APi Group [APG]

Introduction

I first heard of APi Group from my friend Market Euphoria, so let’s start by giving him a shoutout. You can find him on Twitter or his recently started Substack.

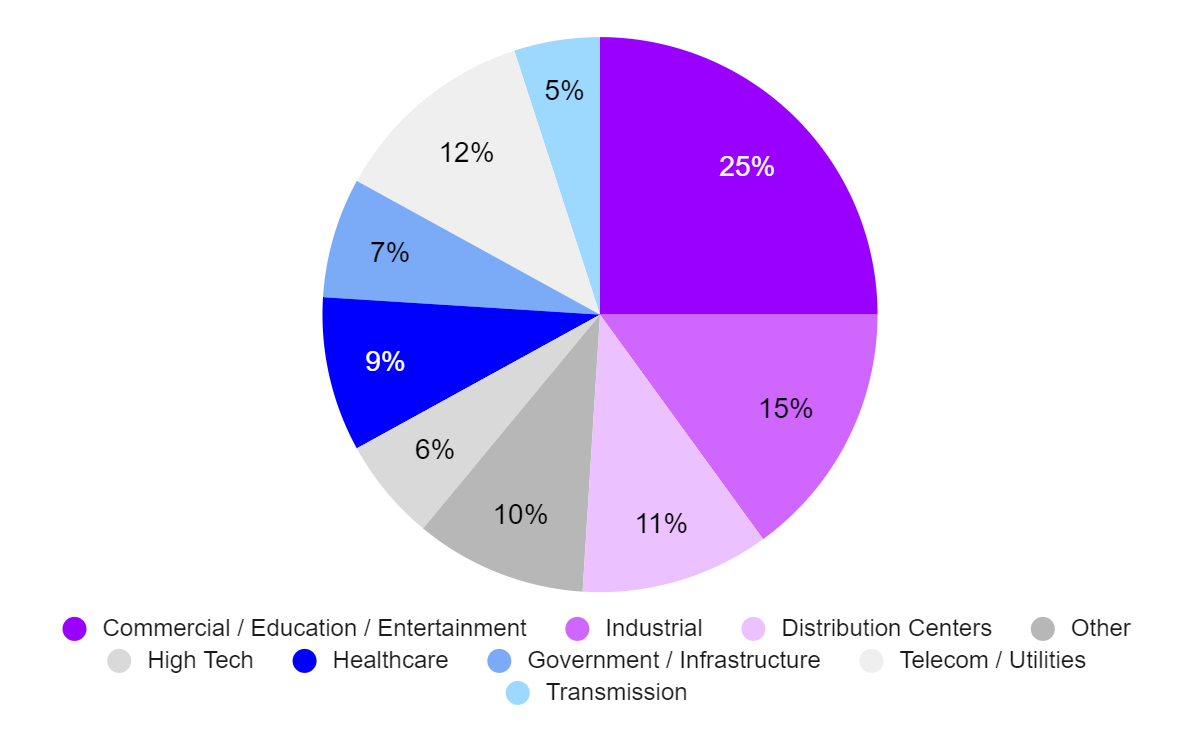

APi Group is the largest provider of life and safety services globally. Founded in 1926, and public via SPAC in October 2019 APG inspects fire alarms, sprinklers, HVAC systems and critical infrastructure . Exhibit A shows the company's revenue base today and its diversification by end market. APG’s core strategy is simple: acquire small established owner-operated life safety businesses, provide them with the support and resources of the mothership and let them operate with autonomy. I believe there are two key questions to answer:

Can the existing portfolio of APG businesses continue to produce a predictable and growing cash flow stream for decades into the future?

What portion of APG’s growing FCF stream can be deployed on M&A, and what incremental return will they earn on that spend? Can the M&A machine operate at full capacity or is it slowing down?

Through their Safety Services segment (70% of revenues) they provide statutorily mandated fire safety inspections such as inspecting fire alarms, fire pumps, emergency fire suppression systems, sprinklers and backflow devices to commercial buildings. These services are required by local building codes to be done at least once a year. This business can be split between contract and service/inspection.

Contract is the lower margin and more cyclical side of the business as it is tied with commercial construction. Many competitors hold the view that it is necessary to win this competitive contract business on a new building in order to position themselves to win the more attractive inspection/services work later.

APG has employed an idiosyncratic go to market selling inspection work first which have 10-20% higher margins because they are required to happen by law, regardless of the economic backdrop and have sticky customer bases with 90%+ retention. A long list of marginal competitive advantages aggregated has allowed them to take share from the long tail of local mom & pops. Scale allows APi to have greater route density to lower cost to serve, affords greater bargaining power over suppliers, separation of back office and field work allows them to turn inspection into deficiency reports faster and geographic network effects allows them to service national and multinational clients cheaper by consolidating their spend.

Mom & Pops often do not have a dedicated salesforce and target new contract (lured by the higher $ price tag) rather than inspection and service sales. Competitors focus on submitting proposals to general contractors hired by building owners for new construction work. APi’s strategy is reversed, they start with targeting inspection work at existing facilities with the intent to generate $3-$4 of service work for every $1 of inspection work, and by delivering to customer expectations in a timely manner build a sticky relationship that could lead to future contract opportunities in the future. The most important element is that it enables APG to be selective on the contract work they do undertake i.e. leaning in towards customers who have a larger footprint/longer lifetime values. They target owner direct relationships where possible vs a general contractor as they believe it positions them to better capitalize on future service and inspection work at the property.

As APG scales, many of their competitive advantages build on each other. In particular, as multinational clients seek to consolidate their safety services spend, APG is one of just a handful of competitors that can effectively service that demand. As a result, I think APG is well positioned to continue taking share from small competitors for decades. There are others players who offer fire safety but it is not central to their business and they have not built an end to end service offering that could compete with APG and therefore I think pierce competition is far off.

The second segment, Specialty Services (30% of revenue), maintains and repairs critical infrastructure, such as electric, gas, water sewer and telecom infrastructure. While there is a service element to revenues here through multi-year master service agreements entered into with customers, the majority of sales here are one time contract based.

On the second question, there is plenty of opportunity to continue rolling up the long tail of life safety providers, plugging them into the APG platform and wringing efficiency out of them. Chubb, the recently acquired fire and safety arm of Carrier, is the quintessential example of this acquisition strategy which enhances APG’s offering to multinational clients, has an opportunity to expand margins and shifts the business even further in the direction of statutorily mandated services making the new APG much more resilient in downturns.

Lastly, equity ownership amongst the management team and a large portion of regular employees is quite high. Everyone appears to be rowing in the same direction as investors. The operational management team at APG are strong operators. Russ Becker has been CEO for two decades and has completed 90 acquisitions since 2005. New CFO Kevin Krumm played an integral role in integrating Nalco into Ecolab ($8b acquisition). They are also supplemented by experienced capital allocators Martin Franklin and Jim Lillie of which APG is their largest public holding.

Thesis

The key debates over APG boil down to three points: what is actual organic growth at the business, how cyclical is APG revenue and what is Martin Franklin’s role? At the margin I believe that its high leverage as a result of completing a large acquisition and complex story with lots of moving parts and no clean comps make it difficult for the market to value.

The water around historic organic growth is muddy. Estimates range from 0% to 7%, but I suspect the truth lies somewhere in the middle at ~3%-5%. The fire safety market is stable, growing (projected to grow low to mid single digit per year through 2030), and highly fragmented, providing an excellent backdrop for both strong organic growth and tuck-in M&A for many years to come. APG differentiated go to market sets them apart. APG has stated that inspection revenue is growing 10%+ annually and now makes up 50% of the business while service grows slower at 2-3% annually and composes the other half. If this mix were to continue it would imply the business can grow 6%+ per year. I believe with the recent acquisition of Chubb organic growth will temporarily fall to 4.5% as they work to integrate the business and focus on shedding low margin contracts. Some elements of churn at Chubb is not a bad thing over the next twelve months.

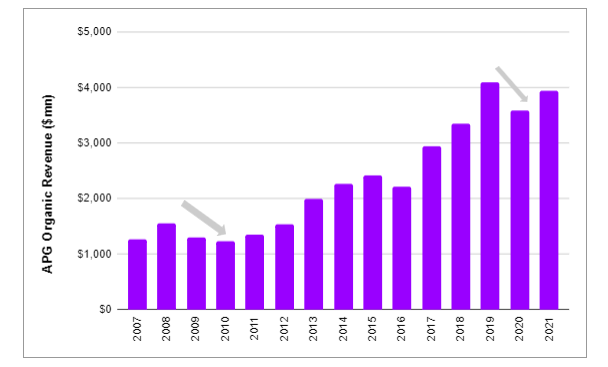

APG is an almost entirely different business than what it was when it went public and especially than what it was in 2008. The shift to recurring services revenue has been in place since the financial crisis. The business posted a peak to trough decline of about ~25% in the GFC over two years and APG realized it no longer wanted to be as heavily exposed to more cyclical new contract work. The acquisition of Chubb is proof of this mentality shift as Chubb swung the pendulum to a majority (50%+) inspection business up from 15% in 2008. Since going public, APG has divested several industrial services businesses to focus on higher margin, acyclical, low capex life safety services. The recurring nature of service revenues insulates the company from downturns and provides visibility into cash flows. There is natural margin expansion as the mix shifts more heavily toward inspection with 10-20% higher gross margins. Lastly, their variable cost structure and small average project size/ shorter cycle duration projects help protect margins in downturns.

