they are flush with cash than during the winter months. This seasonal pattern is very evident in each of the past four years since the Ultimate film was introduced into the market.

One of my favorite mental models for durability is a business that provides consumer-visible products to service based businesses where labor is a large portion of the ticket for the end consumer. The classic example here is Sherwin-Williams. SHW enjoys controlled distribution through its own stores to a price insensitive customer base (pro contractors), which allows the Company to exercise pricing power. Paint represents only 10% of the cost for pro paint jobs (90% labor) and contractors prefer to work with the brand they know and trust. Many contractors believe that SHW’s paint quality allows them to complete a job faster and avoid the costly repaints associated with botched jobs. Since this “controlled” distribution (Sherwin-Williams owned stores) represents 75% of the company’s sales, Sherwin has an easier time raising prices to cover raw material increases.

XPEL is running the same playbook. Direct customers [installers] can pass any XPEL price increase onto the end customer with a slight mark up. The end customer is relatively price insensitive as the product comprises only ~20% of the cost of the total job with the balance being installation. So a $10 increase in the price of PPF only results in ~$2 increase in the cost of the installation job.

Management has made clear that their acquisition strategy centers on the belief that the closer the company is to its end customers, the greater its ability to drive increased product sales. We've see them move “upstream” (closer to end user) through consistent acquisitions of installation centers which have occurred at 4-6x trailing EV/EBITDA before synergies. XPEL claims that they can achieve 20% cost synergies within a year of acquiring the businesses.

SHW has exhibited long term gross margin expansion coupled with impressive operating leverage as the business scaled. I believe that XPEL could enjoy a similar scenario as they put in the fixed infrastructure today. This will drive a much higher level of revenue which should result in SG&A falling as a % of revenues.

This section from Scuttleblurb’s SHW piece does a great job capturing this point. If you just substitute paint for PPF and SHW for Xpel, you get the Xpel moat.

XPEL has a long runway of growth and addressable market penetration. I estimate that PPF is applied to 7-9% of new vehicles in North America. This compares to only 2% in 2010 and demonstrates the uptick in adoption rate. While XPEL controls the #1 market share in automotive PPF of 35-40% this implies that XPEL is installed on <3% of new vehicles. We believe the penetration could eventually reach 20%, which would provide XPEL with a long runway of sales growth over the next decade. Window tinting, by way of comparison, has a 60% penetration rate.

The film sold by Xpel is either in the form of bulk sheets or pre-cut kits that they have designed for every make and model combination of car. They also sell access to their database of designs (10,000+ designs) for installers that want to cut their own paint protection kits should they have the necessary plotter already in-house. Overtime, however, Xpel has been shifting the business to encourage purchases of their own film rather than have customers license their Design Access Program software and use 3rd party film.

There is constant new demand for PPF as sales are tied to new car sales which are around 15M units annually in the U.S., but do not fluctuate significantly on an annual basis (normally in a band of 12-18M).

While it is true that the customer base skews towards luxury vehicles because those consumers care more about protecting their cars’ paint from chipping/streaking or other forms of damage and the PPF is also a smaller portion of the overall ticket as the car gets moves further toward the luxury end of the continuum. I think it is a misconception to say that PPF is a product that only appeals to car enthusiasts or luxury vehicle owners.

First of all, the most wrapped car (and they know this because of their DAP software which we talk about in ‘Building An Ecosystem’) is the Toyota Camry. Further, I think the value proposition of the product is simply a lot more compelling than a lot of investors that aren’t familiar with the aftermarket business realize.

It is challenging to match the original paint color and finish type (high-gloss, semi-gloss, matte) during a paint repair job. A basic paint repair costs $1,000-2,000 at a dealership or repair shop and can appear like nail polish was dabbed on the hood and sides of the car. The cost of repainting the entire vehicle and the removal of the prior damaged paint, for the continuity of the color and finish, can cost $6,000. That compares to $2,200 for the front of the car to be protected with film for a decade.

Car dealerships already have success selling, frankly questionable value, aftermarket products like rust or theft protection, that are often not much different in price. PPF’s value is highlighted by the vast majority of installations being either full front or full car.