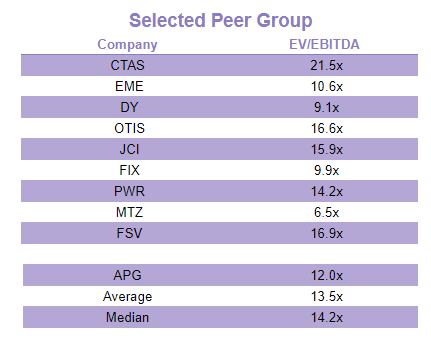

Tying it all together due to APG’s short life as a public company, historical business mix, and industry categorization, the market has mistakenly viewed and valued the Company as more of a construction business subject to the cyclicality of new construction. In reality, the APG’s strategy emphasizes recurring services work driven by regulation. As the company continues to reinvest in the Safety Services segment becoming more of a pure play and executes on the Chubb integration through expanding margins and restarting organic growth, I believe the market will price APG more in line with other niche industrial service companies and precedent transactions in Exhibit B.

I believe APG is worth $26.57 in the base case, representing a 27% upside from the current share price. Looking at a 12/31/2025 exit I value the Company on $1.05bn of NTM EBITDA at an 11.0x multiple for a total enterprise value of ~$11.5bn, an equity value of $9.2bn, and FDSO of 278mm for a target price of ~$33 and an IRR of ~15%. Despite APG’s strong underlying business providing statutorily mandated services, APG trades at 12x depressed NTM EV/EBITDA, a 15% discount to its peer group of publicly traded industrial service companies. Recent M&A transactions on smaller scale fire safety services companies have been done at an average of 16x EV/EBITDA, providing additional evidence that APG is significantly undervalued.

This business is heavily covered by the sell side, which is unusual for businesses I look at and I could be wrong the integration of Chubb is slower than expected and cross selling opportunities are hard to come by or competition rises in selling inspection first which could cause them to compete more heavily on price and drag margins down. Lastly, PE competition to roll up the space would drive multiple higher, eroding either return on incremental capital deployed or the overall dollars deployed faster than I expect.

My model can be found below. If you have any questions feel free to reach out, I want to learn.

History

APi Group traces its roots back to a small insulation contracting and distribution division of a mechanical company, Reuben L. Anderson-Cherne in 1926 by Reuben Anderson in St. Paul Minnesota. APi has been focused on bolt-on acquisitions since early in its history, rolling up companies in order to build out the capability to service a building throughout its entire lifecycle. There were plenty of cost synergies that APi could wring out of these businesses including centralized back office functions and leveraging the purchasing power of a larger entity for raw materials.

In 1948, the insulation related activities were spun off into a separate firm with the retrospectively unfortunate name Asbestos Products. Lee Anderson was headed for a career in the military after graduating from West Point in 1961 but instead came back to Minnesota three years later to lead the company after his father had a heart attack and was appointed President in 1964. His first acquisition was in 1969 with the purchase of Industrial Sprinkler Corporation. During the 80s, Lee recognized an opportunity to expand the business within the construction and construction-related end markets. He embarked on the roll-up strategy we are still seeing executed today, acquiring 3 businesses in 1985.

Viking Automatic Sprinkler, established in 1924 and had the capability to fabricate sprinkler systems in-house for contract in new construction projects. A second acquisition, The Jamar Company was a Duluth, MN based contractor that worked in metal roofing, siding, sheet metal fabrication and piping. The company was established in 1913 and had sales of $4-$5m by the time it was acquired. The third acquisition that year was a building material wholesalers in a Minneapolis suburb that changed its name to APi Supply. By 1989, Lee had acquired three more businesses. The most important of which, Western States Fire Protection Company, acted as a platform to acquire and merge several other fire protection companies in western states such as Kansas, Colorado, Nevada and Texas. During the 90s the company acquired more than a dozen domestic and international fire protection companies. By the turn of the century, the company had changed its name to APi Group (1997) and fire protection had become 60% of APi revenues and the business had grown from $1m in revenue when Lee took over in 1964 to $423m in revenue (link).

APi operates with a decentralized structure as acquired companies keep their established brand names, identity, reputation and culture. The local branches can move faster, be more responsive to customers and maintain a business-owner mindset with the backing and financial strength and support of the larger corporate mothership. This shows up in higher than the industry-average organic growth of 2-4% because of the entrepreneurial culture, higher customer loyalty with lower churn and higher employee retention rates. Exhibit C shows customer churn rates amongst peers. Mark Leonard at Constellation Software has described the advantage of remaining human-scale brilliantly in his 2017 President’s letter and describes it better than I could ever hope, but I imagine the thought process is similar at APG (link).

“All the employees know each other, and if a team member isn't trusted and pulling his weight, he tends to get weeded-out. If employees are talented, they can be quirky, as long as they are working for the greater good of the business. Priorities are clear, systems haven't had time to metastasize, rules are few, trust and communication are high, and the focus tends to be on how to increase the size of the pie, not how it gets divided.”

Russ Becker has been at the company since 1995 and became CEO in 2002. Becker was former manager of construction and President of The Jamar Company, a subsidiary of APi, before becoming APi President. Before joining The Jamar Company, Becker served as project manager for Ryan Companies and began his career as a field engineer at Cherne Contracting. Over his tenure, since 2005 APi Group has acquired over 90 businesses. Mr. Becker has extensive experience finding and integrating acquisitions. He has a strong focus on culture and leadership while also extracting operational efficiencies, cost synergies, and integration of organizational processes to drive margin expansion. Their focus historically has been on small family owned businesses given they operate in a fragmented industry.

Battle scars from 2008 introduced a complete strategic shift at APi. Exhibit D highlights that post 2008, management began to consciously reduce exposure to cyclical new construction and contract work and began to emphasize statutorily mandated services revenue. Inspection and service work went from ~15% of revenue in 2008 to over 50% today. This leads to a more stable, recurring revenue model that proves to be recession resistant as commercial buildings are required to have their fire safety systems inspected on an annual basis. The resiliency of the services revenue is supported by APG’s vastly different revenue performance during the COVID lockdown compared to the 2008 recession. APi posted a peak to trough decline of about ~25% during the GFC over 2008 and 2009 while during COVID, despite commercial buildings being completely closed (tough for there to be active fire safety concerns with no people in the buildings) the statutory nature of APG’s business required inspection and service jobs to still be performed and we saw Safety Services revenue decline by only 10%.

I’ll touch on it more later, but this supports the thesis that APG’s revenue should be less cyclical going forward and would be less impacted by a downturn in new non residential construction.

On October 2, 2019, J2 Acquisition Corp, a SPAC run by Martin Franklin, Jim Lillie and Ian Asken, signed an agreement to acquire APi for $2.9 billion, 7.8x LTM June 2019 Adjusted EBITDA of $371 million net of tax benefits. In part, I attribute the low acquisition multiple to Lee Anderson’s desire to find a permanent home for APi as he wanted to retire at the age of 80 and see his baby taken care of and not chopped up or flipped by private equity. Importantly, Franklin and his partners co-invested approximately $100 million of their own money in the deal at the same price as the SPAC holders.

While the thesis doesn’t hang on them, it is a useful context to understand the sponsor. Franklin and Lillie are best known for transforming Jarden Corporation from a $300m jar maker in 2002 to a $15 billion consumer goods conglomerate at the time of its sale to Newell Brands in 2016. Over the nearly decade and a half, they completed over ten $1bn+ M&A transactions including companies like Yankee Candle and Jostens. They also grew organic revenues by ~5% from 2010-2015. Franklin and Lillie were not only capable of acquiring businesses but also integrating and scaling them driving consistent top-line growth.

Martin Franklin’s stated goal for J2 ( Jarden #2) was to find a company where he could apply the same basic strategy he used at Jarden: acquiring and building dominant niche brands with great cash flow conversion to spin the flywheel in an industrial services company.

Safety Services

The Safety Services segment can be broken into two categories of services, Life Safety (88% of segment revenues) and HVAC Mechanical (12% of segment revenues). Life Safety provides design, contract, inspection, monitoring, and other services for life safety systems such as fire sprinklers, alarms and extinguishers in a number of geographies. HVAC Mechanical services includes controls technology and entry systems, HVAC systems service and maintenance, and plumbing engineering and contract. Following the acquisition of Chubb (the safety services arm of Carrier) APG now has a footprint of 425+ branches in North America, Europe, Australia, and APAC and is the largest life safety services firm globally. Exhibit E highlights the highly diversified end markets the company serves with an emphasis on recession resilient and secularly growing industries. This end market diversification serves to make the cash flow stream more durable and reduce revenue cyclicality from any one industry downturn. The core focus for Safety Services is on growing statutorily-mandated, non-discretionary inspection, service and monitoring revenue over a large installed base of customers. These systems typically have a finite lifecycle which, coupled with mandated inspection, provides a predictable, recurring revenue stream.

Before I get into segment economics and dynamics I think it is useful to understand the fire safety industry at large. Most of the industry reports and projections I’ve read have the fire protection industry growing at 2-4% over the next decade in the U.S and Europe, in line with the previous decade, with commercial and industrial growing faster than residential.

This is driven by two primary factors. 1) It is hard to see fire safety codes getting any less stringent and complex going forward as it seems unlikely people want to be less cautious about fires in the workplace. These services will continue to be required by law and insurance companies alike. 2) Increasing system and building complexity driven by variations in building design increases and use more technology they naturally drive demand to inspect them as replacement cost increases. An ounce of prevention is worth a pound of cure.

Regardless of the geography, this industry appears to be extremely fragmented, which makes intuitive sense to me. The industry is experiencing strong growth and barriers to entry are low for a small, local mom and pop operators. There’s limited regulation and minimal start-up costs. It doesn’t take much for a few professionals (field inspectors, sales representatives and back office employees) to build out a local inspection business, especially if they offer services in niche verticals or to smaller customers in regional markets. That said, scale can drive meaningful revenue and cost synergies, and given APG’s size, I believe the company is positioned extremely well to pursue a roll-up strategy with a very-long runway. Exhibit F shows that there are two scaled competitors in fire protection and sprinklers, APi and Emcor with a long tail of small competitors. Although this is 2020 data and slightly dated I think it acts as a good proxy for the general fragmentation in the Life Safety side of the Safety Services business.

Scale matters in the Life Safety business. Despite statutorily mandated elevator service being a niche business that requires technical know-how, OEMs have lost share to independent service providers over the years due to building owners opting for the lower price option. Looking at Life Safety inspection and service, where the technical know-how is less demanding than elevator service, it makes sense that a lot of these businesses deal with price pressure as well. For small businesses, the decision of which inspection contractor to go with is primarily based on price. However, larger accounts and international corporations with businesses all over a region, nation or the world have different priorities. In addition to price, national/regional customers care about ease of contact, reliability of service, reputation of the inspector and response time.

On the customer side, APi’s broad geographic reach to service equally geographically diverse customers places them in pole position to capture market share by becoming the customer’s sole building inspection provider allowing them to consolidate spend and act as a single point of contact. At first glance the value proposition of a single provider makes sense, it could quickly become a headache scheduling and gathering the paperwork for dozens of different service providers over dozens of buildings for a measly $5,000 job each. APG provides this single point of contact through their National Service Group (“NSG”), which enables them to build an understanding of customers on a national scale and allows APi to build stickier relationships with customers. APi doesn’t report customer retention data, but I suspect that retention will decrease over time once customers consolidate their life safety spend. APG disclosed at the time of acquisition that Chubb had 90% retention and I don’t think I’m knocking anyone’s socks off to suggest APG’s is higher considering how neglected Chubb was as a part of Carrier (low organic growth and lots of managerial turnover after APG acquired them)

It’s also worth drilling into why API’s customers tend to be sticky. It’s a hassle to switch fire inspection providers once a customer has a relationship with a sales representative who is familiar with their current infrastructure. There is both a convenience and cost factor in switching. Switching costs also increase as customers utilize more services – i.e. as penetration increases– which is why we’ve seen APi build out their offering to service the entire lifecycle of a building. This also gives me greater conviction that APi’s churn is lower than competitors as penetration of the average customer goes up with inspection services. This should result in an easier time passing through price increases which should lead to higher margins when compared to subscale peers. APG hasn’t been public long enough for me to be able to quantify how sticky price has been through periods of falling raw material costs. Management has noted that historically they have not had to give back price which makes sense given the context around low cost relative to the value of ensuring safety of employees. If this is true we should see higher gross margins (think a step function change similar to SHW 2012-2015) coming out of raw periods where raw materials spike and decrease to previous levels. Exhibit G compares APG’s Safety Services margins to that of their hypothetical tuck-in acquisition, peers including CTAS and historical examples such as UTX’s climate segment and Tyco.

As an aside, management has talked about acquiring businesses in elevator/escalator servicing and they have an existing HVAC segment. If anything, this shows their intent with new vertical expansion through M&A to look at services that have some level of statutory requirement or a “requirement” out of necessity. As an HVAC investor would say “Even if you’re not legally required , if it’s 90 degrees outside you’re fixing your AC.” It’s hard to scribe value to today, but worth noting that it could extend the reinvestment runway.

Scale also begets APG to do more inspections, faster. Through their scale APG is able to build up route density which will continue to grow via future M&A, creating a distribution advantage to cost-effectively push through services and do more inspections per day. Once on-site as a tester goes through their work they are automatically sending data to the back office who are immediately getting to work on the deficiency report and other write ups whereas a mom and pop would have to go back and night write it themselves which lets API get more inspections through their system. The benefit here is twofold: 1) it allows them to turn inspection work into deficiency reports faster and 2) they can convert that inspection work into incremental service work at a better pace. In all, this means that APG can target and service dozens of smaller accounts versus a small family owned business which focuses on single, large accounts.

This differentiation is driven by APi’s idiosyncratic GTM headed by the head of Inspection Sales Courtney Brogard (Exhibit H). Russ Becker explained it well at the Citi Industrials Conference last year:

”We have this inspection first mindset at APi which is not normal for the industry and we are focused on selling inspections into the already built environment. So we continue to evolve and build out our inspection salesforce. We want to sell that inspection first and the reason we want to do that is that we know that for every dollar of inspection revenue we sell we can sell somewhere between $3 and $4 of future service work and we also know then that if we execute at a high level we are going to create a much more sticky, solid, long-lasting relationship with that client so that when they do have expansion needs they are going to pick us and we are not going to be competing just based on price.” (Link) This supports point 2 above and contributes to their above industry average retention. I also think that simply because APG places a much larger emphasis on inspection versus competitors that are drawn to higher price tag contract work, it is in a prime position to slowly win market share and displace incumbents that view inspection business as non-core.

Inspection and monitoring revenue is more stable and recurring because businesses are statutorily mandated (required by law) to have their fire safety systems inspected on an annual basis regardless of occupancy or vacancy rates.

Safety Services is a $4.5b business with an average project size of $5,000. That is a lot of small projects, invoices and relationships to handle. No local operator has the infrastructure and salesforce to compete with APi and support the massive volumes they process. A family business would rather try to win one $1m contract job instead of trying to win $1m worth of $5,000 inspection jobs simply because their lives would be much more difficult with the latter. The lower level of competition in inspection and monitoring business is supported by the 10% and 20% higher gross margins respectively than original contract work.

The inspection first GTM has four other important second derivative benefits that make cash flows more stable. 1) High volume, low ticket structure means that customer concentration is low (no customer accounts for more than 5% of revenues). 2) Short contract lengths mitigate both contract risk and raw material and other input risk on margins because they can reprice quickly which reduces the impact of inflation 3) Inspection and monitoring, which is now 50%+ of revenue and growing 10%+ is retrofit and therefore less exposed to cyclical new construction/contract 4) Inspection allows them to establish long-lasting, first-call relationships with more businesses and they believe that once they are in a facility the next time that customer has an expansion APG can win that business based on their superior performance and existing relationship. Winning business based on a relationship significantly reduces pricing pressure from competition as it is generally only APi vs the existing incumbent.

APi can also offer a broader range of services than a mom and pop. We have seen them systematically build out their fire and life safety offering to cover the entire lifecycle of the building which reduces jump balls for new business. At the margin, due to their size and national presence, they can use technologies and products the regional players can’t compete with such as specialty foams and a variety of fire suppression agents which also raises the customer value prop. Lastly, on the supplier side, APG can often source raw materials and products for cheaper.