While, yes, it is true that the highest penetration rates of PPF of almost 20% are found in brands such as Porsche, BMW, Tesla, Audi, Range Rover and Corvette. I estimate that new pickup trucks, with premium packages, have a penetration rate in the low-teens as many pickup truck owners drive off-road or do construction work in areas more prone to rock chips and debris, which causes more abuse to the hood, bumpers and rocker panels. Which explains the relatively high penetration rates in Colorado and Alberta where PPF has achieved 30-40% penetration.

Building an Ecosystem

Unequivocally they have the premium product. XPEL’s paint and surface protection film rolls are clear thermoplastic polyurethane layers with clarity and long-lasting durability, and are bonded to a vehicle's exterior paint. The films have self-healing properties, which cause small impact dents and small scratches to disappear after the film is exposed to heat and sunlight. XPEL’s products are also non-yellowing from UV exposure, stain resistant and prevent paint discoloration from contaminants. However, looking narrowly at the PPF product itself, is insufficient to understand the moat around XPEL’s business.

The competitive advantage that allows them to earn nearly 100% ROICs in 2021 ($40M EBIT / $53M Net PP&E+WC) is found, however, in the ecosystem they are building. You don’t understand Apple by comparing the technical features of the iPhone against an Android.

XPEL’s large dealer network has been trained to install their product, XPEL is the premium brand of choice with customers asking for installers to “xpel their car”, and a database of tens of thousands of individual kit designs that competitors need to recreate.

XPEL has created an entrenched ecosystem, becoming the champion of PPF by training the installers to install films, accompanying them on sales pitches to new dealerships, capturing leads for them in local markets and making them reliant on XPEL’s proprietary software. XPEL’s revenues grow as these independent installers do well and strengthen their relationship with new car dealerships nearby and customers.

XPEL’s business model is driven by its relationship count with installers and its ability to grow its brand. For this reason, customer count is a good KPI to watch. Track the customer count over time notice how many more installers XPEL works with today versus a year or two ago. As XPEL builds more relationships, XPEL generates more revenue, can invest more in its brand/come out with more products, and therefore create more value for its installers.

XPEL’s proprietary software, Direct Access Program (DAP) is an important differentiator from competitors. Its DAP is a cloud-based application with a database of the designs and shapes of more than 80,000 vehicles models and year types. This provides XPEL and its customers with the precise accuracy for panel shapes and the sizes for paint protection film and window film tints.

XPEL’s DAP software syncs with electronic plotters, which automatically cut the film to the exact sizes and pattern shapes. Instead of hand-cutting the shapes, installers can use the automatic cutting plotter to drastically reduce waste and ensure a better fit. Management has stated that they estimate that DAP saves installers 20% waste (cost of extra film) and dozens of weekly labor hours. According to one sell side report, a full car coverage installation could be reduced from five hours to four hours by using the DAP software.

XPEL also has aligned incentives for introducing a PPF offering with car dealers. Pape mentioned on the Q2 call,

“I think you are seeing more paint protection film preloaded on the lot…Dealers having an opportunity to do more preloading and do that sort of upfront accessorization, so that might be what you're seeing. But we do see more of that occurring and that's typically ultimately motivated by the dealers' profit motive like anything that they would sell.”

From talking with local dealers they’ve shared that they can typically make $300-$500 in profit from simply adding PPF on each sale. The customer benefits because this upsell usually replaces some dealer specific financing or warranty and the car dealership can install a high margin product.

Lead generation increasingly appears to be a significant competitive advantage and switching cost for Xpel. Xpel has a dealer locator on their website, and the company generates numerous leads for their installers through this channel which raises switching costs. Why would an installer go through the trouble of switching film providers to try to save 5% on their film purchases when let’s say even 25% of their sales (probably often more) generated by leads that Xpel is giving them for free?

Similarly, if Xpel wanted to raise prices by 5%, is that installer really going to switch film suppliers and sacrifice the quarter of their business that is generated by Xpel’s leads? Probably not. This leads me to believe Xpel is planting seeds with lots of untapped pricing power.