There are two quick points that I want to at least point out before moving on. The first is that since APG has built up a base of 50% inspection revenues which are highly recurring, they can be much more selective on the contract work they take on because they aren’t pressed for new business. This leads them to target install to growth of 2-4% while inspection grows 10%. I think this disciplined customer selection also contributes to higher margins and longer/stickier relationships. The second point also pertains to customer selection on the install side. They prefer to target owner-direct relationships rather than through a general contractor where there is more price pressure. This positions them to capitalize on future inspection work if they don’t already have it and be selected directly by the property owner at higher prices and better margins. More than anything I think they are aggregating marginal advantages that come from the inspection first mindset which lead to the lower churn, higher ROIC and better margins we see above

All of this said, maintaining a high growth level in inspection and service does require incremental spend in adding and building out the teams and salesforce to support the GTM. Organic growth requires greater use of working capital which leads to lower FCF conversion, weighing down ROIC. Exhibit I shows the relationship between organic growth and adjusted FCF.

The below-average churn rates and increasing ROIC indicate that APG has some competitive advantages in the safety services space. I think these boil down to A) APG’s geographic scale B) single point of contact C) inspection first GTM D) switching costs from full service offering. The combination of which has allowed them to steal significant market share from mom and pop operators who have been the largest share donors over time.

Human-scale business units help maintain an entrepreneurial spirit that likely helps APG gain share in their verticals and generate above-average organic growth over time. The diversity in verticals and geography and focus on inspection also insulate APG from the ebbs and flows of the economic cycles in any one market, and reduces cash flow volatility. This cash generating engine has powered APG’s M&A machine since the mid 80s and especially so since 2005, and there is compelling evidence to suggest that this will continue to be the case for decades to come.

M&A Strategy

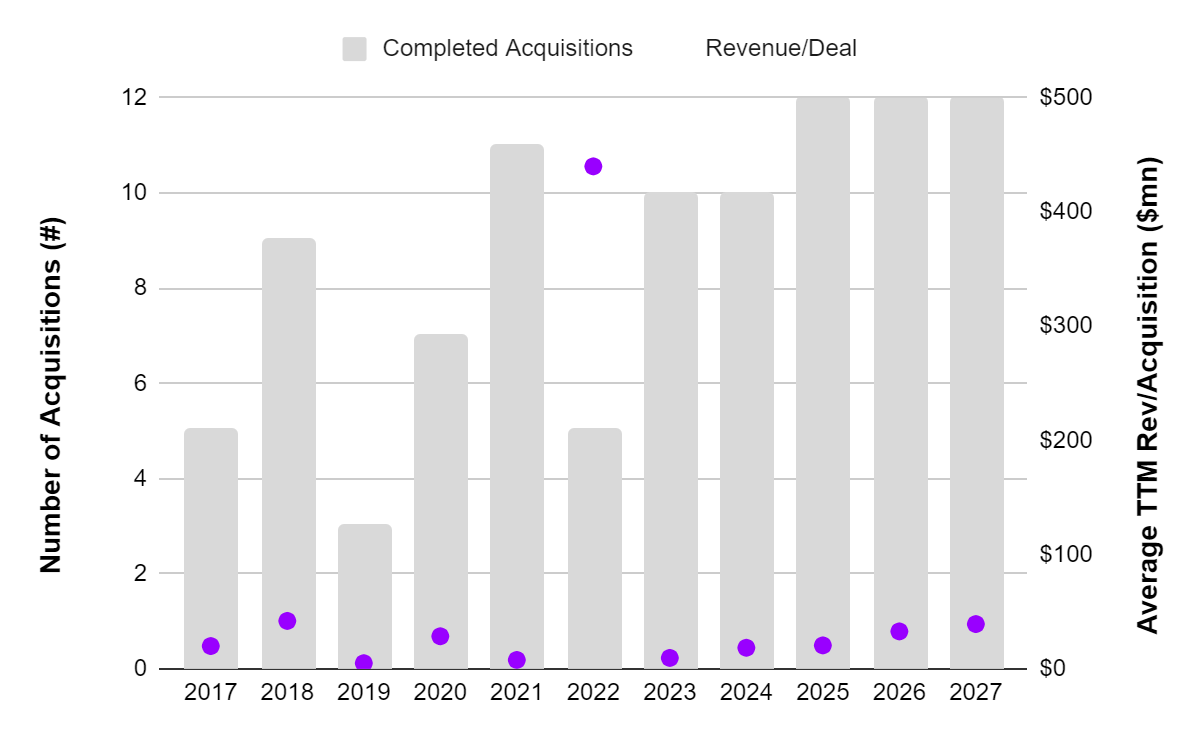

The core strategy with the cash the operating businesses throw off is to consolidate regional safety services providers, expand margins on the back of significant cost synergies, and improve customer penetration by cross-selling services across their various subsidiaries. Exhibit J shows that APG has acquired 90+ companies since 2005, averaging about 5 companies a year.

Management has noted that they are not interested in acquiring the mid to large sized platforms that are trading for north of 15x EBITDA in the private markets. Despite this, they went out and acquired Chubb for 14x EBITDA which hurts management’s credibility in this area. They tend to avoid auctions and instead use their network to buy subscale players with $10m EBITDA. APG guides to a 4-7x LTM EBITDA multiple for these businesses with 7% margins, implying that they can tuck in these businesses in the ~0.35x EV/Sales range. They also lay out a fairly convincing path to doubling margins within the first twenty four months. By my estimate, APG has completed over 20 acquisitions since 2019, however with limited disclosures for all but a few there are only 10 acquisitions that we have concrete data for to check against management guidance. I think there is room to improve disclosures around acquisitions beside the boiler plate “we have completed X acquisitions since 2005” that they provide in the 10K that would help investors gain conviction around management’s ability to execute this roll-up at the multiples they claim. There are some discrepancies to guidance, but my general takeaway is that they’ve executed well to-date.

The opportunity to consolidate regional mom & pops is extremely compelling. This is a highly fragmented industry with a runway for M&A and some secular growth. I’ll reiterate what I said above: the fragmentation makes intuitive sense, the industry has tailwinds propelling modest organic growth and barriers to entry are low for a small mom & pop with limited regulation and minimal start-up costs. That said, scale can drive meaningful revenue and cost synergies, and given APi’s size, I believe they can take full advantage. For context, there’s about 4k-6k family owned life safety businesses in North America and I suspect that number is continuously growing because of the dynamics above. Chubb also acts as an accelerant to opening up a platform in Europe, Asia and Australia. Many of these are also undercapitalized, lack scale, and have limited breadth of solutions, which puts them at a massive disadvantage to larger peers. Excluding synergies, I estimate that these local mom & pops in North America sell for somewhere in the 6-10x EBITDA range. For larger acquirers that benefit from scale, cost-synergies like volume discounts and headcount reduction, combined with modest revenue synergies from servicing national accounts can drop the implied EBITDA multiple to the 3.0-5.0x range. At 10x EBITDA, and ignoring all synergies, I estimate that APG would generate a low double digit IRR on incremental M&A. However, including all revenue and cost synergies, my guess is that APG would generate high teens to low 20% range. This M&A is clearly accretive. Some of the synergies outlined above are easy to give APG credit for (like vendor discounts), while other synergies are harder to verify. I’ll walk through each below.

APG provides an illustrative example of a bolt-on transaction with ~$10m of EBITDA at ~7% margin today that could become ~$30m of EBITDA at ~15% margins through its value-creation process, including 1) +150bps of margin improvement via purchasing power, 2) +150bps of margin improvement via shared services consolidation, 3) +200bps of margin improvement via strategic pricing increases, and 4) +300bps of margin improvement from improving mix (moving from a contract/contract oriented business model and towards a service-focused model). This example also implies the business goes from $142m in sales to $200m in sales over 2 years.

As far as cost synergies go, purchasing power and shared services consolidation is extremely low-hanging fruit and improves EBITDA margins by 1.5%-3% almost immediately. Certain buyers of regional life safety providers (like private equity firms) wouldn’t benefit from these volume discounts – at least not to the same degree as APG – so this feels like a durable edge when competing to acquire small targets and shows their potential as a platform. Given APG’s scale and the stickiness of the underlying services they should be able to push price through. The final 300bps from improving mix and switching to inspection first is APG’s playbook. This takes longer to implement and benefit from, but I estimate that they can accomplish it within 2 years of acquisition and is a trick no other company has up their sleeve. APG’s inspection first mindset means that they can bid more aggressively than competitors because they can wring more productively out of the asset and still get a lower post-synergy price.

Exhibit K shows trailing annual revenue and EV/TTM sales (including deferred and contingent payments) for acquisitions APG has disclosed data on. Acquired targets have had TTM sales ranging from ~$12m - $2.2b, with the majority less than $7m. The median upfront EV/Sales multiple has been ~1.00x compared to guidance of 0.35x. However, if we assume that the average target had ~9% EBITDA margins, then APG’s median EV/EBITDA multiple on acquisitions was closer to 11x, roughly double guidance. If we assume that APG successfully expanded EBITDA margins from 7% to 15%, than the median EV/EBITDA multiple (post synergies and including deferent and contingent consideration) was closer to ~6.6x, which would improve further on the back of cross-selling (to 5x, optimistically)

I estimate that a 1.0x EV/Sales multiple is equivalent to a ~15% ROIC at the operating entity level after all cost synergies. In order to earn consistently high returns on the exponentially growing M&A budget, APG has to keep the average acquisition size small. All else equal, as deal size gets larger, incremental ROIC falls (EV/Sales goes up). Exhibit L shows the historical relationship between deal size and acquisition multiple for deals smaller than $300mn (excludes Chubb)

When I look at corporate EBITDA margins, it is evident that APG has been successful at expanding margins post acquisition. Exhibit M shows corporate EBITDA margins and M&A spend. Margins tend to fall immediately during periods of high M&A, but they typically recover 1-2 quarters afterwards. This makes sense given that it probably takes a few quarters for APG to realize the full 3-5% margin uplift from volume discounts and headcount reduction.

Two of the primary risks to the APG thesis revolves around if they can scale M&A and competition to acquire these local players increases. The post-Chubb digestion period has lasted ~2 years and management has stated they intend to restart the smaller, bolt-on M&A flywheel by the end of 2023. In either case, incremental ROIC on M&A would fall faster than I expect. There’s enough supporting evidence that APi is managing their integration well and should be able to increase acquisitions/year while maintaining a low average deal size. I’m not that worried about APG actually finding the deals,I am hesitant to underwrite their ability (with capital allocation decentralized) to scale the M&A machine to over 12 deals per year. With their large revenue base and growing free cash flow stream it becomes harder and harder to put a significant portion of it to work. This is probably why we have seen management turn towards larger deals (SK Fire and Chubb).

The other risk to consider is increasing competition in the space, which could impact APG in two ways: 1) more M&A competition could decrease M&A IRRs; and 2) industry consolidation could lead to increased pricing pressure on products and services.

We have already seen purchase multiples rise to low double digits. I think with the macro backdrop it is reasonable to expect multiples to come back down, albeit not dramatically, say 7-10x. I think this is a longer term risk and worth watching the trend in multiples paid. Despite consolidation efforts, I expect the market to remain extremely fragmented over the next decade as new entrants prop up the number of potential acquisitions. I also expect that APG will continue to sole-source some of their deals, which should generally result in better prices. We have seen this management team, through both the APi deal and Chubb deal, get reasonable multiples based on relationships. Given APG’s size and focus on inspection, I also expect that they’ll continue to execute on sub-$50 mln deals for a long time, which should be less competitive and come with better incremental ROIC.

The primary competition is private equity. Management has alluded to getting first look at many deals so they have an edge in being selective and picking their spots with the acquisitions that fit their existing culture which means integrations should be smooth. I have a general feeling that they target small deals that PE would not be interested in. However, this is tough to quantify and I’m not willing to die on that hill. I do think after 90+ deals completed since 2005 APG has built up a level of process power converting these businesses from contract to inspection focus and perhaps an information advantage over PE competitors.

APG operates under a decentralized operating model with capital allocation centralized. This structure has pros and cons. Some of the pros include better opportunities for cost synergies and more concentrated decision making on strategic M&A and capital allocation. However, the biggest drawback is that it will become increasingly difficult to reinvest all of their growing free cash flow. The focus on targets with EBITDA in the ~$10mm range necessitates a high velocity of transactions to move the needle. Under decentralized M&A models, a growing free cash flow stream can get deployed by increasing the number of deals/year, without having to increase average deal size. Typically, when deal size increases, IRR falls, so the decentralized approach helps keep incremental returns high. While it’s possible to scale centralized M&A with more transactions/year, more often than not this leads to bigger deals, and in turn reduces incremental IRRs which we have seen at APi and would explain why management has talked about moving to other verticals. I would expect to see average deal size increase These larger deals are more competitive on average, and I would expect to see some combination of higher initial prices paid, higher integration costs, and lower cost synergies. As a result, APi would likely fall short of their 1.5% EBITDA margin uplift from better volume discounts.

There is some data to suggest that more people are fishing in the pond. Since becoming a public company, M&A deals have been richer both in terms of transaction prices and valuation. APi bought SK FireSafety and three tuck-ins in October-2020 for $302mm. The four businesses were expected to contribute approximately $200mm of revenue in 2021 at 13% adjusted EBITDA margins, representing a ~11.5x multiple. SK FireSafety multiple was ~12-13x while the other three tuck in businesses were bought at ~10x. Quite a bit higher than the 4-7x guide.

There are tangible benefits that mom & pops get for joining APi beyond the margin uplift from scale that I think can insulate them over the next 5 or so years. There are personal and professional growth opportunities within APi than as a standalone entity and Russ Becker is living proof that advancing from a manager at Jamar to CEO of APG. Employees that want to progress their careers will find multiple opportunities outside of their specific BU. This increases employee retention. Access to APi peer networks is invaluable in helping to grow the business in ways that might not have been possible as an independent company and helps introduce cross selling/best practices. APG subsidiaries are collaborative and the APG leadership development program breeds an incredible culture that is (don’t gnash your teeth!) Danaher-like. APG has spent $20-$50m on leadership programs within the company and has immense training at headquarters. Lastly, the acquired businesses can continue to operate autonomously and maintain their own subculture, brands and customer relationships. This is important to sellers that want to continue running the business post-sale.

All told, I’m inclined to believe that M&A multiples on acquisitions will increase in the future, but this is likely to happen slowly. Even if this plays out, APG is likely to earn a return on incremental capital deployed that’s meaningfully in excess of their cost of capital for at least 5-10 years.

Chubb: “Center of Fairway”

No acquisition highlights APG’s ideal transaction and integration process power better than the thesis-making Chubb acquisition. The Chubb acquisition from Carrier was announced in July 2021 for a $3.1b EV price tag. At the disclosed 9.6% adj. EBITDA margins on $2.2b in revenue, APi paid ~14.5x EBITDA for Chubb pre-synergies. In many ways, Chubb has the potential to become the European APi and was a scaled up version of the dozens of previous acquisitions APi had done before. No way around it, Chubb is certainly more complex than anything APG management has undertaken in the past, but as Market Euphoria wrote in his VIC write up, “there is a ton of operational bloat that can be cut.” (link)

Chubb offers many of the same products and offerings the legacy APi Life Safety segment offers including service and contract work for fire detection and alarms, electronic security, and monitoring of these assets. For context Chubb operates in 17 countries, serves over 1.5 million customer sites through 200 branches and 22 monitoring centers and their top 6 markets comprise 90% of their revenue which is important for their scale advantage. Based in London, it was originally acquired by United Technologies (UTX) in July 2003 for ~$1b and generated $2.5 B in sales in 2002. In 2004, UTC reported Chubb revenues of $2.8 B with 4.8% operating margins in the one year before the businesses results were merged with UTC Fire & Security. In early 2019, Chubb was cited as a business doing ~$2.5B in revenue with ~10% operating margin indicating that the business has had 0% organic growth over the last decade and margin structure hasn't changed since 2019 (Exhibit N). When United was separated into 3 separate businesses in 2020, Carrier was given the ability to focus on its core HVAC business and Chubb was deemed nonstrategic and became a neglected asset. As a corporate carve out Chubb didn’t get Carrier’s best talent, the CEO never visited local branches and the business as a whole was undermanaged. Russ has spoken in the past to the fact that for the 5 years pre-COVID Chubb has 0% growth CAGR, APi cleared out 80% of senior management since buying Chubb and APi filings show that Chubb had zero R&D expense the 2.5 years before the acquisition.

There are a few reasons why I think Chubb was so attractive to APi to pay a mid teens EBITDA multiple. 1) Chubb accelerated APi’s shift toward recurring revenue as at the time of acquisition 63% of Chubb revenue was service. This pushed APi as a whole close to 50% inspection and service revenue and the revenue visibility gave management greater confidence underwriting cash flows 2) they have a diverse set of end markets that are secularly growing and provide durable cash flows with no customer more than 2% of revenues 3) 40% of total revenues come from multi year service contracts 4) 90% customer retention despite being a neglected asset 5) visibility to low hanging fruit 6) enhances scale offering for NSG and multinational clients 7) chance to cross sell. Exhibit O shows the product and service revenue mix at Chubb.

The Chubb deal looks attractive in theory as buying an orphaned asset from a willing seller which, with more attention, has the ability to grow faster and drive margin expansion makes for a compelling setup, but there were/are some ongoing challenges and it's a useful case study. Portable fire extinguishers are a more commoditized service in Europe and made up ~30% of services revenue at the time of acquisition and contract (more cyclical and lower gross margin) still makes up 37% of revenue.