Management and Capital Allocation

Xpel has well aligned, top class management with exceptional capital allocation opportunities. Management oftentimes, but especially in small and micro caps, plays a pivotal role. As Ian Cassel has said in the past, look for small cap management teams that shouldn’t be running a small cap company. Xpel is a case in point.

The BOD and executives own over 20% of the company. Ryan Pape, CEO since 2009,owns over 4% of the company personally. When Pape took over the company in 2009, it was hovering on the edge of insolvency. Within the year, Pape paid $25,000, taking on personal debt, to settle a suit with a race team they had sponsored. Pape showed willingness to put his own money at risk for the company’s sake, and his alignment with shareholders that is the quintessential example of what I look for in a management team.

He’s also gone on podcasts and mentioned learning the importance of cash flow, “people look at an income statement or the profit and loss as the health of the business, but it’s cash flow. . . if you run out of cash, you will eventually go out of business.”

Lastly, this management team also treats shares like gold. Shares outstanding have been, for all intents and purposes, unchanged since 2007. It is incredibly easy to predict shares outstanding for next year: they’ll be the same as last year and the year before.

As a result of Xpel’s low capital intensity (see Exhibit F) and high returns on capital, cash will continue to pile up on the balance sheet at a rapid rate even if the business were to double or triple in size. The story then turns to one of capital allocation.

The acquisition philosophy is based on getting closer to the end user. There are more than one hundred targets for XPEL to acquire and roll up including installation centers in the U.S., Canada and Europe, as well as distributors in those regions. XPEL could put over $250m+ of cash to work in bolt on acquisition.

To draw on our mental model from earlier, Sherwin-Williams has a massive footprint of 4,800+ retail stores. I doubt XPEL reaches even half that size for paint-specific demands but look for XPEL to step on the gas with more installer acquisitions now that the focus is back on NA domestic growth. The installer acquisitions add higher margin installation services to revenue mix as well as continue to Xpel’s share of mind.

Management has also moved to build relationships with car dealerships. New car dealerships generally have three options to install protective films and other appearance products once sold to their customers: through an “in-house” program whereby the dealerships hire installers on their payroll to install the product once sold; out-sourcing the installation to an aftermarket installer; and, utilizing a labor service model whereby third-party labor performs the installation on dealership premises. PermaPlate and TintNet added this third party labor option to their quiver and increases PPF exposure to more mid-range automobile dealerships.

As Pape mentioned on the Q2 call:

“We have some connectivity directly and indirectly into several thousand new car dealerships in the US, but I think that there is tremendous opportunity to grow the number of dealerships offering paint protection and that doesn't mean that we need to sell to them. We will and we might, but also through our after-market channel”

Lastly, they've recently diversified their supply chain, which had sourced 75% of its auto film materials from one supplier (Entrotech) in 2021 and 2020, into six suppliers none of which supply more than 25% of its PPF.

Optionality

Xpel finally started leveraging their valuable direct distribution network (I believe ~1000 independent film installers) to enter additional product categories. Their first launch is a window film/tint. PPF penetration is only 7-9% of new car sales in the US vs 60% for window film. Management expects the product to have margins on par with PPF and it appears to be a major focus for the company. Management has also launched architectural films that block the sun’s heat and improve energy efficiency in buildings. Pape stated recently, “When we look at where we want to go on a 10 year horizon, we want to be about personalization across verticals, not just about automotive.”

Bears are right to say that there is a limit to the PPF market. It is unlikely that penetration of PPF reaches that of window film. But there is still room for growth. XPEL generates around ~$10 per Canadian auto SAAR versus the US ($4), China (<$1) and Continental Europe (<50c). So plenty of white space to fill in in spotty regions as they build relationships with new installers. XPEL’s management has mentioned, for example, that Europe feels like the US did 5+ years ago.

In addition, XPEL’s window film business continues to become a larger percentage of the overall market and we know this is a large, established market with entrenched, conglomerate competitors who have bled share to XPEL in the paint protection industry for many years. EVs have a higher attach rate than ICE and EV OEMs have shown a willingness to partner with Xpel for pre-loaded PPF installs at the factory which will lead to broader adoption. If PPF application becomes the default option, which would make sense as the OEM gets some of the economics, this business could become very powerful very fast. XPEL also has a couple other direct OEM relationships, including Ford and a European OEM. I envision that PPF becomes more of a pre-loaded feature as part of the vehicle sticker price and no longer solely an aftermarket installation.

Pape touched on this in August,

“There remains opportunity with OEM and you know what the OEM channel has the ability to do is to reach buyers that we wouldn't reach in many cases any other way, either because the dealers aren't offering and the customer is not aware of it. So especially in Rivian's case, they’ve been a very forward in terms of marketing it, talking about it, branding it as XPEL. So, I think they've done us a service by doing that, and they've done the broader business of paint protection film service by introducing it to a lot of people that didn't know about it. And so, I think there is plenty of opportunity to expand upon that when you're looking at this still small attach rate total new car sales, and looking at ways to grow that. So this would be not the last one of those to look at doing.”

Iestimate that OEM is still less than 5% of total sales but represents a terrific opportunity to increase installs and brand awareness.

Competition

XPEL is the #1 player in PPF with a 35-40% market share in North America. The #2 player in PPF is a dual-branded company using the LLumar and SunTek names, part of Eastman Chemical ($EMN). Eastman’s Advanced Materials Segment did $3,027B in revenue in 2021 and said they “performance films” subsegment is 20% of AM sales, implying ~$605M of revenue in 2021. The segment grew 20% in 2021 and lost 6% from 2019 to 2020. This implies XPEL has taken share as EMN volumes have remained unchanged this year while XPEL has grown topline 20%.

Both of Eastman’s brands do PPF and window tinting. Eastman Chemical acquired SunTek in 2014 for $438 million (4.4x EV/Sales). Suntek is largely a window film business, which is a more mature market with much slower growth, and is significantly less attractive than PPF .Eastman Chemical received LLumar and other PPF brands from its acquisition of Solutia Inc. in 2012.

3M is now a distant #3 player with its Scotchgard Paint Protection Film series. 3M was the pioneer of paint film protection technology during the Vietnam War to protect helicopter rotor blades from debris and dust. Its product was also popular during Operation Desert Storm in 1990 before slowly becoming introduced to consumer retail cars a few years later. It lost market share because of not offering certified training to the installers like XPEL does, not having the database of vehicle models and contour types like XPEL with DAP, and not innovating with new formats for trucks and electric cars. My best estimate as to the market share of automotive PPF players is below in Exhibit G.

As management stated on the Q1 call: “Despite the anemic SAAR for reasons we know, which is primarily related to new car inventory shortage, we saw good growth which suggests we're continuing to see attach rates growth for our products and to take market share.”

Risks

The bear case here is self-evident. Xpel operates in a cyclical industry, sequential growth slowed throughout the year and it trades at 30x EBITDA. Automotive ROIC is partially driven by superior go to market (they are the golden boy for PPF at large) and superior software, but this is not the in architectural which makes them more commoditized and therefore lower ROIC. There is some China exposure here as they sell to a distributor who controls China.

Xpel’s acquisition strategy has led them to go further upstream and closer to the end customer through buying installers. While on one hand it helps them control distribution, more easily change pricing and access higher margin service revenue; on the other this begins to nullify the “small part of the end customer final bill” business quality argument. By acquiring the installer Xpel gets the entire ticket, including the labor portion meaning the pricing power narrative is nullified.

Like Domino's or any good franchisor, I think it is essential for Xpel to own some installation centers so they can serve their customers better by understanding what the daily challenges are, get their own data/experience and run test products. I would be hesitant though to see Xpel expand into mass acquisition of installers and each and every one of them.

Bulls would respond that Xpel needs to control distribution and have some customer access to build a brand. Sure, but there is no reason to control the entire value chain here. The host of Founders, David Senra, in his episode about the Everything Store nailed this point,

“You see over the last few years, people build media businesses on top of things like Facebook. Like wait a minute, what the hell happened? You turn off my traffic overnight, and now you're saying I have to pay to reach the people that were following me. Yes, because you were building on -- you're building a castle on sand… You can't do this. You cannot build on top of somebody else's platform.”