On its initial announcement management stated that they were targeting $40m of cost synergies which they have increased to $100m by the end of FY’25 implying 15% EBITDA margins at Chubb. Exhibit P shows management’s breakdown of the savings into 1) Restructuring 2) Branch & Footprint Optimization 3) Attrition Improvements and 4) Country & Branch Optimization.

Management has provided guidance on some of these buckets, but we will tackle each independently by comparing Chubb’s operating performance to APi’s and assuming Chubb can get closer to APi levels over the next 3 years.

1) Most of the cost takeout from restructuring will come from G&A above the branch level. Management guided to $30-$35m last year in FY22 and another $30-$35m in FY23 and FY24 each. There are some clear quotes from APi management that Chubb was bloated with too many layers between corporate and the actual branch level employees driving revenue. In Market Euphoria’s conversation with APi management, he noted that Chubb operated with 3 or 4 layers of leadership between country MDs and those in the field, whereas APG operated at about half that level. Exhibit Q gives us a sense of this looking at Chubb’s 2021 revenue and adj. EBITDA per employee compared to APi. Normalizing operating performance between both companies suggests $70-$90m+ opposed to $30-35m management has targeted for this year.

2) APG has stated they closed down ~10 locations in FY22 with additional footprint consolidation coming this year. This category is a little harder to quantify and management has provided any specific guidance so I am shooting from the hip. With existing branches at SK FireSafety Group, Vipond UK and Vipond Canada I am included to give some credit for this and peg $0-$5m in synergies.

3) APG is targeting a mid to high single digit attrition between FY23-25 by reducing attrition ~2%. This implies that current attrition is around 8%-10% and per management’s disclosure Chubb spent $40m in 2021 for identifying, hiring, onboarding, and retaining employees.the 2% guide implies that they are reducing this expense $40m expense by 20-25% [2%/10% and 2%/8%] or $8m-$10m

4) Country & Branch Optimization has two parts 1) exit markets that are unprofitable and 2) raise the performance of $500m worth of lower/mid quartile businesses to top quartile units. Of Chubb’s 200 branches management has indicated that 85% were profitable by YE22 which implied 170 profitable branches up from 145 in FY’21 (Exhibit R). Management has also said that by 2024 there will be zero unprofitable branches which implies another $18m of savings. The transition of $500m worth of lower/mid quartile branches to top quartile branches is difficult in my view. I understand the argument of Chubb branches benefiting from human-scale operations and a decentralized structure fueling entrepreneurial spirit. In light of that I am comfortable underwriting bottom quartile performers (the bottom $125m in sales at 7%-9.5% EBITDA margins moving to 12%-15.5%) which equates to $6.25-$7.5m in value capture.

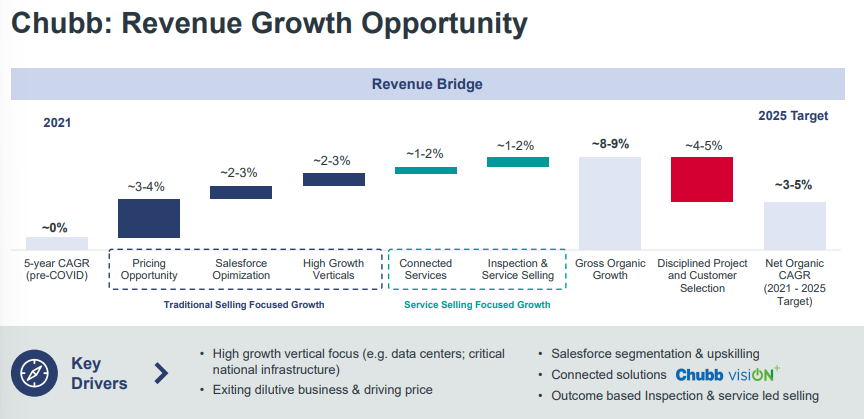

Let’s move on to the revenue side of the equation. If you recall from above, Chubb had 0% organic growth for the 5 years prior to 2020, but management is targeting a 3-5% net organic revenue growth through 2025. Exhibit S shows through this. 3-4% pricing, 2-3% salesforce optimization, 2-3% high growth verticals (data centers, pharma, critical national infrastructure all growing 10%+), 1-2% connected services and 1-2% inspection & service selling offset by -4% to -5% project and customer selection.

This is an achievable goal that implies how poorly Chubb was run before. A pricing opportunity of 3-4% and needing to walk away from 4-5% of revenue because the contracts are unprofitable/ a margin headwind supports the thesis that Chubb was neglected and Russ Becker has at nearly every conference since the Chubb acquisition that, “In Chubb, some element of churn is not a bad thing in that business.” Recent Chubb performance starting in Q2’22 provides some data behind revenue synergies and management's ability to deliver on those promises. Chubb had growth year over year growth of 3%, 7% and 8% in 2Q22/3Q/4Q . Management stated that they took 3% price in 2022 and Chubb’s revenue growth of 7% and 8% in Q3/4 imply volumes growing at a strong 4-5%. At the heart of the rationale behind the transaction was implementing an inspection first culture at Chubb. Like APG’s other competitors, Chubb had historically focused on winning service work from its installed base as opposed to winning new inspection business. Therefore, they lacked the proper infrastructure to approach sales in the same way as APG and building up that muscle will take time. If this transition is successful we will see a meaningful step in Chubb’s organic growth as APG believes they can grow inspection and service revenue from ~2% in ‘22 to ~10% in ‘23-’25.

Finally, APi believes they can cross-sell other offerings to Chubb customers. This includes all services across the lifecycle of the building, but the company seems to be primarily focused on inspection and monitoring for recurring and higher margin nature. Rolling out more services also increases customer switching costs and should help reduce churn/improve net organic growth at Chubb. Executing on the cross-selling initiatives is dependent on successfully integrating new acquisitions (more on this below), but it also takes time.

It's difficult to assess APG’s track record at cross selling to newly acquired customers to-date. If integrated properly, acquired business should be able to approach existing customers with solutions that include products and services from the other APG subsidiaries. As an example, organic revenue growth has been strong, but management hasn’t provided commentary or guidance around Chubb expectations so it’s hard to benchmark results. Exhibit T highlights that there are a number of muti-national clients that are served by either APG or Chubb depending on geography and make for logical consolidation.

There are also complementary offerings that open up new adjacencies both ways. 54% of Chubb’s existing business is related to Electronic Security and Portable Fire Extinguishers which were a smaller proportion for legacy APG. On the APG side, they are focused more heavily on sprinkler related work (albeit much more prevalent in the U.S. than Europe because of the historic architecture/age of many European buildings) within fire safety that can now be ported to Chubb. Through the branch led model, the services themselves are fungible, at least in theory, they should be able to push new services through the system relatively easily.

This initiative is still in the first or second inning and will take time to execute, but I’m inclined to think that APG will ultimately succeed at cross selling, particularly as customers demand more services and look to consolidate their safety services providers.

Tying everything together, by FY25 management is targeting 15% adj. EBITDA margins at both Safety Services and Chubb, implying similar cost structures, greater efficiency at the latter, and benefits from scale economies via route density. Exhibit U depicts the walk from 9% to 15%. 2% comes from growth, a modest amount from attrition improvements and then ~4% from restructuring and branch optimization. I am much more comfortable underwriting the cost synergies outlined above to get to 15% adjusted EBITDA margins as there is more data to support this thesis and the simple fact that expenses, especially labor expenses related to headcount, are within management control. I am more hesitant on the revenue synergy side, but there is compelling evidence to suggest that APi is having early success improving organic growth and cross-selling with Chubb. 3-5% net organic growth is a major improvement from 0%, but seems like a reasonable target given the changes to pricing and the selling culture that are to come.

Specialty Services

The Specialty Services segment is a result of the integration of the Industrial Services segment and the legacy Specialty Services. This segment is 30% of revenues and 27% of operating income ex corporate and eliminations with ~$200m in adj. EBITDA. The segment provides diversified, single-source infrastructure and specialty contractor solutions, focusing on infrastructure and industrial plants. This is maintenance and repair of water, sewer and telecom infrastructure. Services here are split into three subsegments: Infrastructure/Utility, Fabrication, and Specialty Contracting. Infrastructure/utility services include electric and gas utility maintenance, fiber optic and cellular system install, natural gas line distribution services, underground electrical, transmission line and fiber optic cable install and water line and sewer install. Common Specialty Contracting services include insulation, ventilation and temperature control, plant maintenance and outage services, and specialty industrial and commercial ductwork while Fabrication Includes structural fabrication and erection.

For context, there are 10 operating subsidiaries in the segment, 4,500 employees and the average project size is much larger than safety services at $75,000. Aging infrastructure and demographic shifts drive market growth as this business is solely focused on the U.S. A growing U.S. population puts an increasing strain on existing public and private infrastructure resources like water and transportation which fuel spending growth in the space albeit not significantly above GDP. Management is focused on higher growth verticals (similar to the Chubb focus) such as data centers which could propel growth to LSD-MSD in the segment.