I think the big difference is that there are hundreds or thousands of installers so Xpel isn’t really building on some else’s platform because of the fragmentation.

As Xpel has grown, working capital has eaten up a large portion of would-be FCF. The question becomes, when does Xpel begin to generate a meaningful amount of FCF and at what point does WC normalize?

Obviously, Xpel sales are tied to new cars, as interest rates climb, that deters people from buying new cars and acts as a headwind to Xpel sales. I think there are some offsetting factors here such as supply chain issues easing and some pent up demand/backlogged orders but still a risk that could impact the next few quarters. Overall, this is going to be a cyclical business that fluctuates with changes in car sales. I’d read about AXTA, PPG, the OEMs and S&P Global’s mobility research to get a better handle on this if you’re trying to ramp up.

I think there’s a risk out there that a PPG or AXTA could develop a paint that did not chip, scratch or was generally not as susceptible to damage, which could impact demand for PPF.

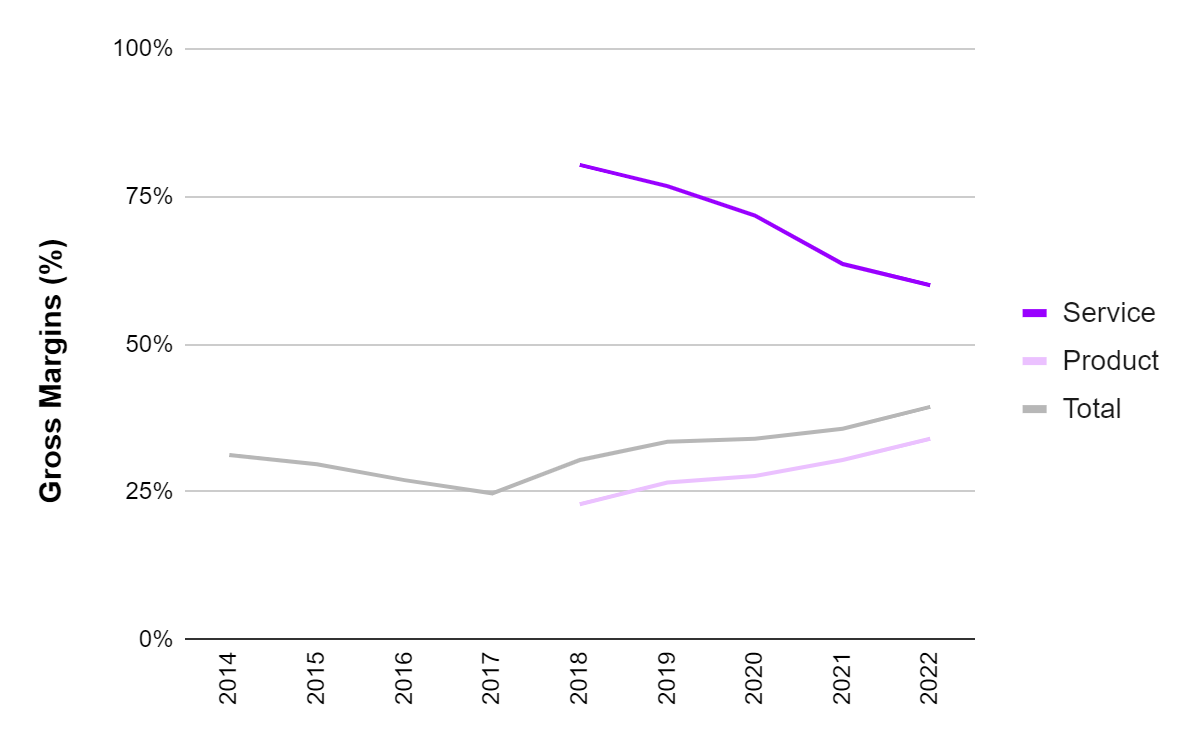

Lastly, service gross margins have fallen every year since 2018 from 80% to 63.6% in 2021. The question here is, where is the bottom? Incremental service gross margins have been in the mid 50% range which has come as they have bought more installers/distributors and could act as a headwind to gross margins.