Specialty Services serves very resilient end markets with nearly 40% of revenues tied to the telecom / utilities sectors, this exposes them to the capex cycle in these industries. Within its pipeline work, APG emphasizes integrity services which are statutorily required while actively avoiding the new project based component of this end market. Strong diversification and focus on acyclical end markets make this a strong segment. Much of the work is done under quasi-recurring Time & Materials arrangements and/or Master Services Agreements (MSAs).

Management began deemphasizing the Industrial Services business since the IPO, and two Industrial Services businesses have been divested in the last four years representing $300m in revenue. Industrial Services is not an important part of the investment thesis, aside from being a possible candidate for divestiture.

Russ has made comments around exiting the Specialty Services side of the business in recent conferences that show his dedication to cleaning up the APG story for investors and getting a higher multiple, “Will we be in Specialty Services a year from/ 2 years from now? Everything is open for conversation. If the best thing for us to do is to prune then we will prune. Should we look at potentially selling this part of the business? Everything is open for conversation. We have a lot of robust dialogue.”

Specialty Services competitors include Quanta, MasTec, Dycom and MYR Group and generally trade at lower multiple than Life Safety business. At even the HSD EBITDA multiple peers trade at specialty could be sold for north of $1.5b which would allow APG to quickly de-lever from the Chubb acquisition and restart the M&A flywheel.

Risks

The primary debates revolving around APG are Chubb integration, organic growth and end market/cyclical exposure.

The thesis here revolves around Chubb. Those who own APG hang their hat on “Life safety is a terrific business that deserves a higher multiple and Chubb only strengthens that so they should rerate.” The key risk is that management stumbles with the Chubb integration makes achieving $100mm in value capture unlikely and organic growth remains flat. Some integration has been tough because of a fundamental philosophical difference between APG and Chubb (Chubb thought branches supported corporate i.e. centralized but APG is decentralized where corporate supports the branches) and switching the culture to sell inspection first takes time. As I laid out above, evidence points to Chub being integrated well, but that was the low hanging fruit and a weary eye should be kept on the longer term integration. If it were to go poorly we would see organic growth at Chubb stall as cross selling becomes more difficult, margins compress as they struggle to sell inspection and higher attrition rates show up in elevated SG&A expenses. The employee turnover could also lead to customer churn as we covered this is a relationship driven business.

Recall the above where I mentioned all the benefits of scale and density in this business. Exhibit V shows that Chubb and APG have low geographic overlap (only in Canada) which leads me to question the benefit they can gain from scale economies. Perhaps this is something they can build out in years to come with bolt-on acquisitions but could cap margin expansion in the short to medium term.

Chubb also may not be as high quality an asset as those who simply look at the mix of services revenue would conclude. A high service mix doesn't make the business inherently good, it is the nature of that service that matters and at Chubb ~30% of the services revenue come from less differentiated portable fire extinguishers (PFX). PFX in Europe is more route based and commoditized vs traditional fire inspection in the US because a technician dispatched to a building in Europe may have to inspect 30-50 extinguishers a day, which means they cannot spend a lot of time driving around while also seeing less interaction with the facilities manager. Conversely, in the US there is less PFX work and technician’s inspection work is less commoditized. APG only does PFX work in NA if they do the whole building because the company believes in NA it’s hard to make money from that business from a margin perspective. I think it is a valid question to ask whether or not Chubb deserves the same multiple you would slap on the U.S. Life Safety business.

Any difference in quality or breadth of services between the larger competitors is likely immaterial. Since products and services tend to be homogenous, it’s possible that APG starts competing more on price to gain market share, particularly with larger customers, which could result in margin compression. While this could play out in the future, we haven’t seen it yet. My guess is that because the fire safety industry remains highly fragmented, the large players who can avoid major competition amongst themselves. However, further consolidation could make price a bigger differentiator. I don’t expect significant pricing pressure over the short-term or medium term.

The other key to this thesis is being right on organic growth at APG. It has been fuzzy and more difficult than comforting to parse out real organic growth at APG historically. JPM’s initiation report from June 2022 turned a skeptical eye towards management’s claim of 7% historic organic growth and suggested a low single digit range (0-3%) for legacy APG.

Specialty is a lower quality, much lumpier business and still accounts for 30% of company EBITDA. It has lower than average EBITDA compared to peers and is a contributing factor to why APG trades at a discount to Safety Services peers.

I’ll call this the Andrew Walker push back, as it is one of his go to questions on his wonderful podcast and blog. The original SPAC deal to bring APG public was done at 7.4x, why should investors pay any more for this asset? There are two points I would offer here. 1) services and Life Safety is a much higher mix of the revenue today than when the business first came public and 2) Lee Anderson was 80 at the time of the sale and wanted out, the catch was this was his baby that he spent his entire career building and was leaving people he cared about behind to run the business. He wasn’t making his decision based on the highest price he could get, but based on a relationship with the future owner and trust they wouldn't rip apart what he spent so long building. The SPAC gave him instant liquidity vs an IPO or sponsor sale both of which would allow him only to get out over time. I’m sure at 80 it is nice to get cash now, your personal DCF might be a lot shorter. The last thing I would note is that Carlyle and KKR wanted to do the deal at a higher multiple, but Lee went with Martin Franklin/Viking since Carlyle and KKR wanted to break apart the business (sell fire business and run other segments for cash).

On the acquisition and deployment of cash into M&A, I don’t think the rising cost of debt impacts them all too much. The return to bolt-on M&A means deal size drops significantly and APG is likely able to fund acquisitions with internally generated cash instead of tapping capital markets. APG’s multiple getting compressed also doesn’t affect their M&A strategy to the extent they aren’t issuing shares to complete M&A. The multiple arb story that often gets tossed around with serial acquirers only makes sense if you're issuing equity at X and acquiring a comparable business at lower than X, but if you're acquiring with internally generated FCF then that doesn't matter. Multiple arb is possible in the sense that if you are APG trading at ~10-11x EBITDA and buying businesses for 4-7x LTM EBITDA. Theoretically, you just added EBITDA that rerates at the higher 10-11x multiple so there is some arbitrage even if you don’t issue equity. This revenue is lower margin which could bring down APG’s 10-11x EBITDA multiple since acquisitions are going to have a meaningful impact on consolidated financials. Even if you say that APG should be at 9-10x, there is still a healthy multiple uplift from “plug and play.”

On the depth and breadth of the moat I don’t want to suggest that APG is some super high quality Death Star-type moat business and deserves that kind of multiple. I do that it takes culture and process power to sell inspection work first. Despite it being higher margin than contract, it takes significant resources and investment in salesforce to build out. It is gritty work where you get your foot in the door and parlay that into future service work based on quality of work and relationship. APG obviously has experience changing cultures of acquired businesses given the 90+ acquisitions they did.

Finally, to be explicit. I don’t think APG should trade with construction peers. The end markets here are extremely diversified. Yes, if commercial construction rolls over the install side of the business will take a hit. Contract is 50% of the business and around 30-35% of EBITDA. If it gets cut in half your forward multiple goes from 11x to 15x which is toward the high range of where Life Safety buyouts have taken place. I would point out that if contract slowed it does have an impact on future service work but the emphasis on services and pulling through $3-$4 of additional service work is what drives this business's growth, not new construction. APG has designed their business around earning the right to be selective on contract work as evidenced by their 1-3% growth by focusing on inspection with 10%+ growth.

In the tail, there is higher than normal lawsuit and litigation risk that is worth watching closely. I am unsure how to underwrite this and therefore reflect this risk in demanding a larger margin of safety in my price paid.

Management and Governance

Russ Becker joined Jamar, a subsidiary of APG, in 1995. He was quickly promoted to President of Jamar, and then took over as the President and COO of APi in 2002. After two years as President, he was tapped to fill the CEO seat and continues to hold that position today. Russ comes across as competitive, thoughtful, focused and driven. A nuts and bolts guy that doesn't live in the spreadsheet of a roll up strategy. His focus on culture and value alignment during an acquisition bleeds through (video). From where I sit, he is a winner who seems to have integrity, morals and discipline.

There are three eras of APG from where I sit. The Lee Anderson days and pre 2008 Becker days when the company was slowly building its M&A flywheel and expanding their offerings to service the full lifetime of a building. The post 2008 days when the company began its shift to selling inspection first and emphasizing recurring revenues. Finally, the public company days where Martin Franklin and Jim Lillie brought the company public picking up the speed of expansion.