Valuation

Xpel is in the early stages of building an immensely valuable ecosystem with a strong installed base of partners and planting the seeds for untapped pricing power. Building this ecosystem is going to be costly for new entrants and difficult for large conglomerates where PPF makes up only a fraction of their revenue. In my view, the company has durable competitive advantages that should contribute to continued market share gains for decades to come. More vehicles and more content per vehicle will continue to drive revenue growth. Being the champion of driving PPF adoption at large and positioning themselves as the premium brand will differentiate Xpel from any would-be competitor.

Xpel has historically grown revenue 20-30% organically per year with big jumps in especially acquisitive years, see 2021. I modeled revenue growing 21% in 2023 falling to 20% in ‘25 and 19% in ‘27. I believe this is reasonable and fine projecting historical growth as there are plenty of levers to pull in attach rate and content per vehicle as well as plenty of white space in $/SAAR (see exhibit X).

Inorganic growth will largely be in the service segment and driven by net M&A spend, number of acquisitions/year and EV/EBITDA multiple.

I took a stab at modeling out ROIC for an individual acquisition. At current purchase multiples, once all contingent considerations and synergies I estimate that Xpel is generating incremental ROIC in the high-teens to mid-twenties range on installer acquisitions

Margins

Gross margins have grinded higher since 2015 when they were 29% to the most recent quarter’s 39%. Service/product split is the biggest driver of gross margin variability, and we know that services have much higher margins than products. I suspect that Xpel will have success selling services (like installation and training) as PPF proliferates and more dealerships/installers join their network. As mentioned earlier, service gross profits have been trending down. This is as the service mix shifts away from software and cutbank credit to installation service. The overall effect of this mix shift is that as service gross margins have tended lower service gross $ are a larger portion of the pie (See exhibit H) which increase company-wide gross margins. Incremental gross margins have been in the 45-55% range and act as gravity for future margins.

S&M as a % of revenues, which is mostly salaries and advertising , has hovered between 5.5% and 7% over the past few quarters/years. Xpel has recently moved into sponsoring races and drivers which will drive this higher in line with revenues. I assume that S&M stays in this band declining by 25 bps as a % of revenue per year.

G&A has been 13-15% of revenue historically. This is mostly salaries, IT , occupancy cna heightened amortization of intangibles because of recent acquisitions. This is the place to look for operating leverage as revenue grows. Management has stated an internal target of S&M + G&A to be 18% of revenue in 2024. I model 20% in ‘23 with a 50 bps decline each year to get me to 18% by ‘27.

Overall, I expect EBIT margins to expand as Xpel continues to benefit from an improving mix of high-margin services (installation labor and cut bank credits) and the scale leverage benefit of its SG&A expense as its volumes grow. I expect that EBIT margins expand by 10% (~7% from higher gross margins, and ~3% from lower SG&A), reaching ~25% by 2027. This would place them above paint companies like SHW and AXTA.

Capex

As of Q3’22 $10.2m of cash and $41m in various lines of credit, operating lease liabilities and notes payable. The company has historically kept low levels of debt but has taken on more recently to fund acquisitions. They should be able to use all FCF going forward to roll up installers and international distributors with the small delta made up for with debt/revolving line of credit. As mentioned capex has been a blip of revenue at around 1%-2.5% annually.

Tying it All Together

Xpel is certainly not cheap at a $1.7b market cap. They’re growing topline 20%+ with gross margins pushing up past 40% and 30%+ incremental FCF margins. Overall, my base assumes that Xpel generates $540m in FCF between now and 2027. I project that Xpel will spend $75m on internal capex with the rest of FCF used to acquire installers/distributors. It is possible Xpel could focus on buying back shares at some point in the future as well. They most definitely will generate the cash to do so. However, given management's commentary around M&A and historical allocation, I believe that M&A and expanding into new film markets is priority number one. My DCF, attached below, gets me to ~$60 in fair value in my base case.

Since its 2003 IPO on the TSX, Xpel has evolved from an automotive product design software company to the leader of aftermarket surface and paint protection and passenger vehicle window tint films. Today, Xpel is a fantastic business. PPF has low penetration to new cars sold, a fragmented market provides opportunity ripe for consolidation and dealerships are on board as they need tangible profitable products to sell alongside cars.

If you’re going to express a bet on accessories into the car market (owning OEMs has been a tough bet over the last century) Xpel is the place to do it. VVV has terminal value risk, what do store margins look like at maturity and what about the long term shift toward EV? I can't own that for a decade. AXTA has never been able to get on the right track despite all the ink spilled explaining why it is such a fantastic business (management turnover every 2 years is worrisome). XPEL avoids both of those. The partnership with Rivian and Tesla highlights that PPF has a place in the EV world as EV owners are noticing that exterior paint is not as durable as with conventional vehicles. The softer and thinner paint coat on many electric vehicles have low levels of volatile organic compounds (VOCs), which make it more susceptible to rock chips, small scratches and blemishes. Best of all, this management team is well aligned and has been fantastic operators.

Sources

Ryan Pape on Texas Business Podcast

How A Struggling San Antonio Company Became a Wall Street Darling

Disclaimer

I am not a financial advisor. These articles are for educational purposes only. Investing of any kind involves risk. Your investments are solely your responsibility and we do not provide personalized investment advice. It is crucial that you conduct your own research. I am merely sharing my opinion with no guarantee of gains or losses on investments. Please consult your financial or tax professional prior to making an investment.

XPEL Q1’23 quarter review:

Total revenue up 19.5%, Product up 15.9% driven mainly by 30% growth in window film which is growing faster than PPF which shows that XPEL is taking market share in a mature market and creating a strong ecosystem. PPF attach continues to grow and has a long, long runway with only HSD% attach rate and another lever to pull in content/vehicle. Service revenue up 34.6%. XPEL is retiring the old DAP software to roll out the DAP NEXT. They are really creating a strong ecosystem around installers building software not to just measure and cut film but manage invoices and payroll.

OEM biz grew 50% y/y to $3.5m, once they become the default attach rates start to soar. The luxury share of the US car market reached an all time high in the quarter. Pape mentioned the vertical expansion into marine and aircraft which, while far off and nascent, is exciting to see.

Gross margins 41.9% (incremental GM 59%) which was especially strong. This was driven by a decline in lower margin China revenue (-25% COVID impact still lingering) so we could see this number come back down as China rebounds. China will improve throughout the year and will finish ~flat with ‘22 Which is why I don’t think they raised margin guidance. The bright spot is that (it looks like) we finally found the bottom in service gross margins which should be ~60% going forward as we see continued operating leverage.

Also good to note that customer concentration is coming down. Largest customer down to 7.7% of revenues from 12.3% last year. Growing the customer base as consumer awareness of PPF goes up.

Leverage on S&M (down to 7.8% of revenue) is great to see. EBIT Margins up to 17.4% (35% incremental EBIT margins) and should be higher as China comes back and allows them to leverage G&A expense which is at its highest % of revenue over the last 5 years. UFCF for the quarter was $1.1m as A/R increased and A/P went down. Pape mentioned we are at peak inventory and we should see WC unwind throughout the year which leads to strong cash generation.

During the quarter they acquired a dealership services business for $5.3m (look like it was at book value considering little change in GW or 1.2x sales) as they execute on getting closer to the consumer to increase PPF preloading. Actively seeing XPEL get back into M&A and deploying cash at great ROIICs with a strong pipeline.

Mgmt left 20-25% rev guide unchanged and guided to $100m+ in revenue in Q2. (see my model attached for my revised estimates) but I am at $391m in 2023 revenue 42% GM and $2.12 in UFCF for the year.

$XPEL looks expensive, is expensive but is not as expensive as it looks. You’ve got EBITDA growing 44%+ y/y at 30%+ incremental margins with no share dilution.

Someone loved your analysis and linked it in a post at Jika ! I don't want to insert a spammy link but you can visit it at jika dot io