Working off the last Proxy statement, Russ owns 1.1% of the company worth ~$58m. Considering he’s worked at APG since the mid 90s I think it is fair to presume this is the majority of his net worth and therefore he is rowing in the same boat as minority shareholders. There is also an Employee Stock Purchase Program in place that permits employees to purchase common stock at a price equal to 85% of the lesser of (i) the market value of the common stock on the first date of the offering period, or (ii) the market value of the common stock on the purchase date. Employees may not purchase more than 500 shares in any offering period or more than ten thousand dollars of common stock in a year under the ESPP, but significant employee ownership is comforting.

To briefly touch on two new hires. CFO Kevin Krumm is coming over from Ecolab and has significant experience in M&A integration having worked on Ecolab’s $8bn acquisition of Nalco. CEO of Chubb Andrew White is joining from Emerson Electric. It’s obviously too early to judge his track record at Chubb, despite the integration's success so far.

Now to turn my skeptical eye to the J2 Crew, Franklin, Lillie and Ashken (I’m trademarking that!). The go-to line here, “Look at all the value Martin Franklin created at Benson Eyecare and Jarden, APG is a shoe-in to follow that path!!!” Yes, no doubt he created tremendous value for Benson shareholders and played a role in taking the business from $40m in revenues to $150m through acquisitions in about 4 years and Benson generated a 23-fold return for investors who bought when Franklin became CEO. Jarden was also a blistering success over the 14 years he and Jim Lillie (COO/President from 2003-2011 and then CEO thereafter) were at the helm achieving a 32% IRR. But then there are the works in progress. He is the founder of Element Solutions which has achieved a TSR of 60% since going public in 2013 and co-founder and co-chairman of Nomad Foods which has delivered an 80% TSR since going public both meaningfully trailing the S&P.

My view is that APG would be successful without them, Russ has full autonomy over the day to day operations, but the J2 Crew is there to sell the story and make sure the value creation is realized by public markets. I think they fully realize this role of deal maker, capital allocator and storyteller and embrace it. Martin Franklin said at the investor day, “In terms of convincing investors and the analyst community, and I look at some of the research that’s done, we still have a lot of work to do, and it’s on us, not on you. It’s really on us to convince the analyst community that this is a business that is worthy of, if you like, a loftier opinion.”

It is one thing to create value and make sure people know it, it is an entirely different thing of who that values accrues to. These are PE guys who have done well in the past acquiring companies and creating value, but boy does a lot of the value accrue to them and not minority shareholders. Martin Franklin owns ~12% of the common stock and APG is both his and Lillie’s (2.4%) largest public holding. Franklin also owns Series A Preferred Stock through his ownership of Mariposa Acquisition IV. There are 4,000,000 Series A Preferreds outstanding that convert on a 1:1 basis to common. Holders of the Series A Preferreds are also “ entitled to receive an annual dividend in the form of common shares or cash…The Annual Dividend Amount is equal to 20% of the increase in the volume-weighted average market price per share of the Company’s common shares for the last ten trading days of the calendar year, multiplied by 141,194,638 shares.” Finally, the Series A Preferred Stock will be automatically converted into shares of common stock on a one for one basis upon the last day of 2026 and has a high watermark that currently sits around $24.40 a share. Both NOMD and ESI had similar provisions that minority shareholders weren’t exactly thrilled about with the potential for dilution, but the structure does incentivize Franklin and the J2 Crew to tell the APG story and tell it well to get the stock price up. The problem is that much of the share buybacks will go to offsetting dilution as opposed to actually retiring shares.

APi also funded the acquisition of Chubb through $800mm of 5.5% Series B Preferred stock (800,000 shares) . This stock is entitled to 5.5% dividend per year, payable in cash or the company's stock. The Series B preferred stock is convertible, at the holder’s option (Viking and Blackstone), into shares of the company's common stock at a conversion price equal to $24.60 per share. APG can effect conversion of the outstanding shares of Series B Preferred stock to common stock but only if the volume-weighted average price of the company’s common stock exceeds $36.90 per share for 15 consecutive days.

Valuation

Organic Growth

Legacy APG has grown organic revenue by 3%-5% per year over the last decade and Chubb has, well, not grown. APG is now at a 50/50 contract/inspection split and they have stated that inspection revenue is growing 10%+ annually while contract growth is 2-3% annually. This implies legacy APG can grow 6%+ organically per year. Chubb is dilutive to overall organic, but we have seen recent performance indicate integration is going well and organic growth has picked back up to low single digits. I have Chubb growing 3% annually. In all this means Safety Services revenue is growing 4.5%/year through the forecast period (to 2027). There are three reasons why I have organic growth toward the upper end of the historic base rate:

I believe that the switch from contract to inspection has understated historical growth, and that this should normalize over the next decade. Inspection revenue has grown much faster than contract , and as inspection becomes a bigger part of total revenue, the drag from contract will diminish.

Cross selling between Chubb and APG customers presents meaningful opportunities for revenue uplift

Positive industry outlook from new infrastructure spending and increasing complexity of fire codes

Inorganic growth and net M&A spend is driven by number of acquisitions/year, average annual revenue per acquisition, and an EV/S multiple.

The company averaged 5 acquisitions/year from 2005-2022, and was able to ramp that up to over 10 in 2021. With management much more firmly focused on small bolt-on acquisitions post the Chubb integration I think we are likely to see average deal size fall from the Chubb-skewed year and deals/year increase. Exhibit W I assume that APG is able to execute on 10 acquisitions/year in 2023 and 2024, and by 2025 I assume that they reach a 12-per-year run rate as they turn the Europe platform on.

I expect that most of the acquisitions will be below $50mn in revenue largely because of the tuck in opportunities left in the U.S. and what Chubb has opened up in Europe. Exhibit X my expectation around the average multiple paid to climb from 0.7x to 0.9x range over the forecast period implying 10x EBITDA at 9% EBITDA margins on the high end.

Overall, I expect revenue to grow at a 5.1% CAGR from 2022 to 2027, 4.5% organically and 0.6% through M&A. See Exhibit Y.

Margins

Gross margins have been range bound between 20% and 23%% over the past few years with a meaningful uptick post Chubb to 26%. Install/inspection split is the biggest driver of gross margin variability, and we know that inspection has much higher margins. It is no coincidence that gross margins reached a high in the same year inspection revenue reached a high in revenue mix. Going forward I estimate that gross margin can grow 0.3%/year with the mix shift toward inspection.

I expect that APG will successfully cross sell services to new and existing customers, but that the revenue split from new M&A will be a constant drag (acquired targets initially have a higher 80/20 contract/inspection split). I expect that inspection will be 63% of revenue by 2027.

Average project duration is also relatively short, mitigating inflationary exposures to COGS or changes in labor expense that some peers may experience in an inflationary environment. They can also flex their labor force as market conditions dictate without incurring significant trailing severance cost as they are predominately a union labor force. The union labor force also gives them line of sight to only 3-4% wage inflation per year, but reduces their flexibility in hiring/firing employees. Lastly, their cost structure is also beneficial as they have ~75% of costs that are variable. The company notes that within COGS, 41% of costs are labor/payroll, 27% of costs are material, 20% is subcontract and 9% is equipment/vehicles.

SG&A as a % of revenue, which is mostly labor costs, has been ~20% since 2015. The Chubb acquisition has driven this temporarily higher as the company goes through their integration process. 69% of SG&A are people, 9% is building/office expenses, and 22% is T&E, professional fees, and other. As the company scales, SG&A as a % of revenue should steadily decline. I assume that this falls from ~22% today to ~18% in 2027. In all I have EBIT margins going from 4.7% to 9.6% in 2027 benefit from scale economies and as inspection grows as a % of revenue. Exhibit Z shows my estimates for go-forward EBITDA margins

In Sum

The DCF model shows that fair value in my base case is ~$26.57/share, which is 27% higher than the current share price. A snapshot of the model is shown below. Another way to think about this is that looking out to 2025 an investor could expect a 15% annual return in the base case.

In my opinion, the risk/return potential of APG at $20.91/share is skewed to the upside. There are numerous areas of conservatism built in on both the acquisition and EBITDA margin front (I model 12.2% vs management at 13%). The bull case assumes 6% organic growth at Chubb and Safety Services 6-8% growth at Specialty Services. 15% and 13% EBITDA margins between Safety Services and Specialty Services respectively which gets me to $1.02B of 2025 EBITDA at a 12x multiple and 2.25 net debt to EBITDA gets me to ~$35.75/share on 278m FDSO or an 18.5% IRR.

Even if revenues were to grow 3% annually (implying no market share growth) and EBITDA margins were to only get to 10% and APG traded at 9x EBITDA on 2.25x net debt to EBITDA I get a share price of $21, slightly above today’s price of $20.91.

Sources:

LWC Letter

JPM Industrials

August 2019 Presentation

January 2020 Investor Presentation

LWC Letter

First Public filing with data going back to 2015

UBS Presentation June 2022

CJS Securities Presentation July 2022

November 17th Investor Conference

July 2021 Chubb Acquisition Announcement